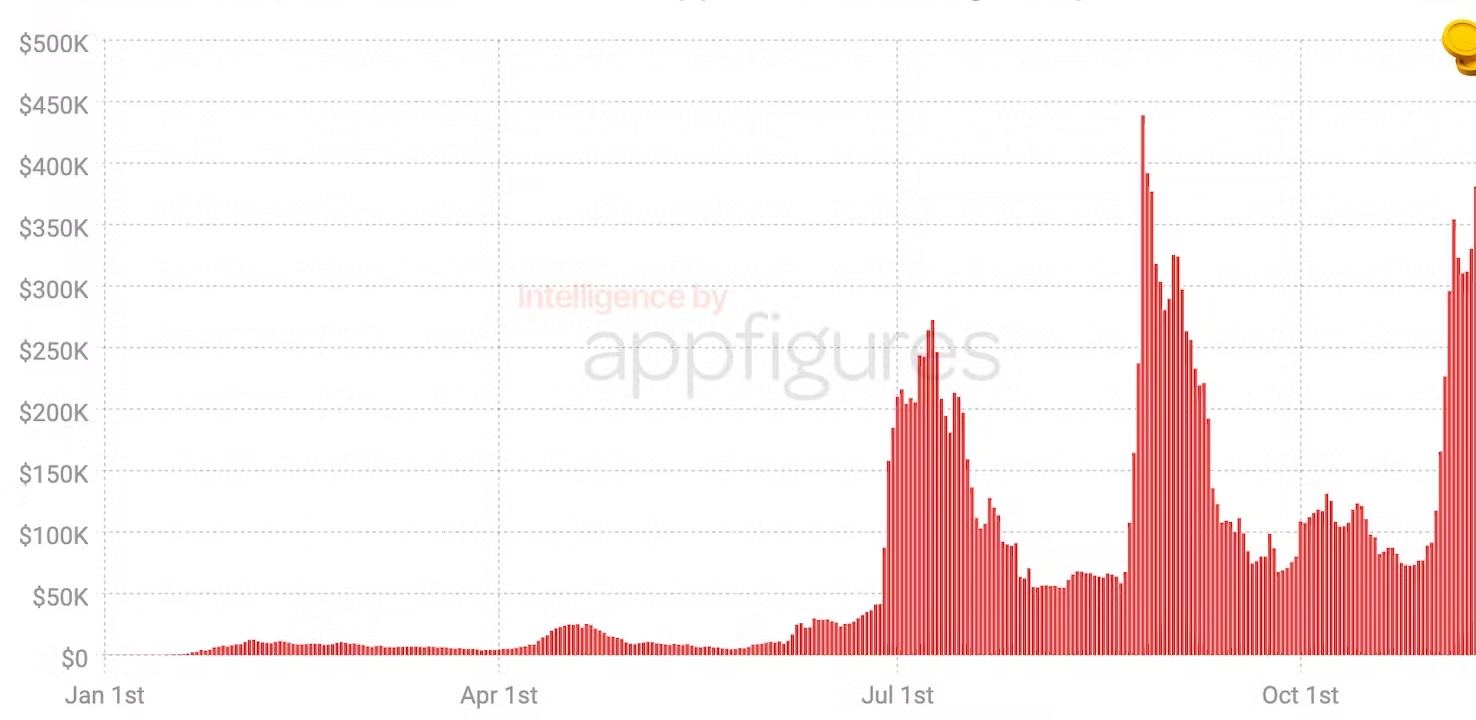

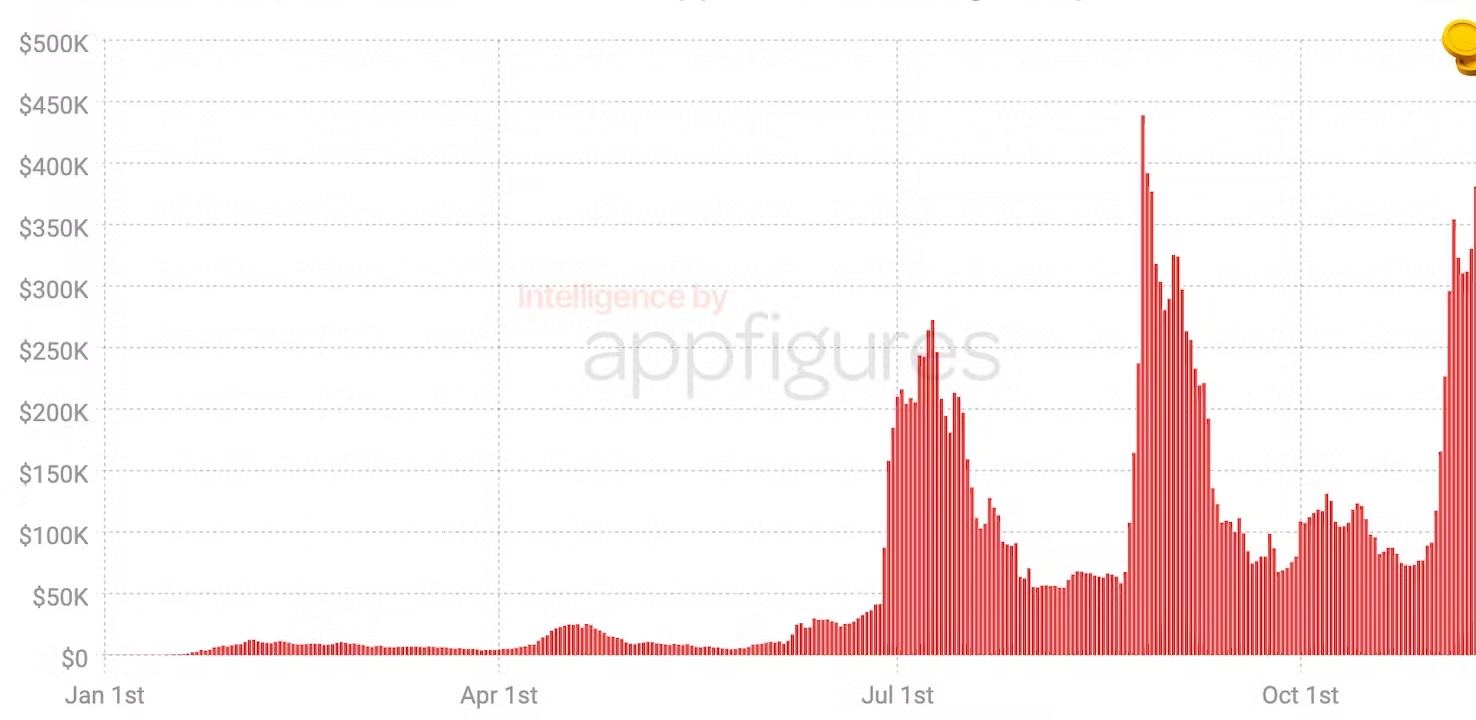

Was Quibi a failure or just before its time? This month, a short video app and a Quibi-like entertainment service called ReelShort found its way to the top of the App Store, which led to the app gaining 1.9 million downloads (so far) in November alone. Last Saturday, the app also set a daily record for downloads and revenue, with 326,000 new installs and $459,000 in net revenue — the latter meaning the revenue it retained after paying app store fees.

This data is provided by a market intelligence company Appfiguresraises the question of whether there’s a continued consumer appetite for short-lived, manufactured entertainment, similar to that once offered by failed startup Quibi, or whether ReelShort’s time at the top of the charts is more of a fluke — or perhaps helped by heavy app marketing spending .

Image Credits: Appfigures

The company, Sunnyvale-based Crazy Maple Studio, did not respond to press inquiries about its app’s newfound success, but the studio’s other mobile products include animated interactive story apps, fantasy apps and storytelling applications. ReelShort fits into this big portfolio as it features short shows with real actors and uses a virtual currency to unlock further episodes. Users can watch ads to earn coins or they can buy them directly in the app.

As a result of this model, the app has been downloaded 11 million times on iOS and Android and has generated $22 million in net revenue to date since its launch in August 2022. This month, ReelShort even spent a few days as the No. .2 app in the US and reached No. 1 in the Entertainment category for about four days.

What’s most striking about this is that ReelShort’s video content itself is arguably worse than Quibi’s — and Quibi hasn’t always been great. The acting and writing in ReelShort is so bad you almost have to wonder if it’s intentional at times. The stories themselves are like low-quality soap opera episodes — or like those mobile storytelling games brought to life. However, regardless of the fact that the application has found little audience, it shows its income.

On average, ReelShort makes about $2 per download, Appfigures says. That’s more than Quibi’s estimated $0.73 per download, though that comparison doesn’t take inflation into account.

Quibi claimed its shutdown was due to the timing of the app’s launch — it was meant to be an on-the-go app, but ended up in the middle of a pandemic when everyone was staying home. However, the app also failed to capitalize on what made social video successful, instead relying on writers and Hollywood personalities to create mindless content that was often boring or just plain weird. ReelShort doesn’t exactly subvert that model with quality content reduced to clip size. On the contrary, it was serving thousands of ads on Meta’s platforms to present his soap opera-like stories.

This month, Meta counts about 8,100 ads in the US, which could explain the boost in installs and revenue. The app also ran an Apple Search Ads campaign recently, notes Appfigures. Its downloads started to decline, probably right after the campaign ended, and then revenue followed.

Image Credits: Appfigures

The question now is whether these new users who discovered ReelShort will stick around for a Quibi redux.

After all, ReelShort’s competition, like Quibi’s, continues to be TikTok — a platform with exciting short-form videos that also feature movie clips from higher-quality sources. TikTok users will often find themselves watching clips in a sequence that pulls clips from popular movies to watch a two-hour movie that’s limited to about 10 minutes of content. Despite claims of copyright infringement leading to many takedowns of this type of content, it still permeates the app. Paramount finally embraced the trend releasing “Mean Girls” last month to 23 clips on TikTok (at least for a limited time).

ReelShort currently has mixed reviews, with many users complaining about the virtual currency and ad model. Some say they’d rather pay for a subscription, or at least think ads should be more limited. Many reviews claim that the content is entertaining or even “awesome”, which seems like a stretch. However, the app continues to rank as the No. 3 entertainment app in the US right now, which suggests there is consumer demand for something like this.