Banking and technology platform Capital continues to raise venture capital, raising another $40 million in Series B dollars and $125 million in debt financing. Tribe Capital led the Series B and was joined by backers including Cervin Ventures, Tru Arrow, MS&AD Ventures and Alumni Ventures.

This is the second investment for the Mexico City-based company this year. We previously covered Kapital’s $20 million Series A in May that included $45 million in debt.

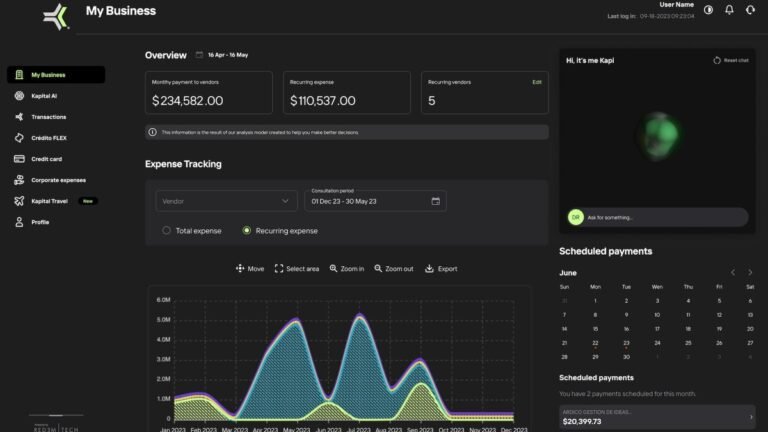

Rene Saul and Fernando Sandoval co-founded Kapital in 2020 to provide similar financial visibility to small businesses, using data and artificial intelligence, that large businesses have. This allows customers to access and manage their business operations and cash flow in real time. The company also uses artificial intelligence to underwrite small business loans.

“Small businesses account for 90% of the world’s businesses. However, in Mexico, only 10.5% of these small businesses have access to total bank credit,” Saul said. “That’s what we’re fixing — giving them visibility into their finances.”

In 2023, Kapital’s customer base grew to 80,000 small businesses in Mexico, Colombia and Peru. It also acquired Banco Autofin Mexico SA in September, which already had 65,000 customers, CEO Saul told TechCrunch. Kapital is profitable and grew revenue 6x last year.

Saul intends to use the new funding in R&D and technology development, particularly to strengthen its cross-border offering and develop its product suite to provide insights to its customers. One of the areas Kapital would like to accelerate is predictive analytics technology so that business customers know how to improve margins by choosing different vendors.

“Now we have a bank and we can create integrated financing options,” Saul said. “We also control payments and can connect seamlessly with everything around customers. Being active in three different countries in Latin America also means our clients can move money faster. Our goal is to build a global bank that will ultimately connect everyone in the world.”