General Catalyst, the Business Company, is considering an IPO, Axios referenced Friday morning, citing “multiple sources”.

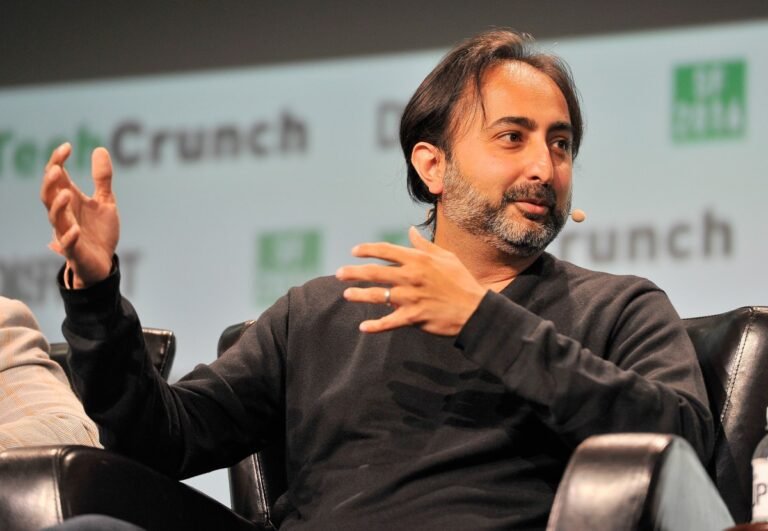

TechCrunch arrived at Hemant Taneja’s management partner for comments. Meanwhile, those who follow the orbit of General Catalyst will not be surprised by the perspective.

Founded 25 years ago as a small business business business Cambridge, Mass., General Catalyst (GC) started with $ 73 million in capital commitments. A decade later, armed with balloons and pre-compo stakes in software companies such as Demandware and Brightcove, Taneja and then-partner Neil Sequeira set up a shop in a charming yellow building with white-lined university avenue at Palo Alto. There, the GC quickly made its mark in the Gulf area, reducing software agreements reminiscent of the successes of the east coast, while forging deep ties with the Y Combinator they attributed. In 2011, the business secured a share on Airbnb. In 2012, he pledged to support every start of y Combinator invisibility.

In the same year, in July 2012, the GC led the round B for Stripe – now the most successful Combinator’s valuation, even when the Fintech giant argues he has “Without immediate plans“To become public.

In the meantime, the GC itself has been exponentially developed. Although Sequeira left In 2015 to start its own store, GC today has an extensive team with 20 managers, over $ 30 billion in assets and offices from San Francisco in Bangalore. It has also expanded far beyond the traditional investment in the argument. As we noted in October after talking to Taneja for a podcastThe business is almost unrecognizable by its former self. Among other movements, it has started funding, a wealth management company has been released, is in the process of acquiring a small Ohio health care system and bought two smaller business activities.

A question that Axios asks – and is good – is whether GC will be the first business business to be done publicly. It’s not just a question as to whether the business decides to move on, but whether the simple debate on an offer accelerates the plans of other heavyweight companies such as Andreessen Horowitz, which seems to have their eyes in the same prize.