Digital Integrationa SaaS company that specializes in helping financial institutions strengthen customer relationships, has secured $58 million in growth capital from Volition Capital to continue developing its digital engagement platform.

Ted Brown and Jonathan Crossman co-founded the company in 2015 under the name SalesBrief and focused on the B2B sales cycle. In 2017, they pivoted after entering the Digital Federal Credit Union fintech accelerator. They changed the name to Digital Onboarding and started selling the engagement platform to banks and credit unions in January 2018.

Notices from financial institutions, which are subject to strict regulations, are often in paper form, especially when opening a new account. This often results in between 25% and 40% of new checking accounts being closed within the first year, said Brown, CEO of Digital Onboarding, citing statistics from Report on the future of finance 2023.

“A lot of the valuable parts of the relationship were taken away by the neobanks that made people swipe a debit card,” Brown told TechCrunch.

Financial institutions then spend hundreds of dollars in marketing and awareness to get a customer to open an account they don’t use to, resulting in both lost money and a lost relationship, Brown said.

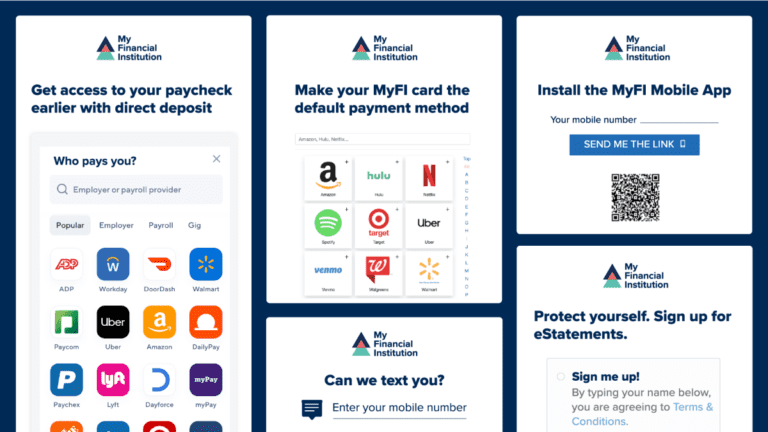

To reduce these losses and keep customers longer, Digital Onboarding technology provides banks and credit unions with a digital aspect of their paper welcome kit in the form of targeted, journey-based communications and customer-oriented microsites. action.

In addition, it offers a library of campaigns and a set of proprietary and third-party widgets that can be added to these microsites or bank landing pages and third-party digital banking applications.

Digital Onboarding works with over 140 financial institution clients. Brown was mum on revenue growth except to say the company was able to grow quickly despite an average sales cycle of five months.

He said the $58 million development investment was “opportunistic.” The company has been on a profitable trajectory and has raised $7.5 million in venture capital in the past, including a Series A in 2020.

“We have very few competitors in the space, and only a quarter to a third of our market knows about us,” Brown said. “With this funding, we also have the opportunity to accelerate our product roadmap and have 140 very happy customers who would buy more from us if we have more to sell.”

Digital Onboarding also plans to invest in additional segmentation and profile management, marketing attribution, machine learning and integrated fintech functionality. Additionally, Brown expects to double the company’s lean headcount by the end of 2024.