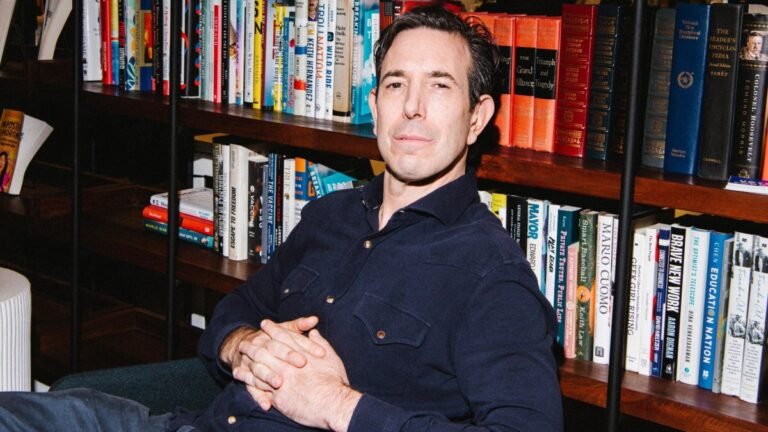

Bradley Tusk, co -founder and chief executive of Tusk Venture Partners, told TechCrunch in today’s episode Equity that VC, as we know is dead. And has passed the last four years.

“Maybe there is some VC I have never heard of this is full of liquidity for the last two years, but we haven’t returned $ 1 to our LPs in four years,” Tusk said.

The VC had a rough couple years thanks to the highest interest rates, it crashes the starting values of 2021 high and tangled IPO and M&A transactions.

Many investors had kept their breath for President Donald Trump to revitalize the VC landscape with liberalization cash and tax reforms in favor of businesses. However, the uncertainty after the recordings of Trump’s executive orders, the trade wars powered by invoices and the disassembly of federal organizations has mitigated the expected increase in VC activity.

Or as Tusk put it, “I just don’t know many serious economists who believe that a trade war is a good idea for one’s economy.”

Thus, Tusk retreats from the traditional VC model and decided not to raise a fourth cashier. Instead, it shifts the focus on a “Services Services” model, which allows Tusk to accept shares in return to help newly established businesses browse regulatory environments, legislative communications and government supplies.

For Tusk, the services for services go back to his roots. In 2010, when he had just begun his political counseling company Tusk Strategies, what was then a small transport technology company called Uber recruited his services. Uber didn’t have the cash to pay him, so he was offered shares. Tusk spent the following years “current campaigns in all the US to legalize Uber and the exchange of ride”.

The creation of regulatory frameworks for the technologies to save newly formed businesses from death by politics was Tusk’s bread and butter for years, an experience gained through a previous role as a campaign manager for Michael Bloomberg’s Municipal Struggle.

All the “real things VC”, such as the concentration of capital from LPS and “compliance, board seats, portfolio construction”, as soon as they began to feel like a detachment of the kind of work that really loves to do.

And it feels like a shortcut to do the work he loves, while still making more money than he can do as a classic business investor.

“When I realized that I could get just as easily on lid tables and get shares from the newly formed businesses I like in return for my experience, the traditional model just didn’t make sense,” Tusk said.

“I really made more money when I was in services for services, because, although there is less leverage than in business control, you keep 100% of revenue,” he said. “While in the traditional business I have to return the investment capital to investors. I have to return the fees, then I have to give them 80 cents to the dollar,” he said.

Tusk Venture Partners will continue to support its existing portfolio companies until the Fund’s life cycle is taken in 2031.