The US Department of Justice filed a lawsuit against Apple on Thursday, accusing the company led by CEO Tim Cook of engaging in anti-competitive business practices. The allegations include claims that Apple is preventing competitors from accessing certain iPhone features and that the company’s actions are affecting the “flow of speech” through its Apple TV+ streaming service.

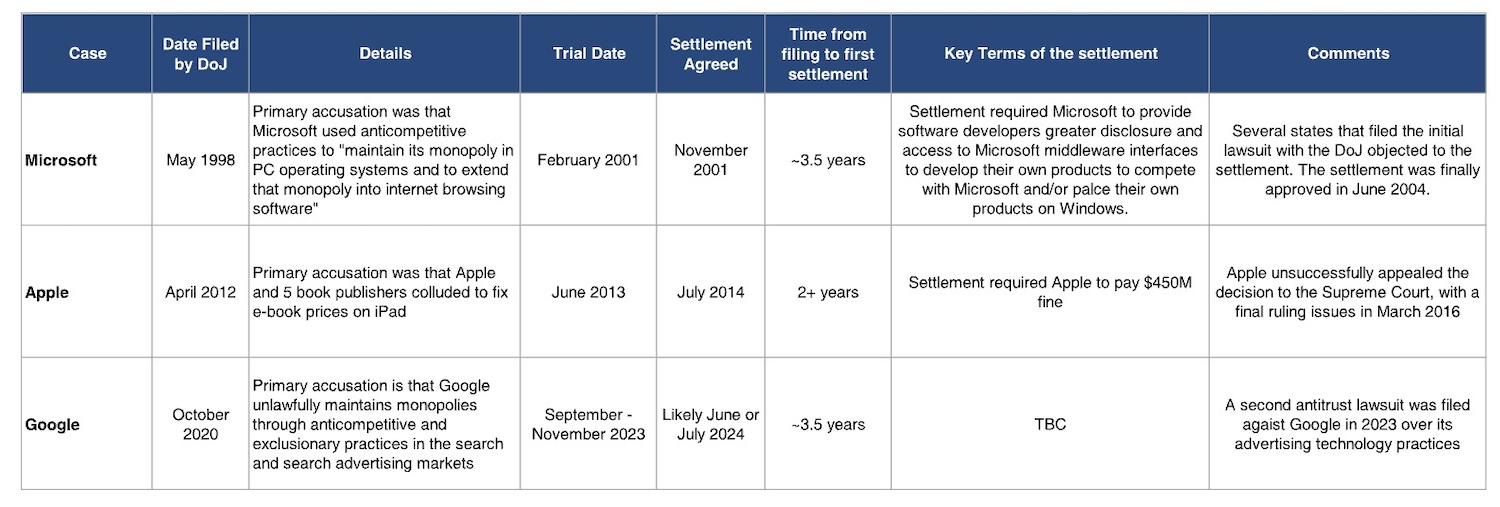

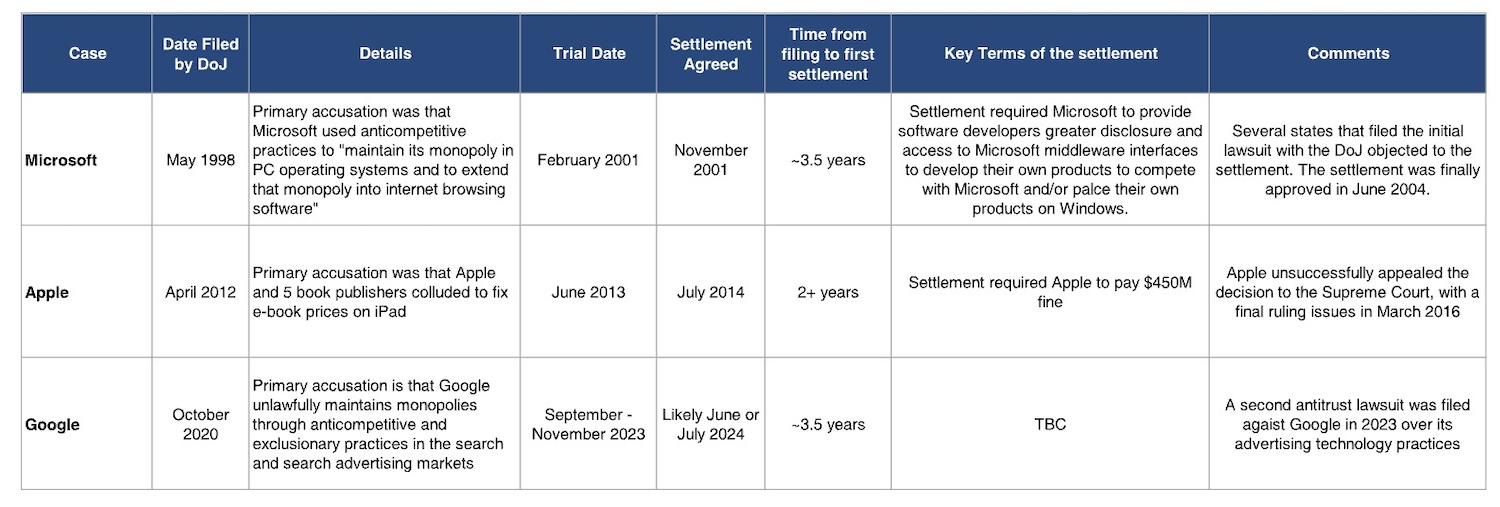

However, even if the DOJ proves any of the allegations, it is highly unlikely that Apple will face material changes for years, as history shows that such lawsuits often take a significant amount of time to reach trial, let alone resolution. The Department of Justice’s ongoing case against Google, filed in 2020, won’t go to trial until 2023, with no legal remedies or financial impact expected for up to two more years.

This is not the first time Apple has faced legal action from the Department of Justice. In 2012, the service sued Apple for conspiring with publishers to raise e-book prices, a lawsuit that was settled only in 2016.

“Precedent suggests resolution of the complaint will take three to five years, including appeals,” Bernstein analysts wrote in a note.

Analysts at Morgan Stanley said on Friday that the current lawsuit could also favor Apple, as several similar complaints have already been ruled on by a judge in the Apple vs Epic case, with the decision saying that Apple is not violating antitrust laws. The DOJ filing also made little to no mention of Apple’s lucrative search deal with Google and did not mention the App Store as one of the five main examples of monopolistic behavior.

Previous major antitrust cases. (Image: Bernstein)

The Bernstein analysts added, “While the Justice Department’s charges focus on the iPhone, we don’t see the potential settlement materially affecting Apple financially or undermining the iPhone franchise: at worst, Apple pays a fine and loosens restrictions on competition on the iOS platform. we believe it will have limited impact on iPhone user retention or Services revenue.”

Which led Morgan Stanley analysts to conclude that the Justice Department’s lawsuit poses “more of a fundamental risk than a near-term event risk” for Apple.

They added:

Otherwise, yes, this lawsuit creates a stock glut, but the market has a short-term memory, and in our view, fundamentals are more likely to drive Apple’s share price over the next 12 months (and several years), rather than this lawsuit. We can cite a number of historical instances where companies in the throes of litigation threatening their core product/differentiating value proposition have outperformed despite legal superiority: 1) Apple/Epic, where the stock outperformed by 15 points in the 18 months since Epic’s first legal filing threatens the App Store to take rates in August 2020 and 2) US vs. Google, where the stock has nearly doubled since the Justice Department first announced its investigation into Alphabet’s search practices. Our point is that the settlement/difference is a bigger long-term risk for Apple than it has been historically, but the stock’s drivers for the foreseeable future will almost certainly be based on fundamentals, especially given that this lawsuit may not resolved by at least 2028 (or even 2030) based on previous cases.