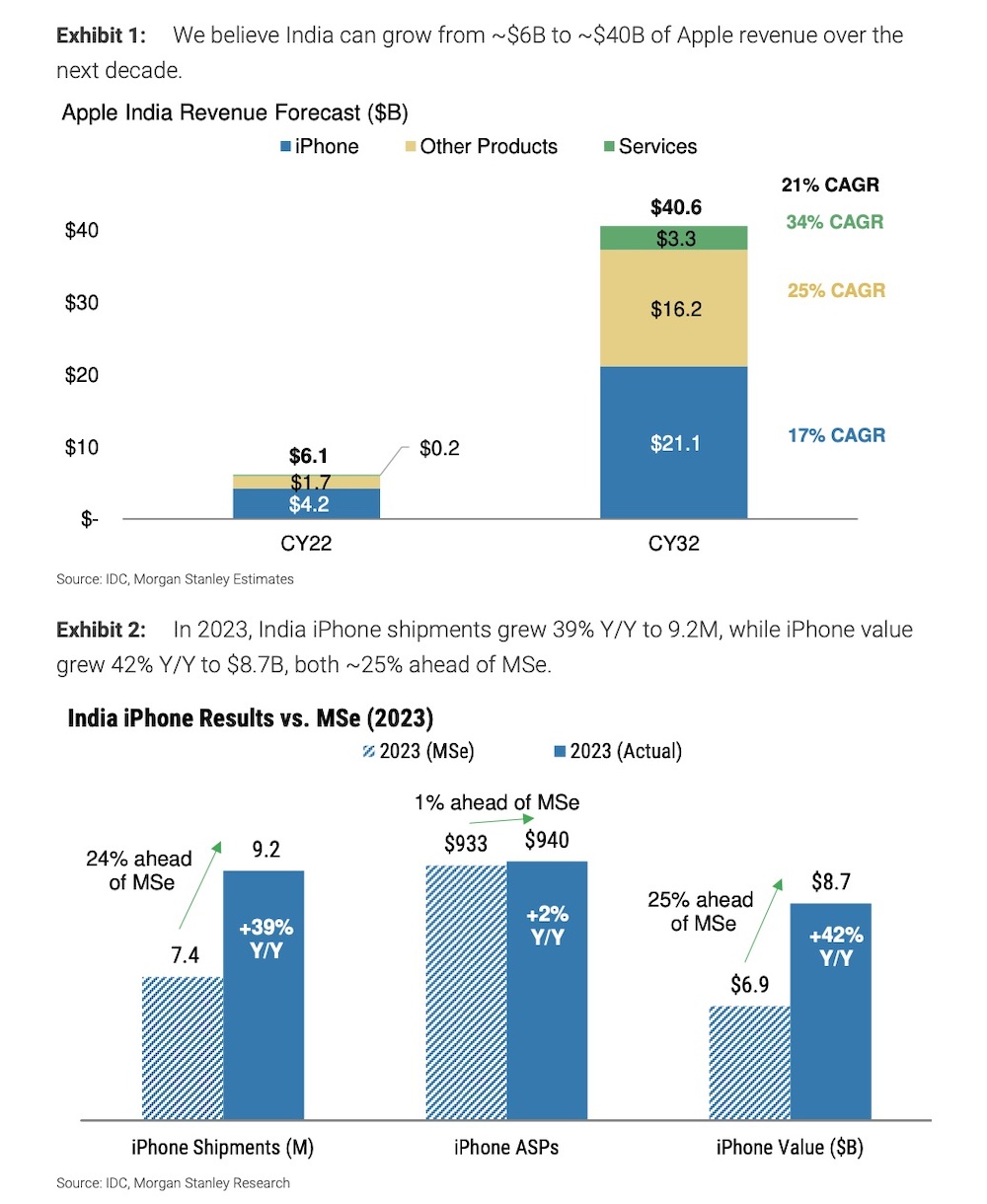

Apple’s long-term bet on India is starting to pay dividends. The company’s India revenue rose 42% year-on-year in 2023 to $8.7 billion, Morgan Stanley wrote in a note on Friday.

iPhone shipments in India grew 39% year-on-year in 2023 to 9.2 million units, making it the fifth largest iPhone smartphone market. India’s iPhone business is now bigger than any single country in the European Union, Morgan Stanley added.

“This means that in CY23, India accounted for 4% of iPhone shipments and revenue, up from 3% in CY22 and 1% 5 years ago. This compares to iPhone shipments in China, which accounted for 20% of iPhone shipments and revenue in CY23 (down 1-2 points y/y, respectively),” the analysts wrote.

“Ultimately, this means that India as a standalone market is still not big enough to offset the declines we are seeing in the Chinese market today, but if India continues to grow on the same trajectory while iPhone shipments to China remain stable, the India would be a bigger iPhone market than China by 2027.”

Image Credits: IDC, Morgan Stanley Research

Driving iPhone growth in India is increasing consumer demand for premium devices with larger storage capacity instead of the latest models. The average iPhone sold in India last year had about 260GB of memory, up 26% from 2022, Morgan Stanley said. India’s iPhone average selling prices (ASP) rose 2% YoY to $940 in 2023.

The top five iPhone models shipped in the country were the iPhone 13, iPhone 14, iPhone 14 Plus, iPhone 14 Pro and iPhone 15 and accounted for 86% of total sales, according to data from research firm IDC, cited by Morgan Stanley. At $940, India’s iPhone ASP still trails the global average of $1,045 by about 10%.

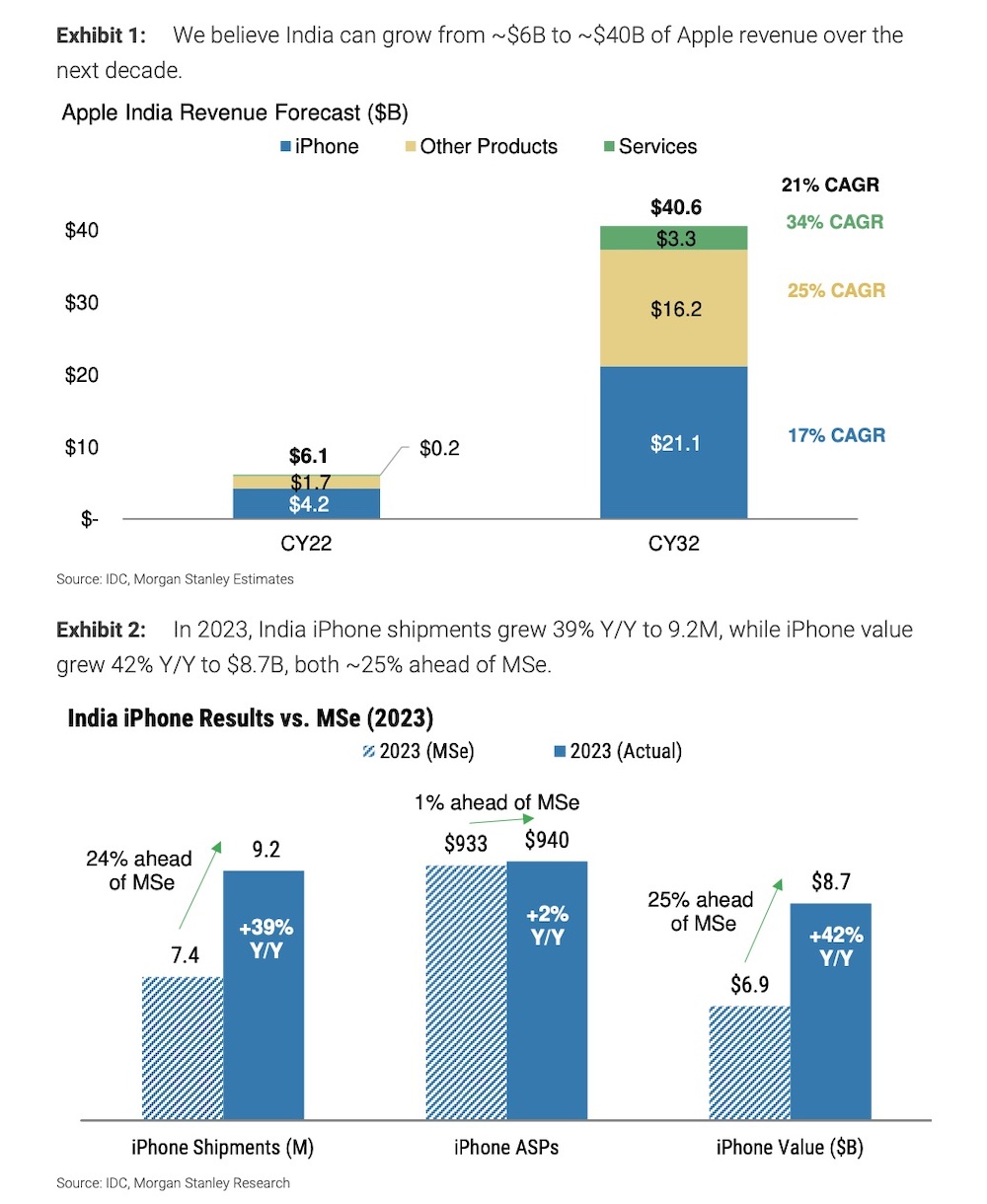

Apple sees India as a major growth engine going forward, having opened its first two retail stores in the country last year. The company is also increasingly shifting its iPhone manufacturing to the South Asian nation. Morgan Stanley estimates that the tech giant’s revenue in India will reach $40 billion by 2032.