Paytm fell 20% on Thursday before recovering slightly after the Indian financial services company said it plans to issue fewer personal loans under 50,000 Indian rupees ($600), a move that has already started to rattle many fintech investors.

Shares of Paytm were trading at INR 678, down from INR 812 on Wednesday afternoon. It fell to INR 650 earlier on Thursday. Paytm’s market capitalization ended Thursday down by $1.1 billion.

The company’s move to put restrictions on low-ticket personal loans follows the Reserve Bank of India, which recently tightened rules on consumer loans and publicly expressed concerns about bad, micro personal loans.

Paytm on Wednesday said it is becoming “extremely conservative” and will expand its portfolio of higher-ticket personal and commercial loans to lower-risk, high-credit customers. In an analyst call on Wednesday, Paytm’s chairman and CEO said “recent macroeconomic developments and regulatory guidance” as well as dialogue with lending partners led to the company’s move.

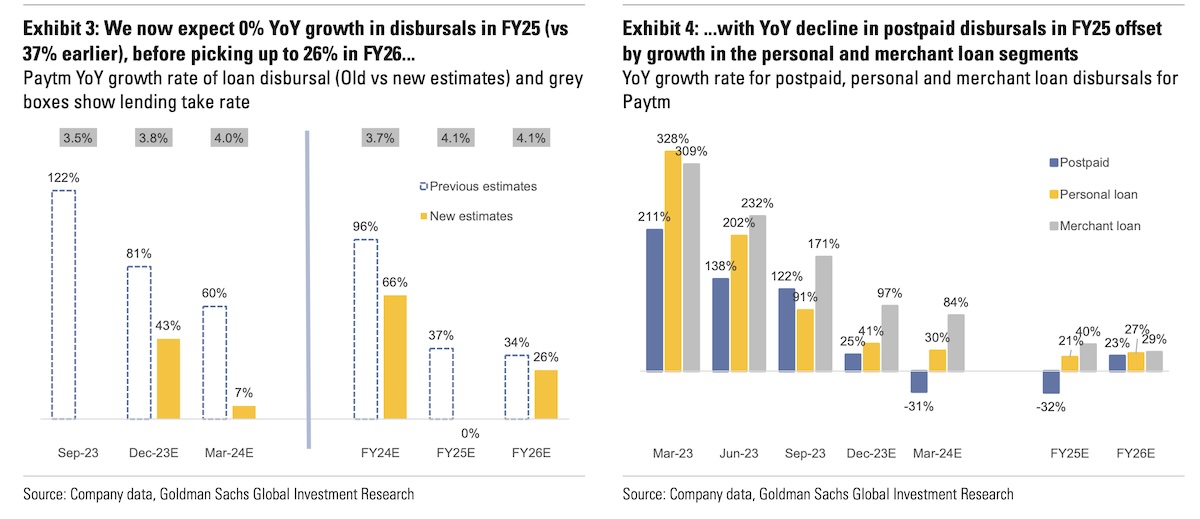

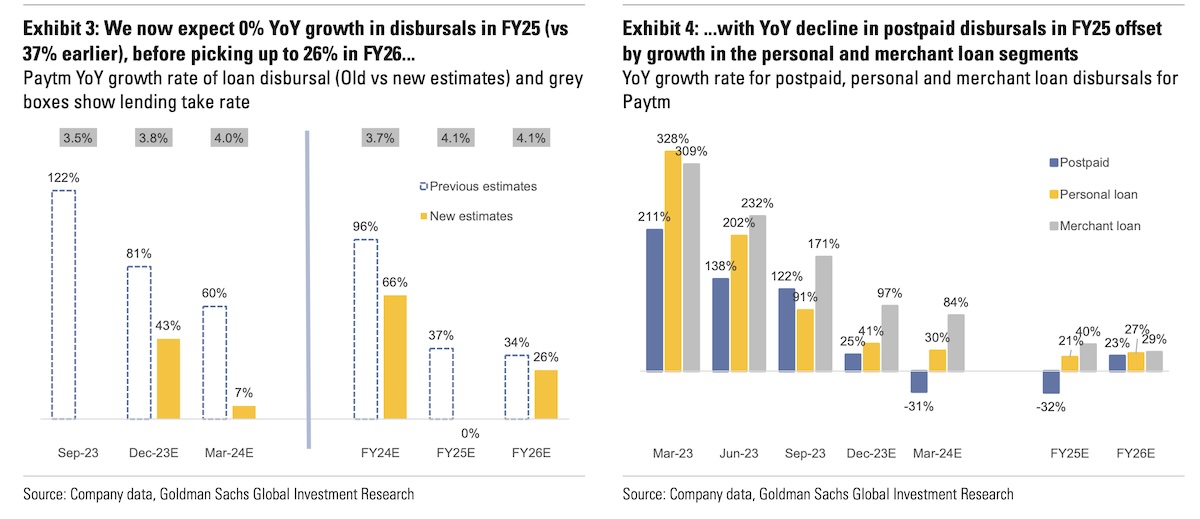

“We believe this reflects growing conservatism in the system as well as Paytm’s large stake in the segments,” analysts at Jefferies said reacting to the news. Goldman Sachs has downgraded Paytm from buy to neutral. It cut Paytm’s revenue estimates and adjusted FY24 to FY26 EBITDA by c.10%/40%, sharply lower loan estimates and said it expects FY25 disbursements to grow by 0% y-o-y vs. 37% earlier.

Industry executives said the move affects the growth momentum and equity return profile for unsecured lending for the entire industry, and smaller players may be disproportionately affected.

Image Credits: Goldman Sachs Investment Research

“For about 77% of Paytm’s revenue base, which includes payments, commerce and cloud, we see no change in outlook, with these segments growing revenue at a mid- to high-teens rate over the next 2-3 years. However, for the loan sector, we now forecast total disbursements in 2H2024 to be 11% lower compared to 1H, with 25Y disbursements growing at 0% y-o-y (vs. 37% that had been estimated earlier),” Goldman Sachs analysts wrote on Thursday.

“Lending has been a key driver of Paytm’s profitability improvement and we see low growth visibility in this segment over the next 6-12 months given the higher-than-expected small-ticket lending pressure Paytm is under. While Paytm has guided for a 40-50% decline in contract disbursements in the near term, the range of outcomes remains wide in our view, with potential for further pressure if the macro environment does not see substantial improvement.”