The UK’s competition watchdog, the Competition and Markets Authority (CMA), has issued a warning about Big Tech’s entrenchment in the advanced artificial intelligence market, with chief executive Sarah Cardell. expressing “real concerns” about the growth of the industry.

In one Paper update on the fundamental models of artificial intelligence published on Thursday, the CMA warned about the increasing interconnection and concentration among the developers in the field of cutting edge technology responsible for the explosion of artificial intelligence production tools.

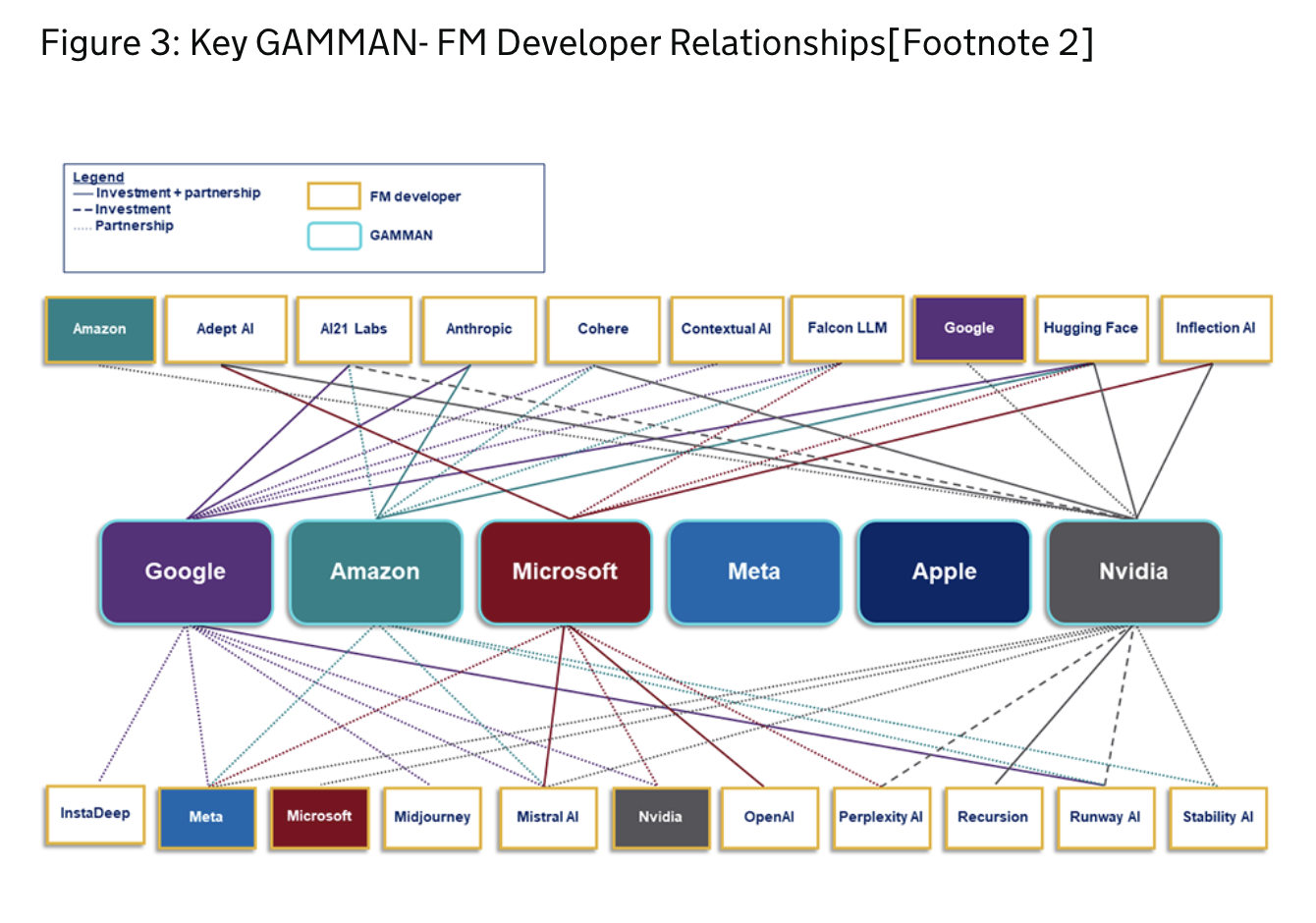

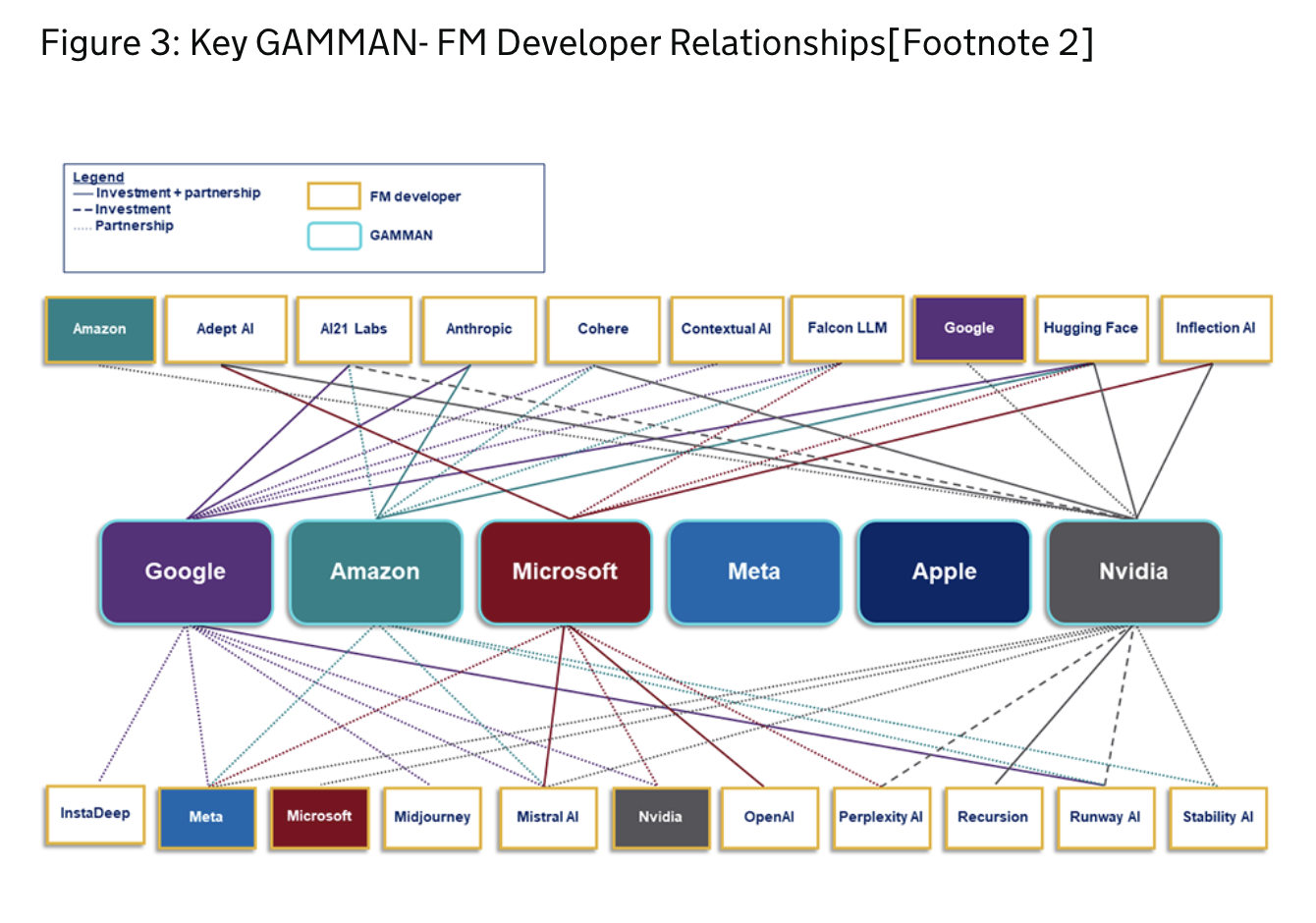

The CMA paper highlights the recurring presence of Google, Amazon, Microsoft, Meta and Apple (aka GAMMA) across the AI value chain: computing, data, model development, partnerships, launch and distribution platforms . And while the regulator also stressed that it recognizes that partnership agreements “can play a pro-competitive role in the technology ecosystem”, it combined that with a warning that “strong partnerships and integrated companies” can pose competitive risks that come in contrast with open markets.

Image Credits: CMA Foundation Models. Paper update

“We are concerned that the Foreign Minister [foundational model] the sector is developing in ways that risk negative market outcomes,” the CMA wrote, referring to a type of artificial intelligence that has been developed with large amounts of data and computing power and can be used to support a variety of applications.

“Specifically, the growing presence in the FM value chain of a small number of technology incumbents, who already hold market power positions in many of today’s most important digital markets, could profoundly shape FM-related markets in burden of fair, open and effective competition, ultimately harming businesses and consumers, for example by reducing choice and quality and raising prices,” he warned.

The CMA undertook an initial review of the leading edge of the AI market last May and went on to publish a set of principles for “responsible” AI genetic development that it said would guide its oversight of the rapidly evolving market. Although Will Hayter, senior director of the CMA’s Digital Markets Unit, told TechCrunch last fall that he was in no rush to regulate advanced artificial intelligence because he wanted to give the market a chance to grow.

Since then, the watchdog has stepped in to scrutinize the friendly relationship between OpenAI, the developer behind the viral AI chatbot ChatGPT, and Microsoft, a major investor in OpenAI. His updated paper makes observations about the dizzying pace of market change. For example, he pointed to research by the UK’s internet regulator, Ofcom, in exhibition last year which found that 31% of adults and 79% of 13- to 17-year-olds in the UK have used an AI-powered tool such as ChatGPT, Snapchat My AI or Bing Chat (aka Copilot). Thus, there are signs that CMA is reconsidering its initial loose position on the GenAI market amid the commercial “turbulence” absorbing computing, data and talent.

Its briefing paper identifies three “key interrelated risks to fair, effective and open competition,” as it puts it, to which GAMMA’s ubiquity speaks: (1) Firms that control “critical inputs” to the development of fundamental models (known as as general purpose AI models), which may allow them to limit access and create a moat against competition; (2) the ability of tech giants to exploit dominant positions in consumer or business-facing markets to distort the choices for GenAI services and limit competition in the development of these tools; and (3) collaborations involving key actors, which according to the CMA “could exacerbate existing positions of market power through the value chain”.

Image Credits: CMA

In a speech delivered Thursday in Washington, D.C., at a legal event focused on genetic artificial intelligence, Cardell pointed to the “win-all dynamic” seen in previous eras of web developers, when Big Tech created and consolidated the Web 2.0 empires while regulators sat on their heels. He said it was important that competition enforcers did not repeat the same mistakes with this next generation of digital development.

“The benefits we want to see flow from [advanced AI]for businesses and consumers, in terms of quality, choice and price, and the best innovations, are far more likely in a world where companies themselves are subject to fair, open and efficient competition than in a world where are simply able to leverage core models to further consolidate and expand their existing positions of power in digital markets,” he said, adding: “So we believe it is important to act now to ensure that a small number of companies with unprecedented power in the market will not end up being able to control not only how the most powerful models are designed and built, but also how they are integrated and used in all parts of our economy and lives.”

How will CMA intervene at the top of the AI market? It has yet to announce specific measures, but Cardell said it is closely monitoring GAMMA’s partnerships and is stepping up its use of merger review to see if any of those arrangements fall under existing merger rules.

This will unlock official investigative powers, and even the ability to block links it deems anti-competitive. However, for now, the CMA has not gone that far, despite clear and growing concerns about GAMMA GenAI’s cozy ties. The review of the ties between OpenAI and Microsoft — for example, to determine whether the collaboration constitutes a “relevant merger situation” — is ongoing.

“Some of these arrangements are quite complex and opaque, which means we may not have sufficient information to assess this risk without using our merger review powers to build that understanding,” Cardell also told the audience, explaining the challenges of trying to understand power dynamics. of the AI market without unlocking formal merger control powers. “Some arrangements that do not fall under the merger rules may be problematic, even if they cannot ultimately be remedied through merger control. They may even have been structured by the parties to seek to avoid the scope of the merger rules. Likewise, certain arrangements may not raise competition concerns.’

“By speeding up our merger review, we hope to gain greater clarity about what types of partnerships and arrangements may fall under the merger rules and under what circumstances competition concerns may arise — and that clarity will also benefit the companies themselves businesses,” he added. .

The CMA Update report presents some “indicative factors”, which Cardell said may cause greater concern and caution in FM partnerships, such as the rising power of partners, regarding AI inputs. and downstream power, over distribution channels. He also said the watchdog would look closely at the nature of the partnership and the level of “influence and alignment of incentives” between the partners.

Meanwhile, the UK regulator is urging AI giants to follow the seven development principles it set out last autumn to steer market developments onto responsible rails where competition and consumer protection are infused. (The short version of what he wants to see is: accountability, access, diversity, choice, flexibility, fair dealing and transparency.)

“We are committed to implementing the principles we have developed and using all the legal powers at our disposal – now and in the future – to ensure that this transformative and structurally critical technology delivers on its promise,” Cardell said.