The world is full of businesses trying to help streamline the company formation process. Doula is one such startup and has raised $12 million to date since its founding in 2020. The company just closed a $1 million “strategic investment round” from HubSpot Venturesless than a year after its $8 million Series A, and today we get a good look at the pitch deck it used to raise this round.

Usually, when a startup raises a small amount of money after a decent-sized round, something strange happens — it’s a symptom of something not enough going to the plan. In Doola’s case, however, HubSpot’s involvement makes sense: The marketing software company reaches a lot of customers, so Doola’s toolset could fit HubSpot’s business model.

We’re looking for more unique pitch decks to tear down, so if you’d like to submit your own, here’s how you can do so.

It slides into this deck

The AI deck review tool estimates that there is only a 15% chance that Doola will successfully raise funds with this deck alone.

Doola shared the 14-slide deck without any editing.

- Cover transparency

- Funding schedule transparency

- Problematic transparency

- Solution transparency

- Product transparency

- Transparency of strategy

- Product portfolio transparency

- Market size transparency

- How transparency works

- Declining opportunities in the US market

- Declining opportunities in the global market

- Transparency of vision

- Group transparency (?)

- Transparency of contact

Three things to love

To be honest, I can tell just by looking at the list above that it exists very information missing from the deck. In fact, the AI deck review tool estimates there is only a 15% chance that Doola will successfully raise funds only with this deck. We’ll get to that later, but first let’s focus on what Doola did right, because it does some things unbelievable Good:

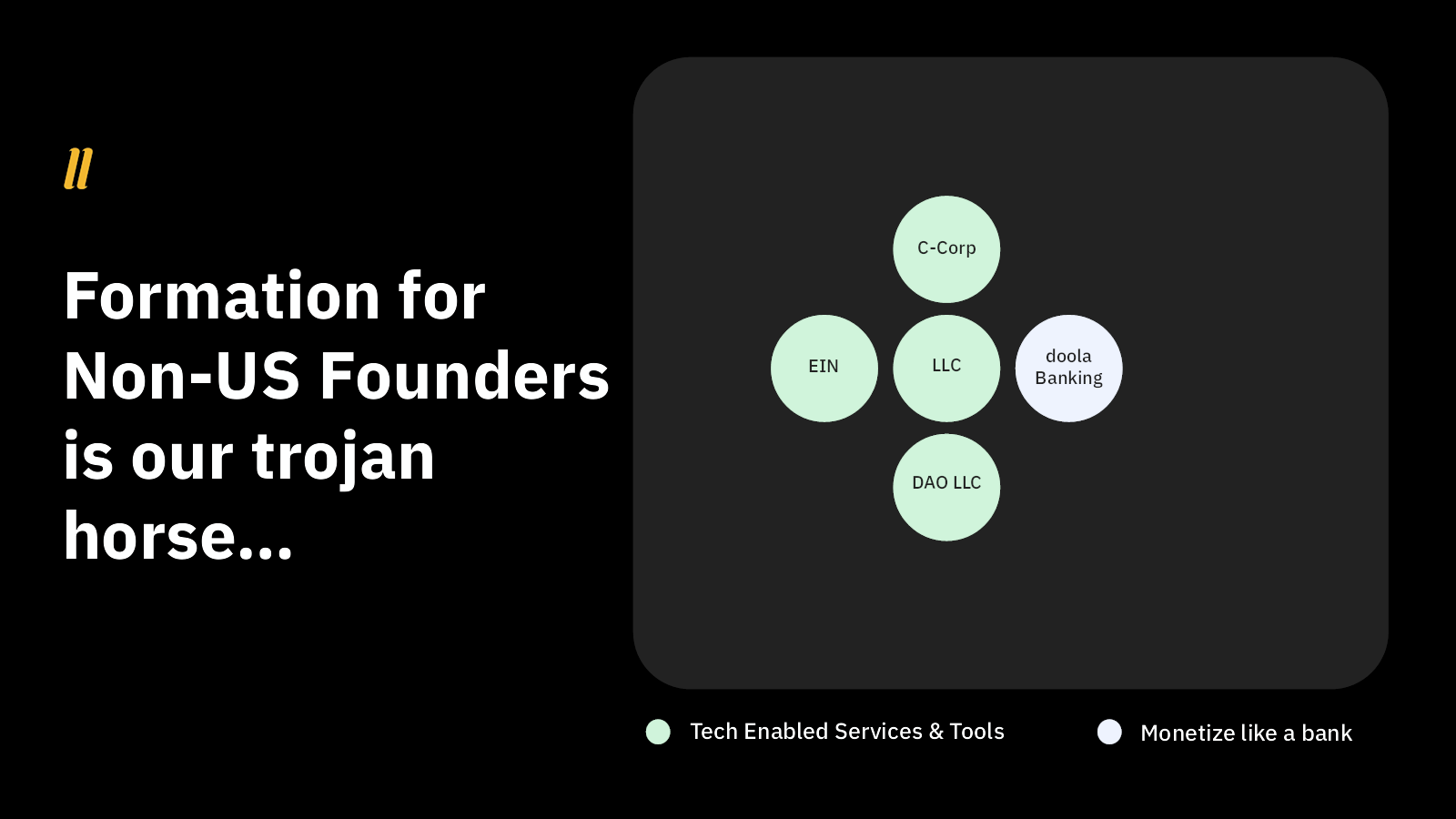

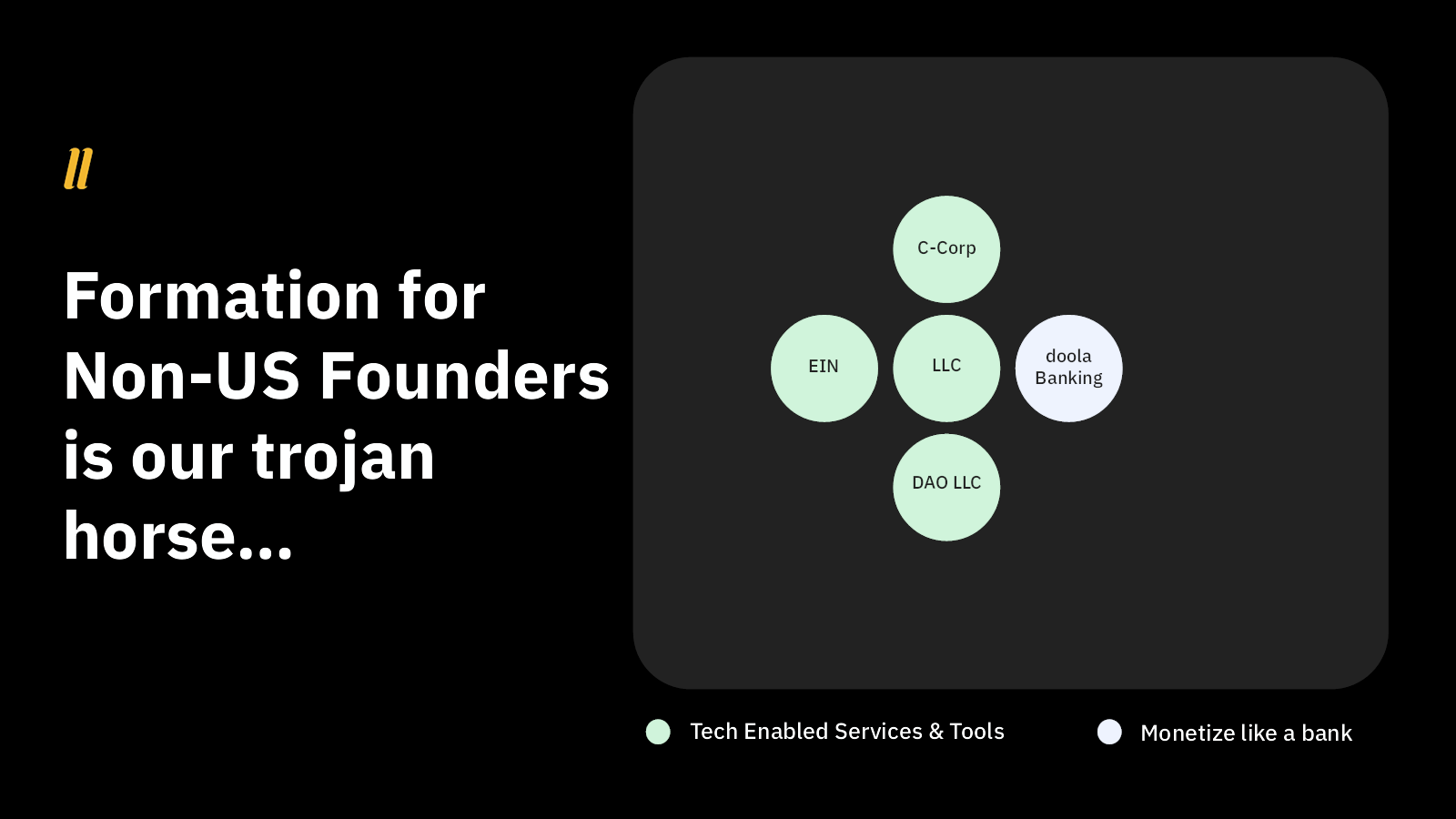

Great use of a combination slide

I like to use two slides that work together to tell a compelling story. Doola uses slides 6 and 7 to great effect:

[Slide 6] The regulation. . . Image credits: Doula

[Slide 7] . . . and what a reward! Image credits: Doula

This is the most effective way to build towards the implicit explanation of the business model. It also lays the groundwork for explaining the business model and monetization plans over time.

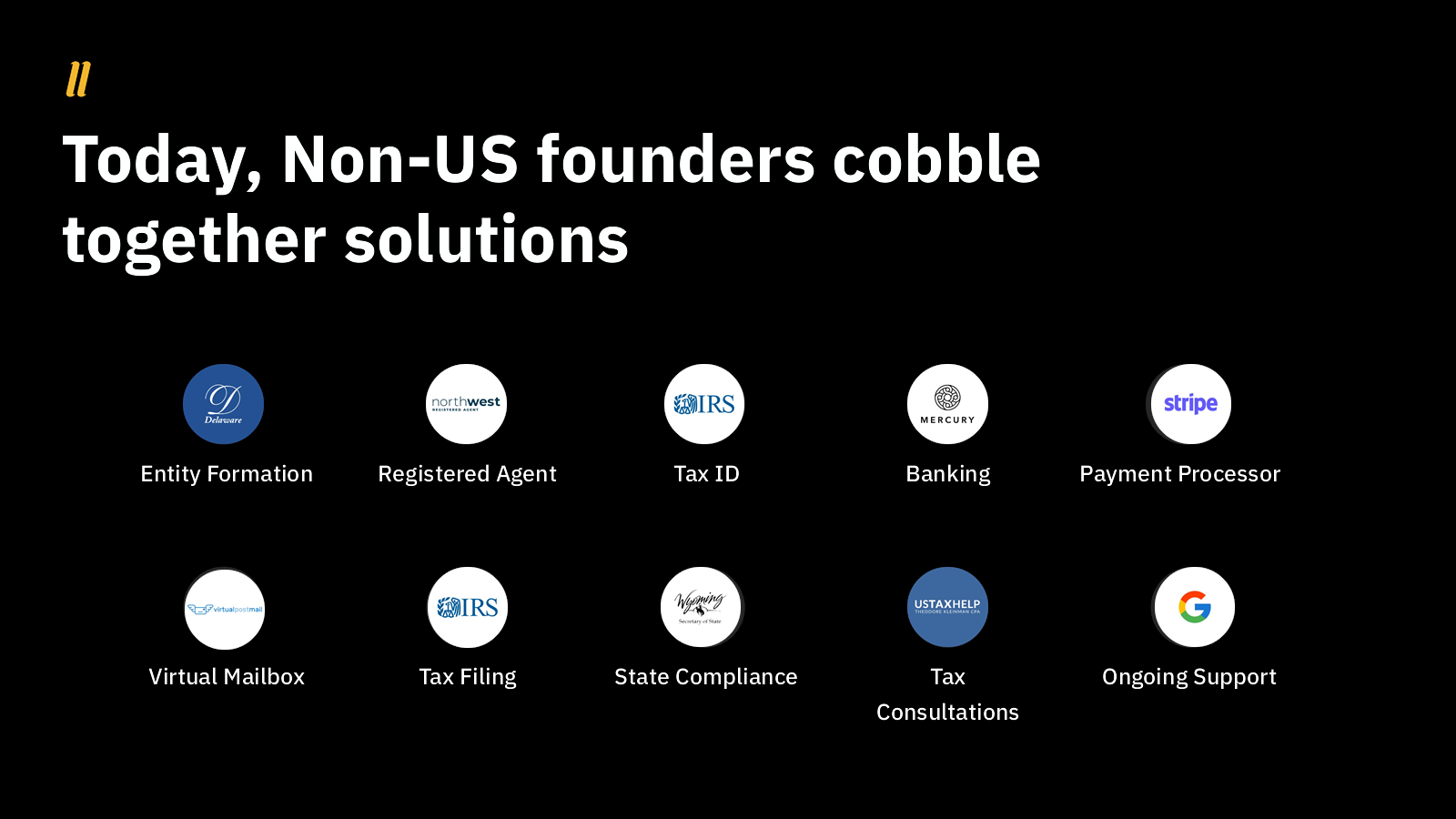

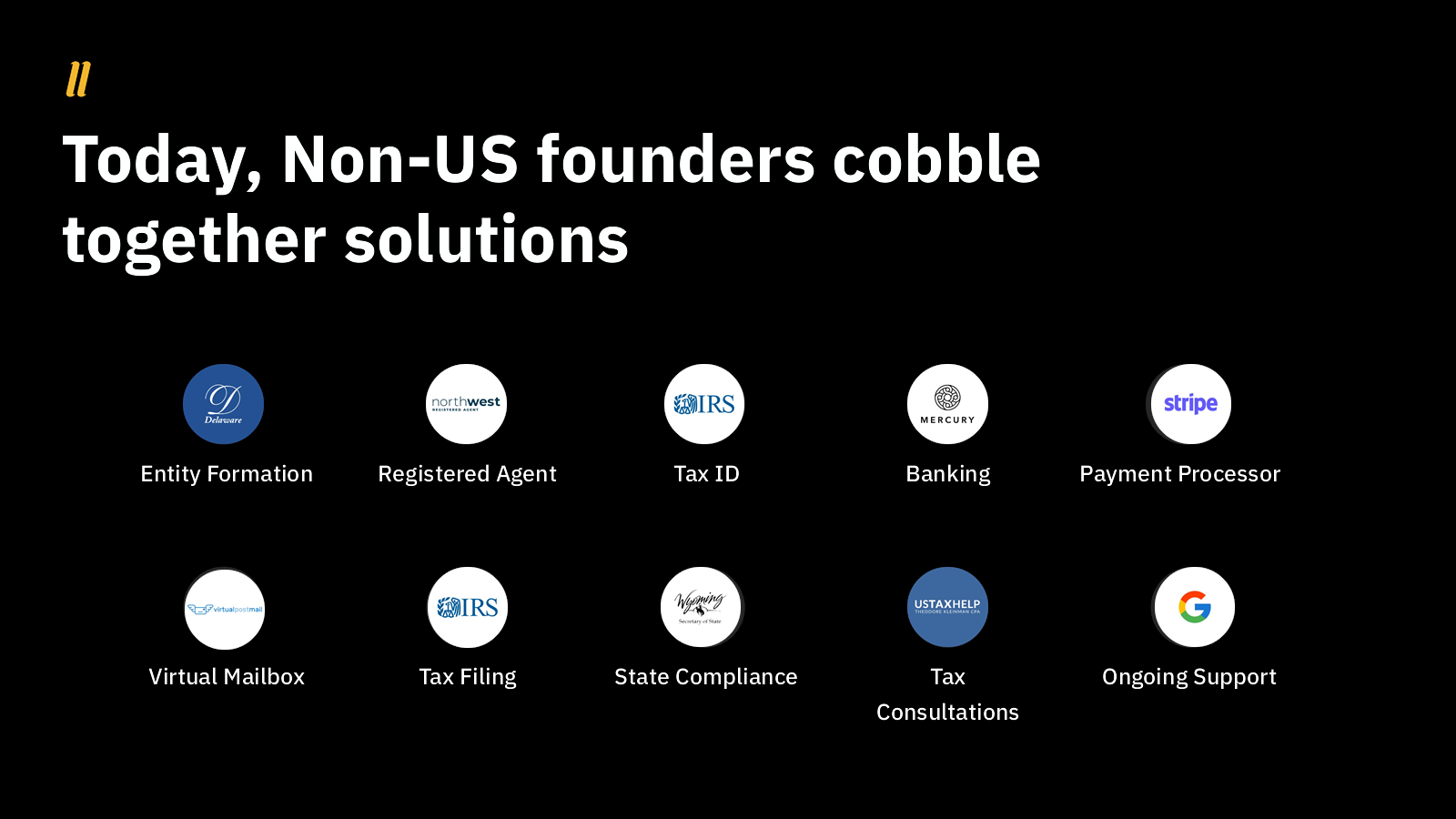

A subtle and elegant problem statement

This is a perfect example of a company that knows its audience. Transparency presents a host of problems, but Doola knows she’s talking to investors, so she resists the temptation to explain every problem. Investors are painfully they know many of these issues and how they appear in startups.

[Slide 3] Understated problem statement — it’s a bit of a gamble, but it works here. Image Credits: Doula

Simplifying things is always a gamble, but in this case, I think Doola won the bet. Yes, these are complex, frustrating and expensive problems, which makes them definitely worth solving!

Interesting bottom-up approach to market sizing

[Slide 10] It’s interesting, but is it a good idea? Image credits: Doula

Most startups have decent success with the top-down approach to estimating their market size (using the TAM/SAM/SOM model). But it’s interesting to see Doola take a different path to reach a potential market size of $4.5 billion per year. As I’ve written before, great founders often have to turn to a bottom-up approach to market size because there’s nothing else like what they’re building out there.

I’m not sure if this is the right approach here, given that this space has some competitors, but I enjoy the clarity of this slide.

As I mentioned before, there is a huge amount of information missing from this pitch deck. So much so, in fact, that it’s essentially useless as a traditional pitch deck. I suspect that Doola was already talking to HubSpot Ventures as part of its seed round and that something encouraged HubSpot to write a check anyway – perhaps the investor had already made up their mind before seeing this deck.

In the rest of this teardown, we’ll look at three things Doola could have improved or done differently, along with her full pitch deck!