Indian financial services startup MobiKwik is seeking to raise about $84.2 million through the issuance of new shares in an initial public offering in the domestic market, it said in a draft prospectus filed with the local market regulator on Friday.

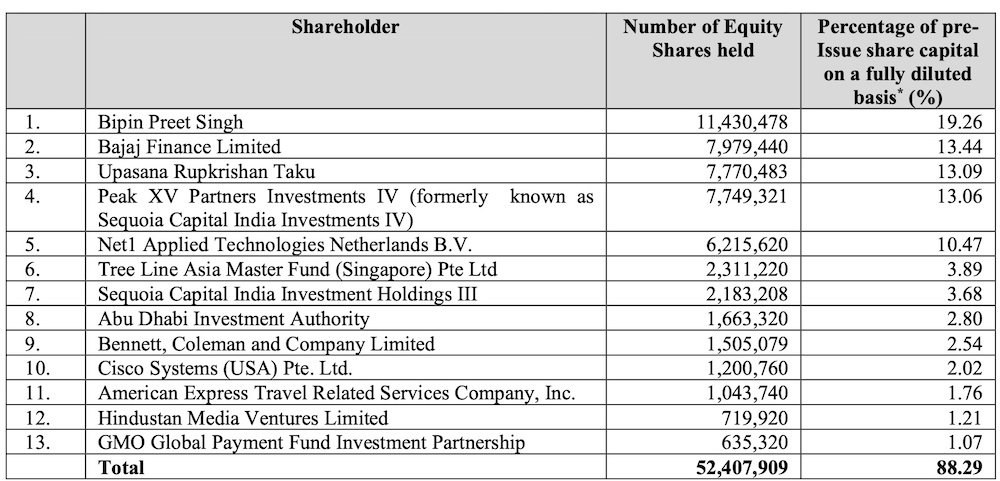

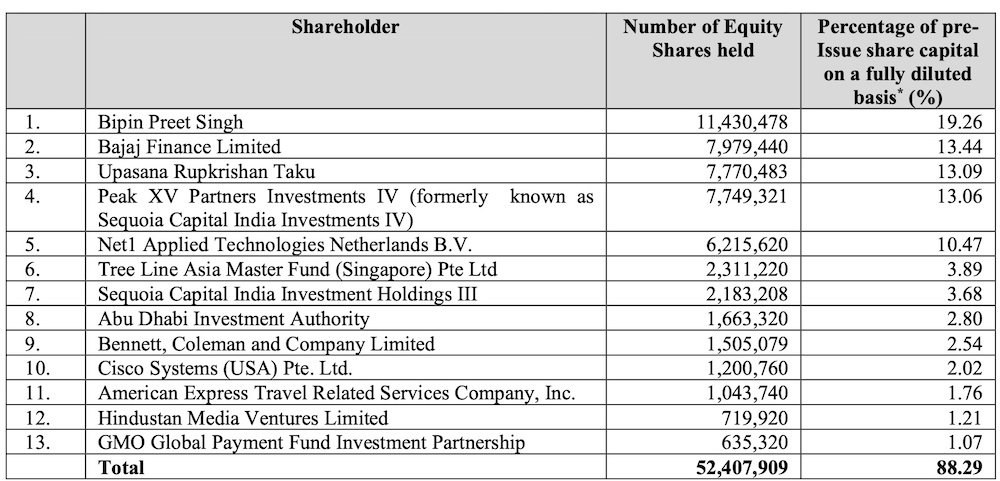

This is the second time MobiKwik has filed for an IPO. The startup, backed by Peak XV, the Abu Dhabi Investment Authority and American Express, initially sought to raise about $250 million through the sale of new and existing shares in 2021, but scuttled the plans after market conditions deteriorated.

The 15-year-old startup, founded by husband-and-wife duo Bipin Singh and Upasana Taku, does not plan to sell existing shares in the IPO, according to the new prospectus. It plans to raise about $16 million in a pre-IPO round, he said.

MobiKwik operates an online financial services platform that offers digital payments, credit, investment and insurance products. The startup has seen strong growth, amassing more than 146 million registered users and 3.8 million merchant partners. MobiKwik, which began its journey as a mobile wallet provider, has since expanded into additional financial services such as buy-now-pay-later credit, personal loans, merchant cash advances, wealth management and insurance distribution.

The Zip buy-now-pay-later product saw credit disbursements of $490 million in fiscal 2023, 21 times higher than two years ago. MobiKwik’s total transaction value across all its payments and credit products also more than doubled from $1.78 billion in fiscal 2021 to $3.15 billion in fiscal 2023. MobiKwik is seeking fresh funding to leverage its user base and its merchant network to cross-sell additional financial products.

MobiKwik’s involvement. Image Credits: MobiKwik DRHP

SBI Capital and DAM Capital are the lead bookrunners for the IPO process, the prospectus said. MobiKwik, which was unprofitable in financial years 2021, 2022 and 2023, turned profitable in the six months ended September 30, 2023. It made a profit of $1.1 million during those six months on revenue of $29.3 million, as the startup reveals in the newsletter.

MobiKwik is the latest Indian startup looking to go public this year. Lossmaking startups Ola Electric and FirstCry filed their draft prospectus for their initial public offerings last month.