Finea European competitive bank targeting SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity financing round.

Founded from the Netherlands in 2019, Finom allows businesses to open an online bank account in minutes and obtain an IBAN (International Bank Account Number) to support cross-border transactions. In addition, customers also receive physical or virtual bank cards, expense management tools and integration support for accounting software.

In fact, the Dutch startup is one of a number of players in a space that includes Wise, Qonto and Revolut, but Finom’s fundraising further highlights the demand for SME financial services in a market that is still essentially dominated by large banks — in recent months we have seen challenged banks such as Atom Bank and Monument attraction significant investments, while SME lenders such as Iwoca also closed significant new financing lines.

“The number one problem [we solve for SMEs] is always irrational banking — serving SMEs is considered “uninteresting” for traditional banks as compliance risks are high, while lending opportunities are also quite limited, meaning the product for SMEs is much worse even in compared to the digital banks we use every day,” Finom co-founder and co-CEO Yakov Novikov told TechCrunch via email. “But at the same time, the level of needs and the complexity of SMEs is much higher.”

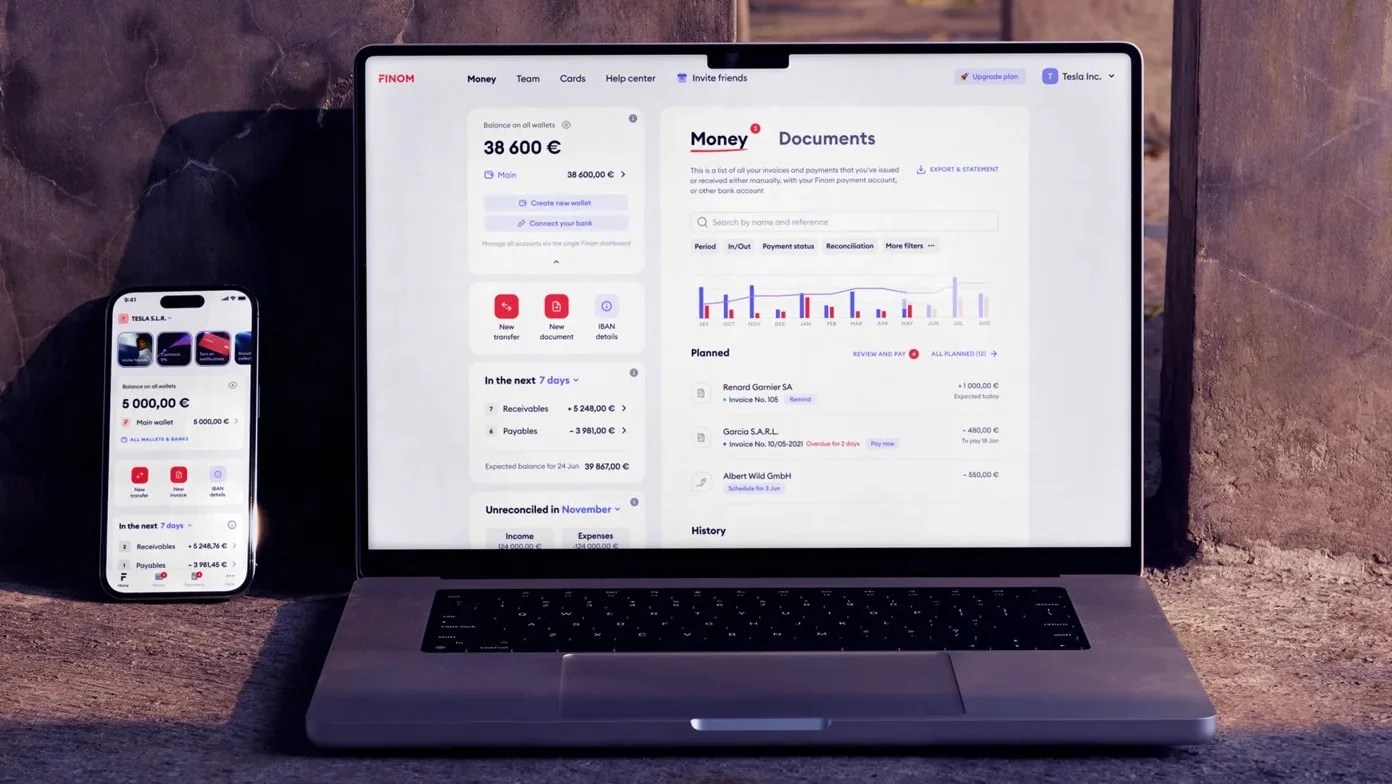

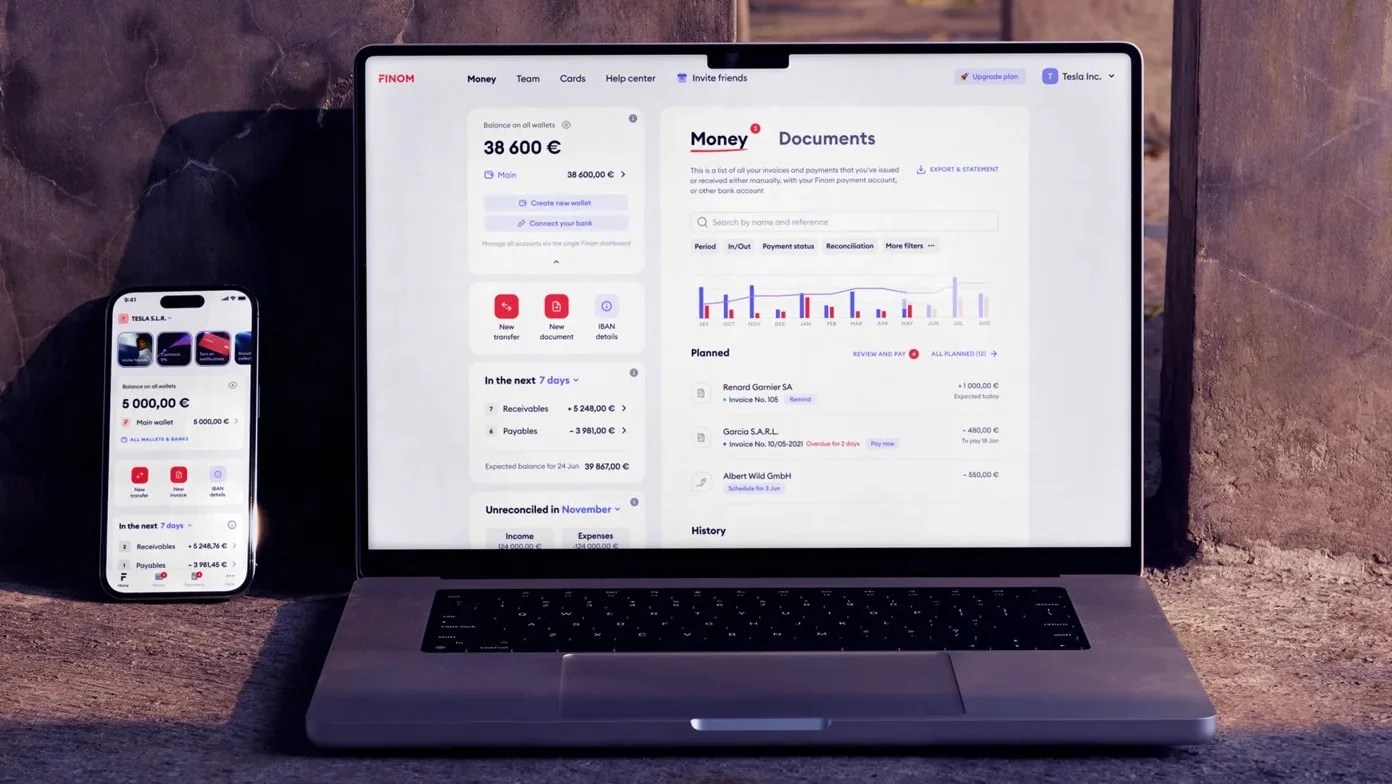

Finom on the web Image credits: Finom

Finom touts its key selling point as a “fully integrated” product that covers banking, payments, invoicing, expense management, accounting and tangential services such as business registration.

“This service integration not only saves our customers hours every week, but also significantly reduces their costs by eliminating the need for separate services,” Novikov said.

Show me the money

Founders of Finom: Andrey Petrov, Yakov Novikov, Oleg Laguta, Kos Stiskin Image credits: Finom

Finom had previously raised around €50 million, including two seed tranches in 2020 and a so far undisclosed €33 million ($35 million) Series A that closed in early 2022.

While Finom generally lumps together other startups that challenge banking incumbents, it technically isn’t a bank — it holds a license known as an Electronic Money Institution (EMI) that allows it to offer services similar to those offered by a bank, but cannot offers things like lending. Finom secured its EMI license in its home market of the Netherlands, but this allows it to operate throughout the European Union (EU).

With another €50m in the bank, the startup is well-funded to ramp up its expansion efforts as it aims to target the entire Eurozone by next year. At the time of writing, Finom claims around 85,000 customers in Germany, Spain, France, Italy and the Netherlands, and while it is technically available across the EU, it will begin localization efforts for additional markets in the coming months.

The Series B round was co-led by new investor Northzone and existing investor General Catalyst, which has previously backed companies such as AirBnb, Stripe and Snap. Other participants in the round include Target Global, Cogito Capital, Entrée Capital, FJLabs and S16vc.