It’s a rare startup that breaks it down mine pitcher, but that’s exactly what it’s equal to it did so after raising a $16 million Series A round. Equals’ mission is not to replace the spreadsheet, but to ensure that a spreadsheet can do whatever its users throw at it. As an experienced spreadsheet user, this is an approach I can relate to — I’ve built entire software solutions with highly complex spreadsheets as the back end.

Plus, as a pitch deck connoisseur, I can also follow the bright and bold design of the Equals deck.

I particularly liked a shot I haven’t seen often in deck design, which splits the deck into two distinct sections: a pitch deck and a data deck. The latter provides a seven-slide breakdown of the company’s financial metrics, showing ARR, customer-to-customer conversion rates, churn and more. It’s a good idea: I often advise startups to tell the story in words and then tell the same story in numbers.

Let’s see what else we love about this deck.

We’re looking for more unique pitch decks to tear down, so if you’d like to submit your own, here’s how you can do so.

It slides into this deck

The figures from the two pull slides have been recomposed, and there is a lot of (revised) data on a separate data floor. There are also no market size and market transition slides, but we’ll see that later.

- Cover transparency

- Opening statement

- Shipping transparency

- Problematic transparency

- Solution/mission transparency

- Product (“Meet Equals”)

- Product demo slide

- Product validation slide

- Drag transparency

- Traction 2 slides

- Slideshow with product highlights

- Product roadmap transparency

- Group transparency

- Transparency of questions and capital usage

- Close slide

Three things to love

I’ve already given credit to Equals for the design, but this deck is impressive enough that it’s worth mentioning again: This is a beautiful deck. Here are some other things that stood out to me:

Making it real

For a while, it seemed like the easiest way to build a successful software startup was to find something people used Excel for, then build a tool that was better, more focused, and easier to use. This has worked well for countless businesses, so it’s a bold venture to tackle Excel at home, replacing a spreadsheet with . . . a spreadsheet. Airtable has had some success in this space, so one of the first things that comes to mind is whether there is room for another company in this industry.

Equals makes a comprehensive and compelling argument for a resounding yes to this question, listing a number of use cases for its software:

[Slide 4] Here is a problem slide for you. . . Image credits: Equal

The problem seems real enough, but seems to have a lot to do with the data source and data analysis/algorithms. And of course, Excel archives it can be difficult, but Excel itself has a relatively robust online solution now as well (so the statement “Excel doesn’t” seems a bit of an exaggeration). We also have Google Sheets, Airtable and many other potential competitors in the space.

However, in the dry and boring world of spreadsheets, this is probably the most fun way to describe the problem you’re trying to solve. I like!

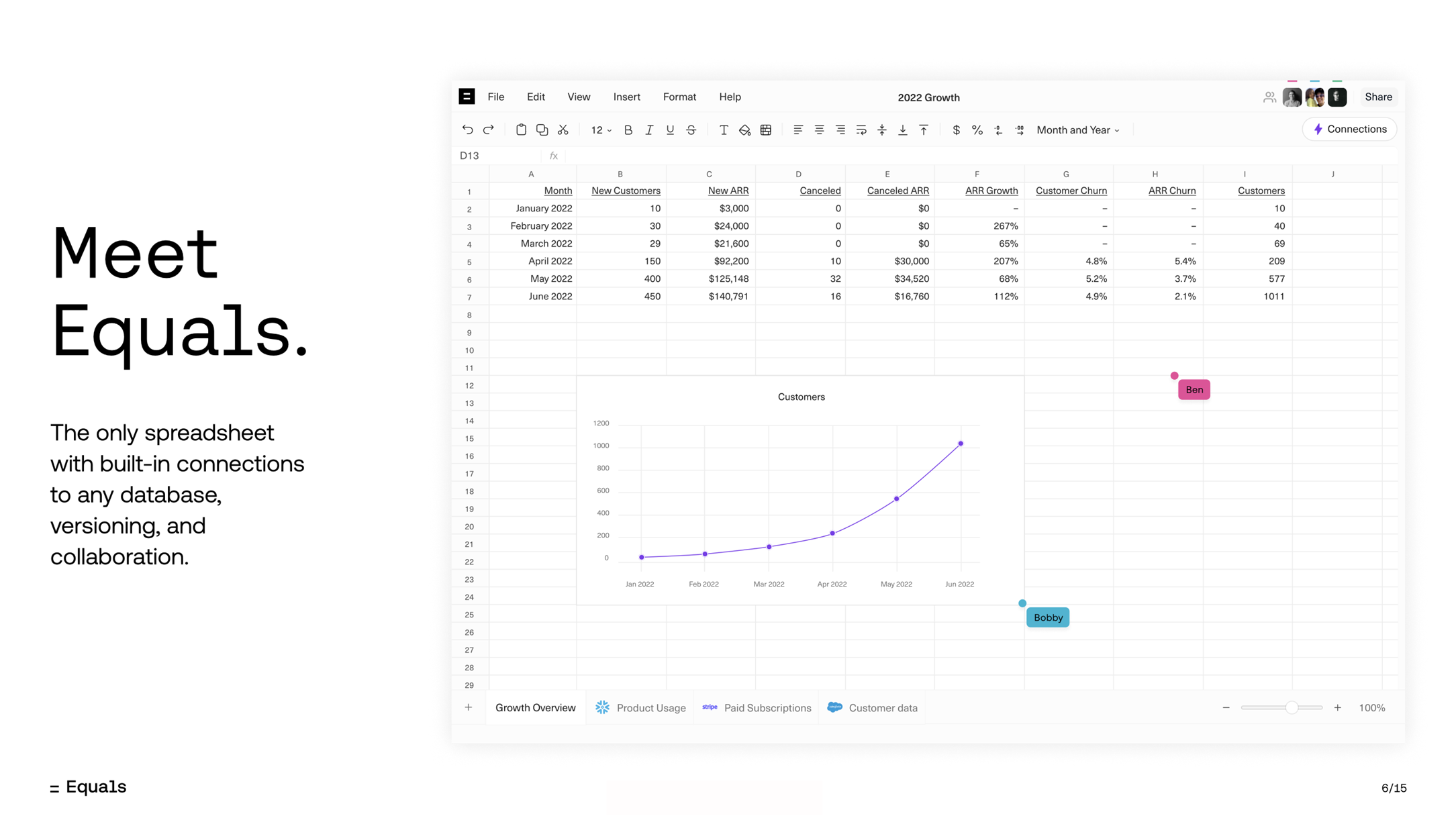

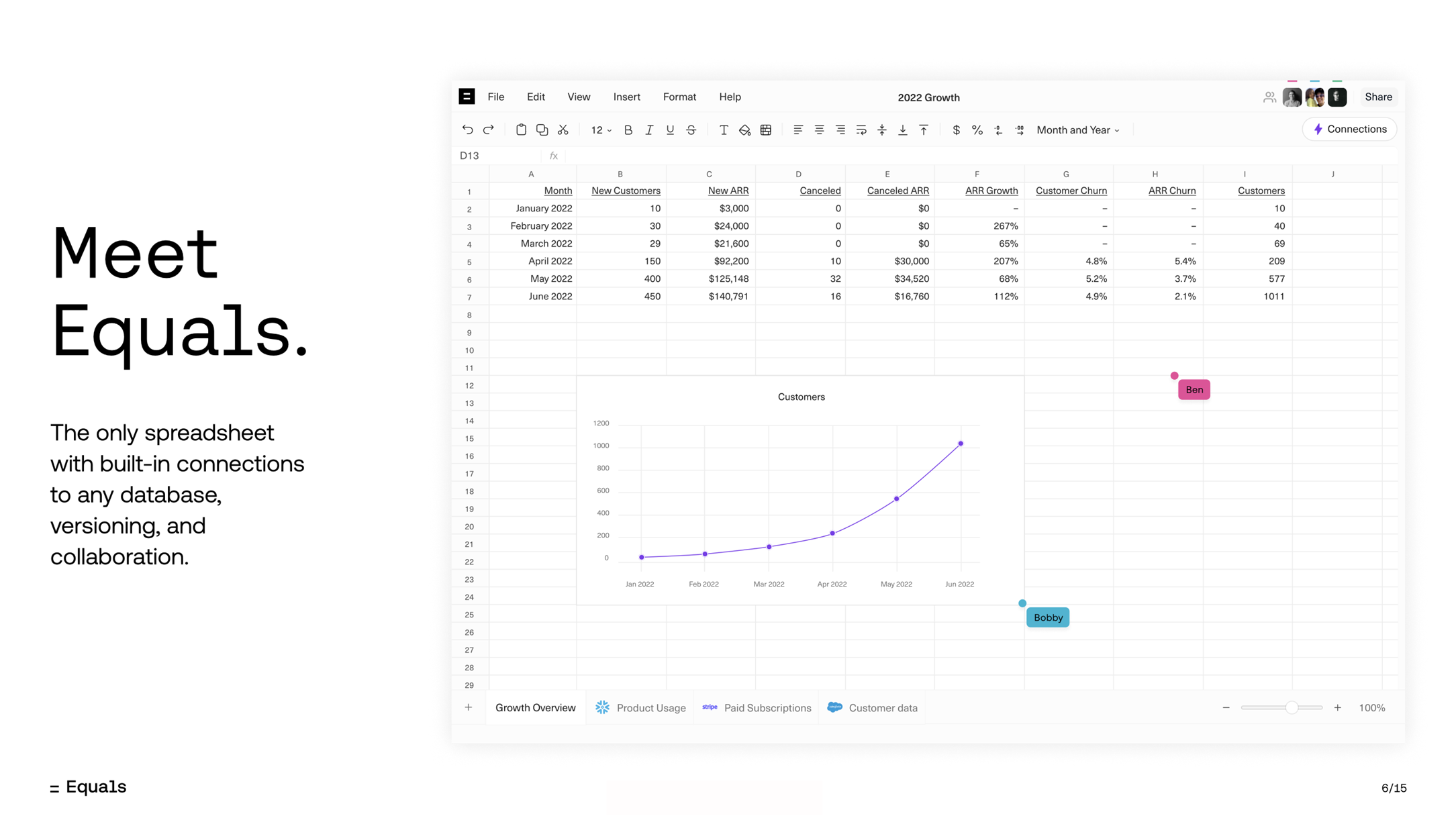

So it’s Excel, but more online

[Slide 6] This is where the magic happens. Image credits: Equal

Founders, especially technical project founders, often face a huge challenge when trying to explain what their startup does in simple terms. I’m really impressed that the Equals team managed to distill the product down to something so simple: Spreadsheets, but with database connections and collaboration. This very simple statement hides a lot of technical complexity and what must have been an absolute nightmare of an integration challenge.

But hiding the complexity is a great idea: End users don’t want to know why their spreadsheet won’t connect to the Stripe data source. They only need it to work.

Quite stylish. Well done.

This is how you chart a path to the future!

[Slide 12] A great way to map out your near future. Image Credits: Equal

Investors rarely care about this level of granularity in your product roadmap, but they don’t indifferent, You know? This is a great general overview of what you’re interested in and doesn’t deal with the nuts and bolts of what the engineering team will build.

Even though this design is quite technical, I’m impressed by the team’s ability to resist the temptation to do too much here. I have no idea what they’ll associate Command + K with, but that’s okay – this is a great top-level view that will allow you to have a board-level discussion about product priorities for the coming year.

I have no idea what they’re going to associate Command + K with, but that’s okay.

Equals also did something clever with the previous slide: Slide 11 shows the features that have already been created, which then allows the narrative to flow smoothly on that slide (with the existing features now highlighted in gray). This allows you to have a two-step product conversation: Talk about everything you’ve built, then talk about everything you’re going to build and how that helps make the product more relevant to your target audience — and maybe expand user base capabilities as well.

As a startup, you can learn from this slide that you shouldn’t spend too much time on your product. These two slides are a great example of how you can get around this problem with finesse.

In the rest of this teardown, we’ll take a look at three things Equals could have improved or done differently, along with its full pitch deck!

Three things that could be improved

It’s not all rainbows and unicorns in the Equals deck. . .

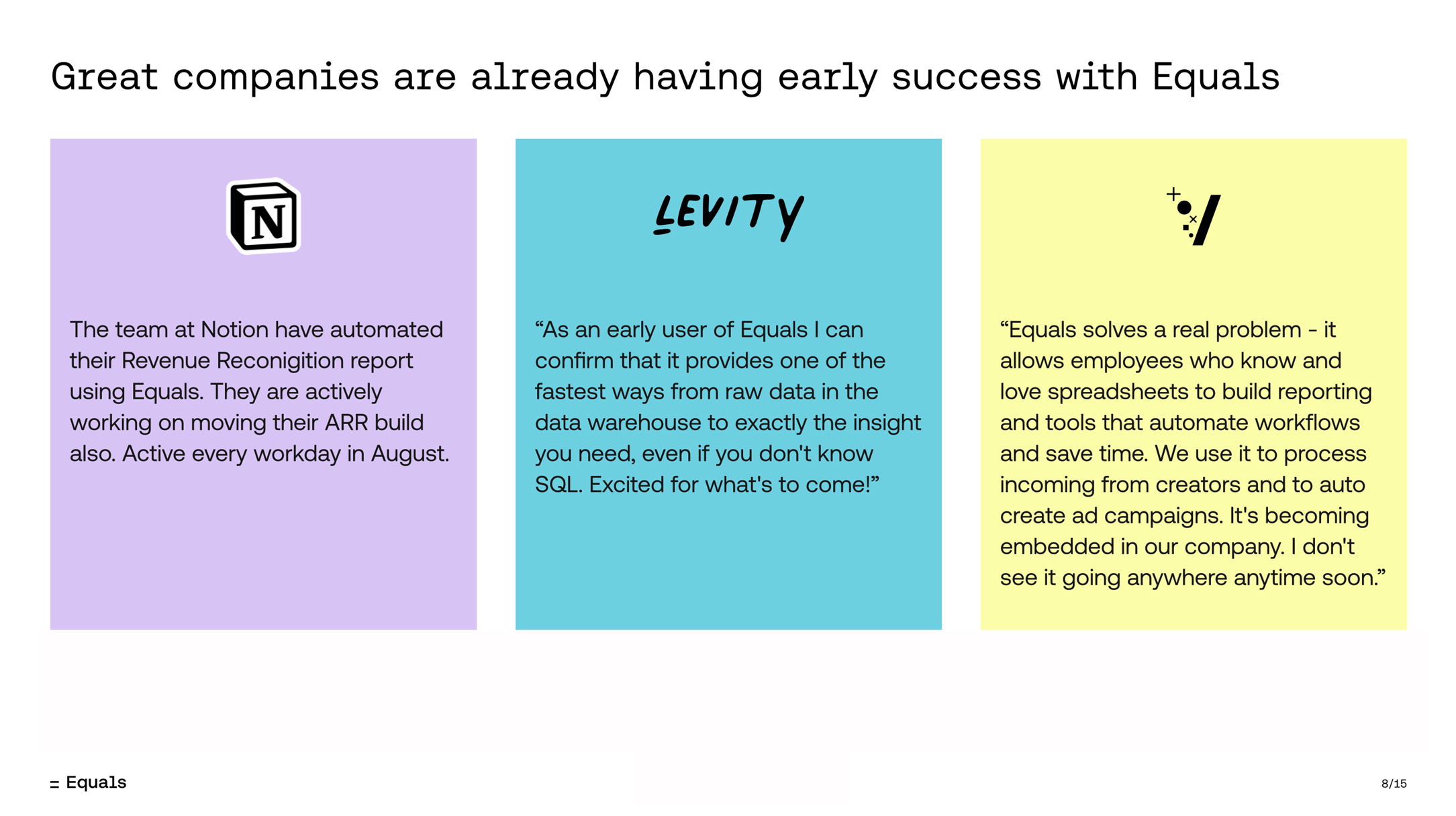

Be aware of your audience

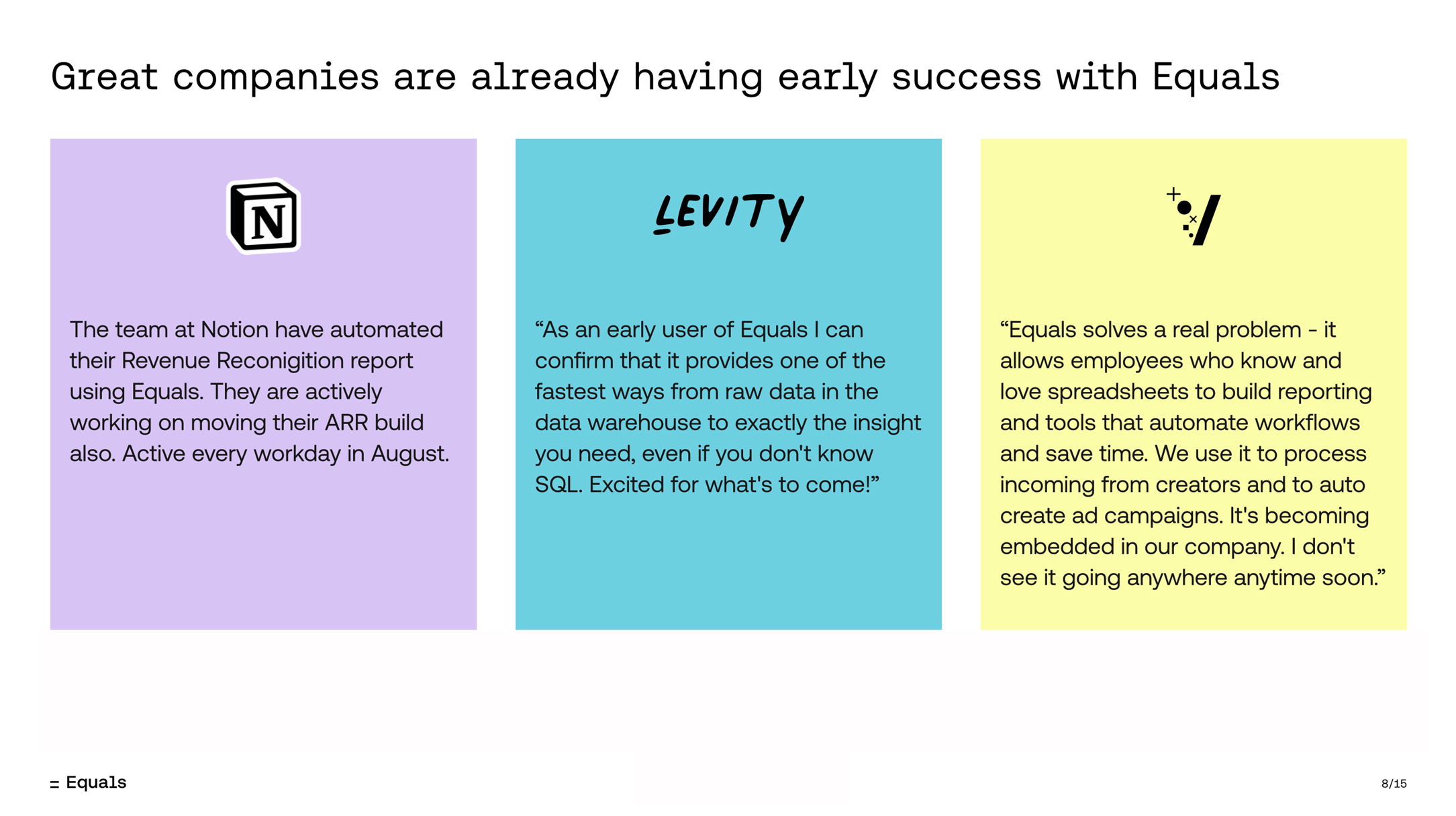

A fairly common problem with pitch decks is that sometimes it’s hard to tell if the founders understand who they’re talking to. Check out this testimonial slide:

[Slide 8] Yes, but do investors care? Image credits: Equal

I have no doubt that this is a powerful slide to use in the company’s sales function when talking to new clients. But I’m not sure how effective it is as part of an investment.

I can see various topics here:

- I don’t know what any of these logos are. OK, I recognized Notion, but I have no idea what Levity is or does, and I don’t recognize the V logo. That means two of the three logos on this slide aren’t helping to convince me to invest. So why use them?

- Two quotes and an unauthorized set of statements don’t really serve as a particularly strong body of evidence.

- In the final testimonial, the line “I don’t see it going anywhere anytime soon” can be easily misinterpreted. I’m guessing the person meant their product is here to stay, but that’s not 100% clear from the quote.

- It is bad form to have quotes without properly attributing them to someone. Who said these nice things? If it was the CTO of a company, you should definitely point that out. Think of it this way: If you attributed “This is a really good product” to “an Apple employee,” would it be good? If Tim Cook said it, that would be pretty cool. If some random sales at an Apple Store said so. . . you know what i mean

Overall, this slippage looks neutral at best — at least when it comes to convincing an investor to invest. So it’s probably safe to leave it out of the deck altogether.

So . . . how big is this market?

Maybe I’m picking nits here. Ask any investor, “If I can steal 30% of Excel’s business, is the market big enough?” and you’ll probably get a resounding yes.

The thing is, this deck is also missing a slide to market. That means Equals misses two opportunities to tell investors how it thinks about its market. Who are the customers? How many of them are there? What is a value proposition? How do you reach these customers? How do you convince them to stay? You’ll need to answer this multitude of questions to successfully raise money — and it’s a little thin on the ground in this deck.

But what are the goals?!

[Slide 14] Erm, sure, but that’s too vague. Image credits: Equal

Investors are not looking for an unknown plan or a vague plan as to how your startup will use the funds raised. A well-made “use of funds” slide does more than just list expenses. it builds trust. By being transparent about your financial needs and how they align with your business goals, you show potential investors that you’re not just another startup looking to burn cash. No, instead, you are a serious entrepreneur with a growth plan and a clear vision for the future.

I know many founders stumble on this critical slide. Flashy but unnecessary expenses, a murky abyss of “miscellaneous” expenses, and unclear descriptions of how the funds will be used are just a few common pitfalls that can turn investors away. Equals falls victim to one such pitfall: None of these goals are specific enough. Transparency should be as clear and detailed as possible, avoid generalizations and focus on specific, measurable, achievable, relevant and time-bound (SMART) goals.

- “Scale Marketing”: Sure, but to what?

- “Success at scale”: Yes, but what is the goal? How do you know you are successful?

- “Speed Up”: Well, yes, but if you wrote 10 new tracks before fundraising and managed 11 after, you’ve hit that goal.

Be specific. Make good use of the “use of funds” slide. This is not a time for abstraction, but for bold, specific, quantified audacity. This transparency is where you articulate your vision in dollars and cents, and if you do it right, it’s where investors will begin to see their futures align with yours.

Most importantly, a well-designed “use of funds” slide helps paint the picture for Next funding round. If you score all the goals, can you top Series B? Exceptional! Is your plan setting you up for success? Fantastic!

This slide is almost useless, which is a shame. More accurate here would be fundraising So much easier.

The full field

If you want to present your own pitch deck teardown to TechCrunch, see more information. Also, check out all of our Pitch Deck Teardowns all gathered in one convenient place for you!