Daringa financial technology company building an electronic payments infrastructure in Colombia, has raised $50 million in Series C funding in a round led by existing investor General Atlantic.

International Finance Corporation, a member of the World Bank Group, joined existing investors InQLab and Amador in the round. In total, Bold has raised $130 million, the company’s co-founder and CEO José Vélez told TechCrunch.

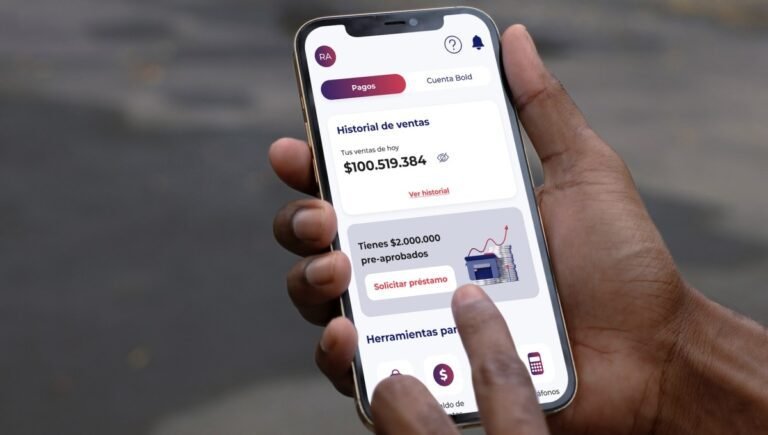

Bold provides low-cost payment terminals, called dataphones, that allow small and medium-sized businesses to accept link payments and other local payment methods.

“Covid accelerated the transition to electronic payments, or digital payments, in the country and we are the beneficiaries of this transition,” Vélez said.

TechCrunch profiled the company when it raised a $55 million Series B round in 2022. At the time, the payments service provider had about 100,000 merchants using its services per month. Now a year later, it has added another 50,000 monthly active traders. Bold has also scaled to more than 800 employees from 380 in 2022.

Meanwhile, revenue has grown sixfold since 2022, and Vélez said the company is growing fast. Bold has approximately 3% market share in current volume terms in Colombia.

“Other companies, for example, in Brazil, have reached 10% market share, so we believe there is a big opportunity in the future when we can triple, or more, our volume in the next three to five years,” said Vélez . “We’ve put a lot of effort into gaining market share, being a relevant player and getting to scale.”

He did not disclose the company’s valuation, but said it was similar to Bold’s Series B valuation.

Cash continues to be king in Latin America, however, electronic payments are gaining ground as the younger generation embraces credit cards and online shopping. Bold is working alongside other startups, such as Pomelo, Liquido and Mattilda — to name a few, to gain market share.

Bold founders, from left, Sergio Vergara, José Vélez, Ana Sandoval and Jorge Ulloa: Image Credits: Daring

Where Bold differentiates itself is by adding additional layers of service beyond payments, said Luiz Ribeiro, managing director and co-head of General Atlantic’s Brazil office.

“The first layer is all the financial products and services you can add, like insurance,” Ribeiro said in an interview. “You can then, in parallel, add software solutions to help, for example, merchants not only accept payments, but manage their own finances. When they are able to offer banking services and software in the next five years, that will mean success.”

With this new funding, Bold plans to strengthen its roadmap and product offerings. Vélez also wants to focus on business expansion as it transforms from a payment link provider to a more holistic offering for merchants.

The company also recently received its financial institution license to offer merchants a bank account and will cross-sell the account to its merchants over the next 12 months.