French startup Hyperline he wants to build the next generation Chargebee. Over the past two years, the startup has built a new billing platform that can be used for recurring subscriptions, one-time purchases, usage-based billing, and more.

Hyperline raised a seed funding round of €4 million from Index Ventures in 2023 ($4.1 million at today’s exchange rate). And Index Ventures is doubling that investment as it invests another $10 million in the startup.

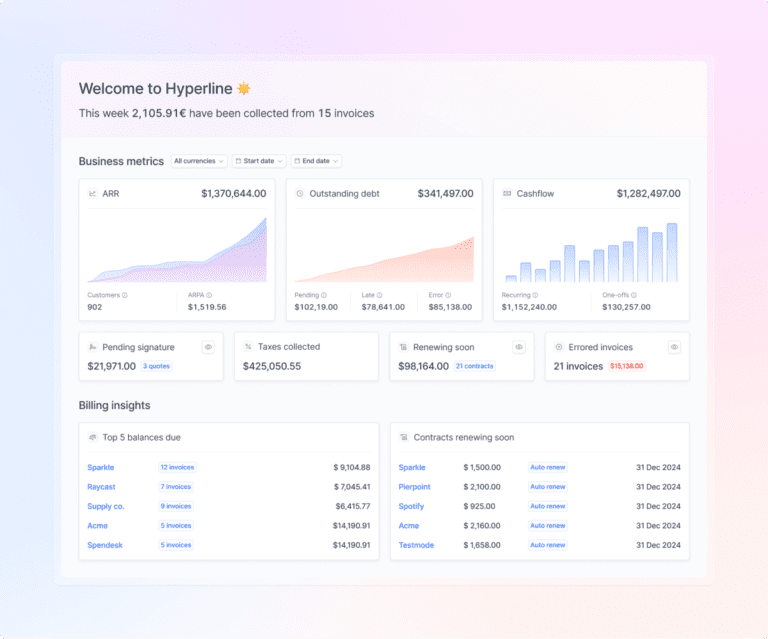

While pricing seems like a simple issue, it becomes a tedious problem once you start scaling. “With billing, what’s time-consuming is really the day-to-day operations. Every day, when you have more than 200 or 300 customers, someone has to go and check that everything is correct,” founder and CEO Lucas Bédout told TechCrunch.

Sometimes, the pricing isn’t right. Other times, you forgot to add some items to the invoice, or the customer asks for a partial refund. And, of course, automatic payments fail quite regularly for one reason or another.

“In the beginning, we told ourselves, we’re going to look at current tools like Chargebee and do a little bit better than them. Except 20% better is nice, but everything has changed so much that now it’s just different. Now, people are looking for automation, they don’t want to manually process invoices, send reminders, create offers, etc.” Bédout said.

In addition to managing subscriptions, Hyperline has added other pricing models. For example, customers can set custom prices on the fly or add a usage-based component so that customers pay for what they use. Hyperline also handles invoices directly.

And when it’s time to pay, Hyperline doesn’t process payments directly, but takes care of that part for you. “We manage the entire value chain except for payments… However, we do something that is really cool about payments. We position ourselves as an orchestrator. Our customers do not use payment processors directly,” Bédout said.

Instead of juggling between different tabs to interact with Stripe, GoCardless, Airwallex, or another payment processor, Hyperline acts as an interface to interact with these payment providers. It makes it easy to use multiple payment providers depending on the country or payment method.

Customers usually start with the web interface. They connect Hyperline to their CRM so that sales teams can create offers directly from the CRM. They also connect the platform with accounting software to process invoices and reconcile payments.

However, Hyperline also offers an API, which can be particularly useful for synchronizing events directly from a data warehouse for usage-based billing.

Currently 14 people work for Hyperline, but the company expects to grow to 25 employees in the near future. Clients include Lokki, Malou, ScorePlay, Gladia and Formance.

“The majority of our clients today generate between 3 and 10 million euros in revenue,” said Bédout. But Hyperline already believes it can work with larger companies that handle a large volume of invoices. This will require working with integration companies. And it’s something Hyperline is already testing.