EduFi, a fintech startup that enables financially disadvantaged students to secure loans for their education, has raised $6.1 million in a pre-seed round led by Zayn VC with participation from Palm Drive Capital, Deem Ventures, Q Business and angel investors.

The Singapore-based startup has launched an AI-based Lending Now, Pay Later (SNPL) platform and its mobile app in Pakistan, a country that does not have student loan products as a category. Instead, users get personal loans with a high interest rate and time-consuming process, Aleena Nadeem, founder and CEO EduFihe told TechCrunch.

EduFi wants to address the two issues of the country – high levels of poverty and low literacy rates – through its fintech platform. In Pakistan, about 40% of students attend private schools because of the poor quality of public schools, resulting in them spending more than $14 billion on their education each year. Moreover, over 50% of the adult population in Pakistan does not have access to financial services such as bank accounts and insurance.

Nadeem, an MIT graduate who previously worked at Goldman Sachs and Ventura Capital, had seen firsthand many children struggle with financial barriers to receive a quality education while working at Progressive Education Network (PEN) in Pakistan. PEN is a non-profit organization that provides free and quality education to children who cannot afford it.

“Many children in Pakistan make it to high school, but there is a sharp decline in those who are able to achieve a higher college education,” Nadeem said. “This drop is where EduFi is trying to inject capital into the gap between high school graduation and first-year university entry.”

The two-year-old company already has partnerships with 15 universities, allowing the app to be available to around 200,000 undergraduate, postgraduate and PhD fee-paying students across Pakistan.

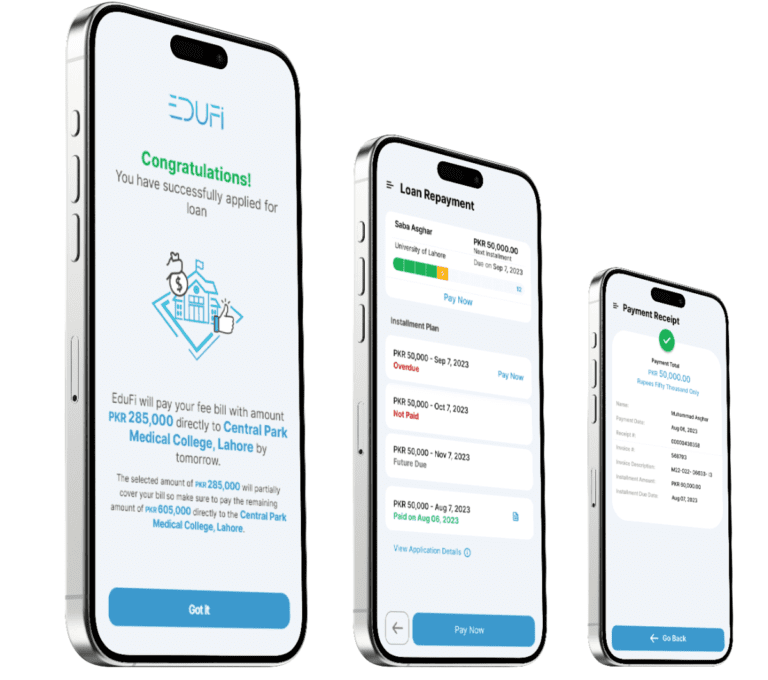

When a student (or a parent) applies for loans through the app, EduFi requires the financial status of the applicant (student or parent). For example, bank statements from the previous 12 months or a source of income that can support their loan repayments, such as employment, a small business or self-employment. Once a student loan facility is approved, EduFi sends the funds directly to the college bank.

During the beta phase for the last 18 months, EduFi tested its credit model against 80,000 consumer finance loans that had been taken out by banks. The startup claims that the credit scoring system allows student loans to be disbursed within 48 hours of application and fast disbursement of the loan. EduFi, which has received approval for a lending license from the Securities and Exchange Commission of Pakistan (SECP), is awaiting the grant of the license, which is expected in November. Nadeem said it is currently validating its product and service with potential customers and collecting feedback and data to improve its services.

The company says it has upgraded the traditional banking approach, which involves high interest rates and a complicated application process, as well as taking at least three to four weeks to be approved. EduFi’s digital lending app offers users a convenient, simple process and flexible loan terms and conditions.

“Education offers hope and can change people’s lives. I am an example of millions out there. EduFi offers that hope and will be a catalyst for change in people’s lives as we lift one of the biggest burdens on aspiring families.” Nadeem said. “For example, students in dental or medical schools have to pay over $8,000 upfront, which is unsustainable for many in Pakistan. Every student we’ve helped is a testament to the ambition, opportunity and empowerment we strive for at EduFi.”

The company will use the seed capital to reach more customers, optimize its platform, expand into neighboring countries and launch other fintech products, including student credit cards.

“This is an important step toward achieving financial inclusion for middle- and low-income families. In Pakistan, families spend more than 50% of their income on their children’s education, which is becoming increasingly difficult due to inflationary pressures. EduFi’s innovative approach will help ease this burden and empower families to invest in their children’s future,” said Faisal Aftab, general partner and founder of Zayn VC.