Last year, startup General Fusion struggled to raise capital, laying off at least 25% of its staff before receiving a $22 million rescue investment while it figured out how to keep the company afloat.

Today, General Fusion revealed its survival plan: It will go public through a reverse merger with a special-purpose buyout company, Spring Valley IIIcombined with additional investment from institutional investors. It’s a significant change in fortunes for a company whose CEO wrote a public letter just last year asking for funding.

If the deal closes as planned, General Fusion could receive up to $335 million from the transaction, more than double what it was reportedly trying to raise last year before landing the $22 million.

The transaction will value the combined company at about $1 billion, General Fusion said. Before the merger was announced. The fusion startup, which was founded in 2002, has previously raised more than $440 million, according to PitchBook.

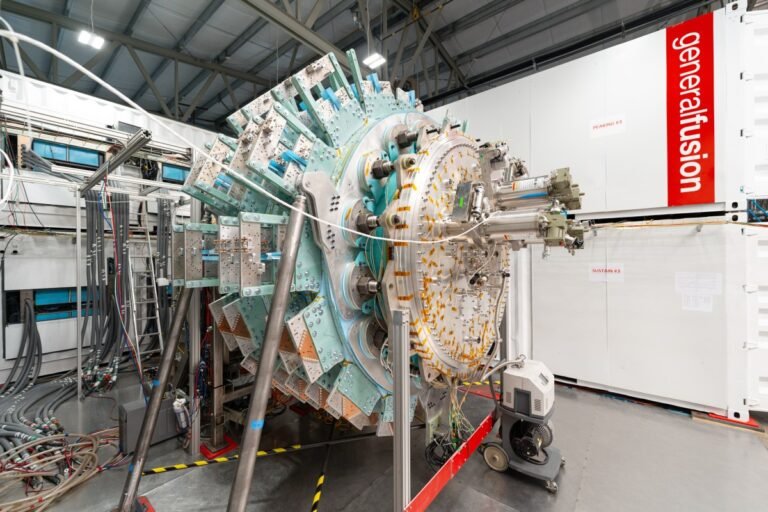

General Fusion plans to use the money to complete the demonstration reactor, Lawson Machine 26 (LM26). The device uses an approach called “magnetized target fusion,” which works by compressing a plasma until its atoms fuse together, releasing energy in the process. The National Ignition Facility used inertial confinement in successful fusion experiments, using lasers to bombard the fuel pellets to release the compressive force.

However, the LM26 avoids lasers. Instead, it uses steam-powered pistons that drive a wall of liquid lithium metal inward to compress the fuel pellet. This liquid lithium is then circulated through a heat exchanger, which produces steam to spin a generator. By avoiding the expensive lasers or superconducting magnets required in other fusion reactor designs, General Fusion hopes to build a fusion power plant for less money. But first the company must prove that its approach is sustainable.

Last year, before revealing its financial problems, General Fusion said that in 2026, LM26 would reach the scientific limit, at which a fusion reaction produces more power than was required to launch it. Scientific balancing is a key milestone, although it is distinct and easier to achieve than the commercial cap, at which fusion reactions release enough energy to export electricity to the grid. In an email to TechCrunch, General Fusion said it now aims to break even in 2028.

Techcrunch event

San Francisco

|

13-15 October 2026

The acquired company, Spring Valley, is something of a specialist in inverter mergers with energy companies. It previously took NuScale Power, a small modular nuclear reactor company, to go public in a deal whose share price has since fallen more than 50% from its peak last year. The company is also in the midst of completing a merger with Eagle Energy Metals, a uranium mining company that is also supposed to be developing its own SMR.

General Fusion is not the first fusion company to go public. In December, TAE Technologies announced it would merge with Trump Media & Technology Group in a deal that values the combined company at more than $6 billion.

The common thread that connects these deals is, of course, data centers. They are expected to consume nearly 300% more energy by 2035, according to BloombergNEF, and General Fusion specifically points to the growing energy demand for data centers in merger announcement.

But the company also pointed to broader electrification trends, including electric vehicles and electric heating, which could increase total electricity demand by as much as 50% by 2035. It’s a reminder that while the Trump administration has questioned an electrified future, other countries are moving forward. While General Fusion may face technological challenges, trends in the energy world suggest that if it can deliver fusion power at a reasonable cost, it will find plenty of willing buyers.

Update: 1:50 p.m. ET: Added comment from General Fusion about the new exit target date.