Robinhood’s long-awaited international expansion is nearing completion. The consumer trading and investing app, tailored for the younger generations, is launched encryption application to all eligible users in the European Union, the company he said Thursday.

The announcement comes after its foray into the UK just a week ago. While it promotes crypto trading to EU clients, it currently only makes its brokerage service available in the UK.

The EU is leading the way in regulations to enforce cryptocurrency traceability to fight money laundering and protect retailers from market volatility. Among the most important frameworks is the Markets in Crypto-Assets (MiCA) rule, which focuses on stablecoin regulation and is considered one of the most comprehensive regimes in the world for crypto-assets.

“The EU has developed one of the most comprehensive policies in the world for the regulation of crypto assets, which is why we chose the region to incorporate Robinhood Crypto’s international expansion plans,” said Johann Kerbrat, CEO of Robinhood Crypto.

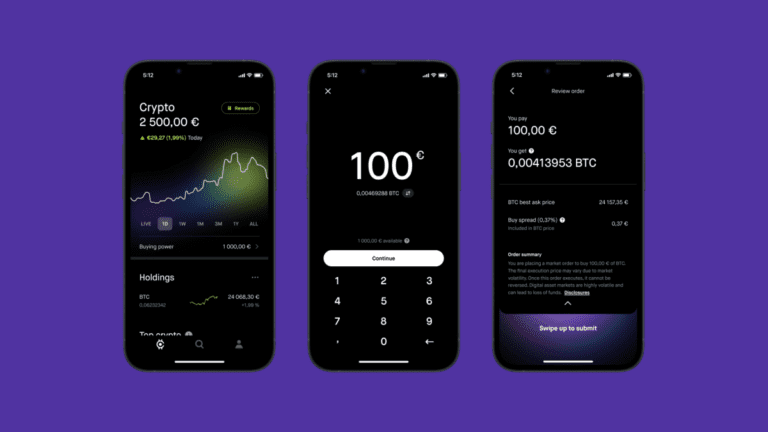

In addition to low fees, Robinhood claims to be the only crypto custodial platform – where clients’ funds are held in the custody of the exchange rather than in self-hosted wallets – that will receive a percentage of their trading volume back each month, paid in Bitcoin. Users in the EU can buy and sell about 25 cryptocurrencies, including major ones like Bitcoin and Ethereum.

Robinhood is taking other steps to reassure European users that their money is being used, given that its past business practices have been less than ideal. In the US, the Securities and Exchange Commission criticized the stock trading app for misleading users about how it makes money and for not fulfilling its promise of better execution of trades. He ended up paying $65 million to settle those SEC charges.

In its push for crypto in the EU, Robinhood promises transparency by showing its trading spread, which includes the discount it takes from sell and trade orders in the app.

It also guarantees that it will never combine customer coins with venture capital except for operational purposes, such as paying network fees. In the wake of the FTX collapse, users are increasingly wary of centralized crypto platforms and moving to decentralized alternatives.

Robinhood itself has been tight-lipped about its crypto operations. In June, it voluntarily moved to limit the trading and holding of certain tokens for its US customers, at a time when the government took a firmer stance against exchange giants such as Binance and Coinbase.

The Robinhood Crypto app, available at iOS and Android as of today, it is limited to European citizens over the age of 18. The platform plans to include more tokens and add new features such as crypto transfers, staking and learning rewards in 2024.