The last decade is filled with examples of fintechs that have reshaped the way American businesses manage money. Brex simplified corporate cards. Automated ramp spend controls. Mercury reinvented startup banking. But this wave of financial innovation has largely bypassed an important part of the economy: nonprofits.

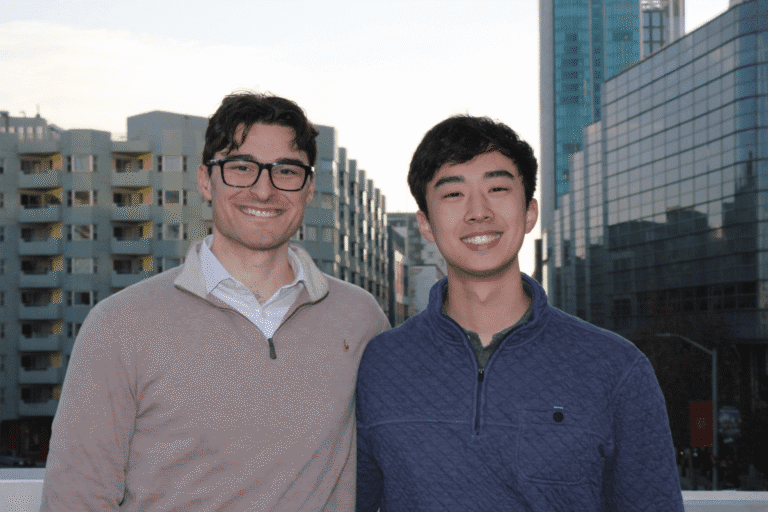

Giveawaya YC-backed startup founded by a 21-year-old Harvard dropout Matt Tengtrakul and UC Berkeley’s Aidan Sunburyaims to change that. The company is building a financial platform designed specifically for nonprofits, including food banks, animal rescues, non-governmental organizations, churches and homeowner associations.

Nonprofits create about 6% of US GDP and contribute trillions of dollars every year, yet most still rely on outdated financial tools. Givefront believes that modern spend management, compliance and reporting infrastructure — tailored to the realities of nonprofits — can unlock significant efficiency gains across the industry.

Before starting Givefront, Tengtrakool experimented with a microloan aggregation startup in Nigeria. He later worked for several non-profit organizations while studying computer science and statistics at Harvard, including running a few organizations himself. At one nonprofit, he helped raise donations to nearly $500,000. Tengtrakool says these experiences revealed a clear gap facing nonprofits. They have strict regulatory and reporting requirements, but lack the tools that modern businesses take for granted.

“I’ve always been interested in financial systems, and this project is a natural fit for that,” the CEO told TechCrunch. “While helping run these nonprofits with a few other students, we realized that most of them did not have sufficient financial tools to ensure compliance or protect their tax exemption. The tools they relied on were completely out of sync with what is considered modern in the startup world.”

Tengtrakool originally built the first version of Givefront to solve these problems internally. What started as a tool for organizations he worked with soon expanded to local nonprofits across the country. Over time, the team narrowed its focus to a unified financial platform built exclusively for registered nonprofits, about 1.9 million of them in the USA

Givefront entered Y Combinator Winter 2024 with a broad vision spanning the banking and accounting sector. The team quickly learned, however, that convincing nonprofits to replace accountants or key banking relationships required a slow and arduous sales process, leading to a shift to cards and expense management.

Techcrunch event

San Francisco

|

13-15 October 2026

“It’s much easier to get an organization to change the card they’re using than to replace their entire accounting stack,” Tengtrakool said.

Although Givefront offers features similar to corporate spending platforms like Ramp and Brex, its exclusive focus on nonprofits sets it apart.

Nonprofits operate under constraints that most businesses never face. They manage restricted and unrestricted grants, report expenditures to donors and foundations, track volunteer expenditures, and file IRS Form 990 disclosures. Many nonprofits manage dozens of grants at once, each with its own spending and reporting rules.

Legacy nonprofit systems like Blackbaud, Sage, and MIP still dominate the market, but they often lack real-time spend controls, modern approval workflows, and seamless integrations with the tools that nonprofits increasingly depend on.

Rather than replacing these systems entirely, Givefront is positioned as a vertical layer that sits on top of them. The platform integrates with legacy accounting software while adding nonprofit expense audits, audit receipt collection, grant-based budgeting, and automated reporting.

“Many of the workflows we’re building are deeply specific to how this part of the economy works,” Tengtrakool said. “Our workflows and integrations are a 10x improvement over traditional enterprise or spend management tools.”

Givefront generates revenue from card swaps and subscriptions tied to its bill payment functionality. Over time, Givefront plans to expand revenue by launching adjacent products, such as payroll, banking, budgeting and potentially investment and fund management.

Since launching its cards about six months ago, Givefront has onboarded hundreds of organizations and is reporting more than 200% month-over-month growth in revenue and total payment volume. The company expects to serve about 1,000 nonprofits by the end of the year, with a long-term goal of reaching 5,000 organizations by the middle of next year.

Tengtrakool says the team’s youth, which also includes a 17-year-old founding engineer, has served as both an asset and a challenge so far. Some nonprofit leaders find the age of the group refreshing, while others are hesitant to trust the financial infrastructure to such a young group.

Churches and religious organizations have driven the strongest adoption, he says. Many rely on volunteer treasurers instead of full-time finance staff, and Givefront’s automation greatly reduces their operational burden.

The company recently closed a $2 million round led by Script Capital with participation from Y Combinator, C3 Ventures, Phoenix Fund and angels including the CEOs of Chariot and Wealthfront. The seed investment will help the company scale distribution, grow its team and expand its card and bill payment offerings.