Super exponentiala London-based insurance technology (insurtech) startup serving the casualty (P&C) insurance industry with “decision intelligence” for pricing has raised $73 million in a Series B equity funding round.

Boston-based venture capital firm Battery Ventures led the round, with participation from existing investor Highland Europe and Andreessen Horowitz (a16z).

Founded in 2017, Hyperexponential helps insurers and reinsurers make better-informed pricing decisions using predictive data and insights from a wider range of sources — including those where that data can be specialized, sparse and highly fragmented.

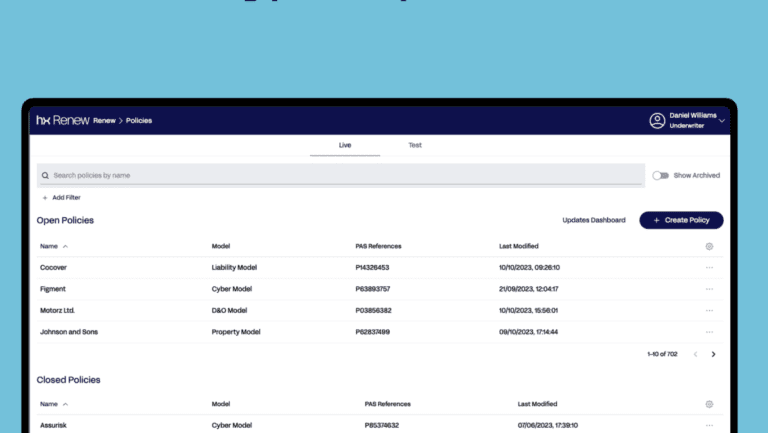

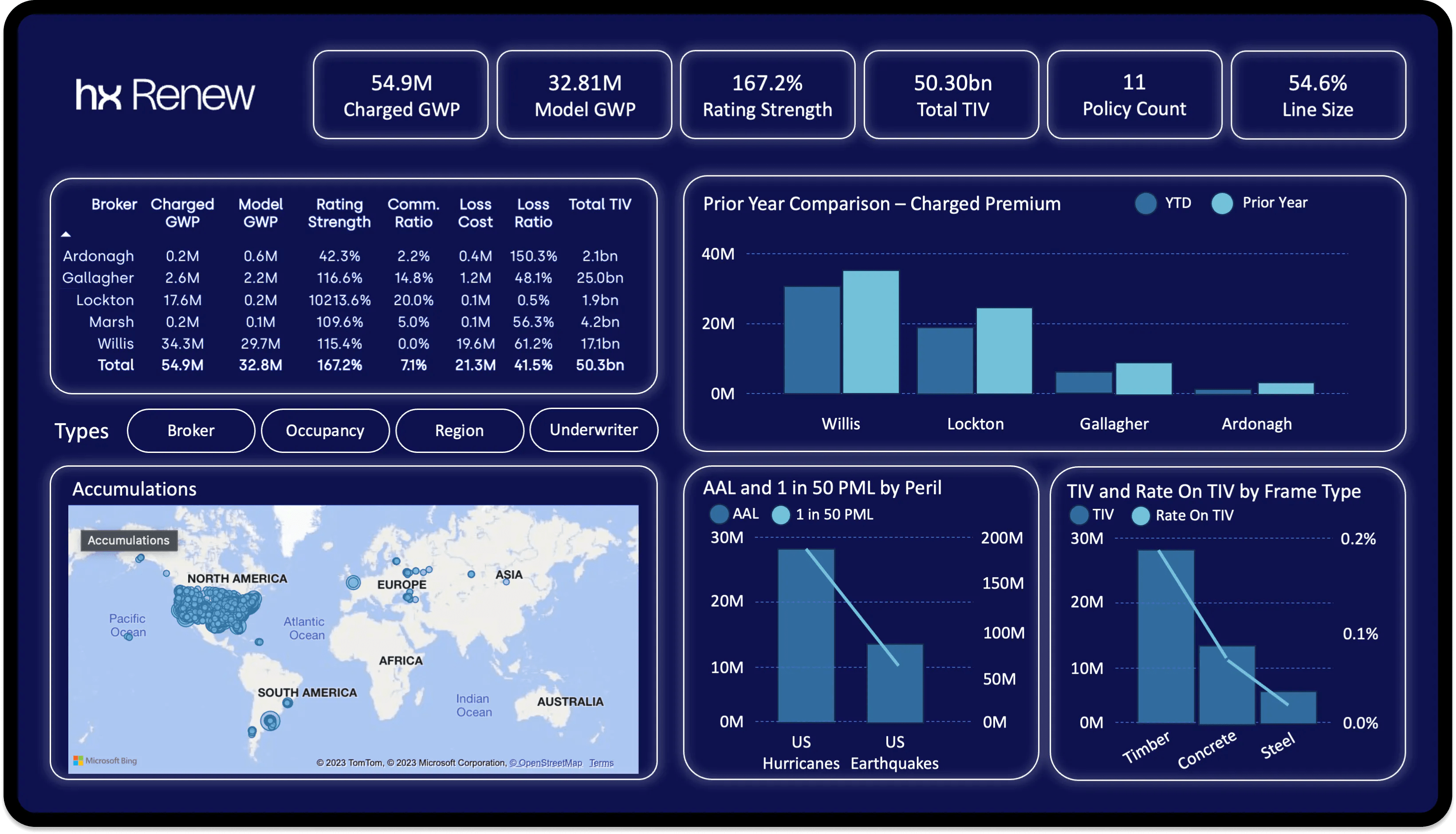

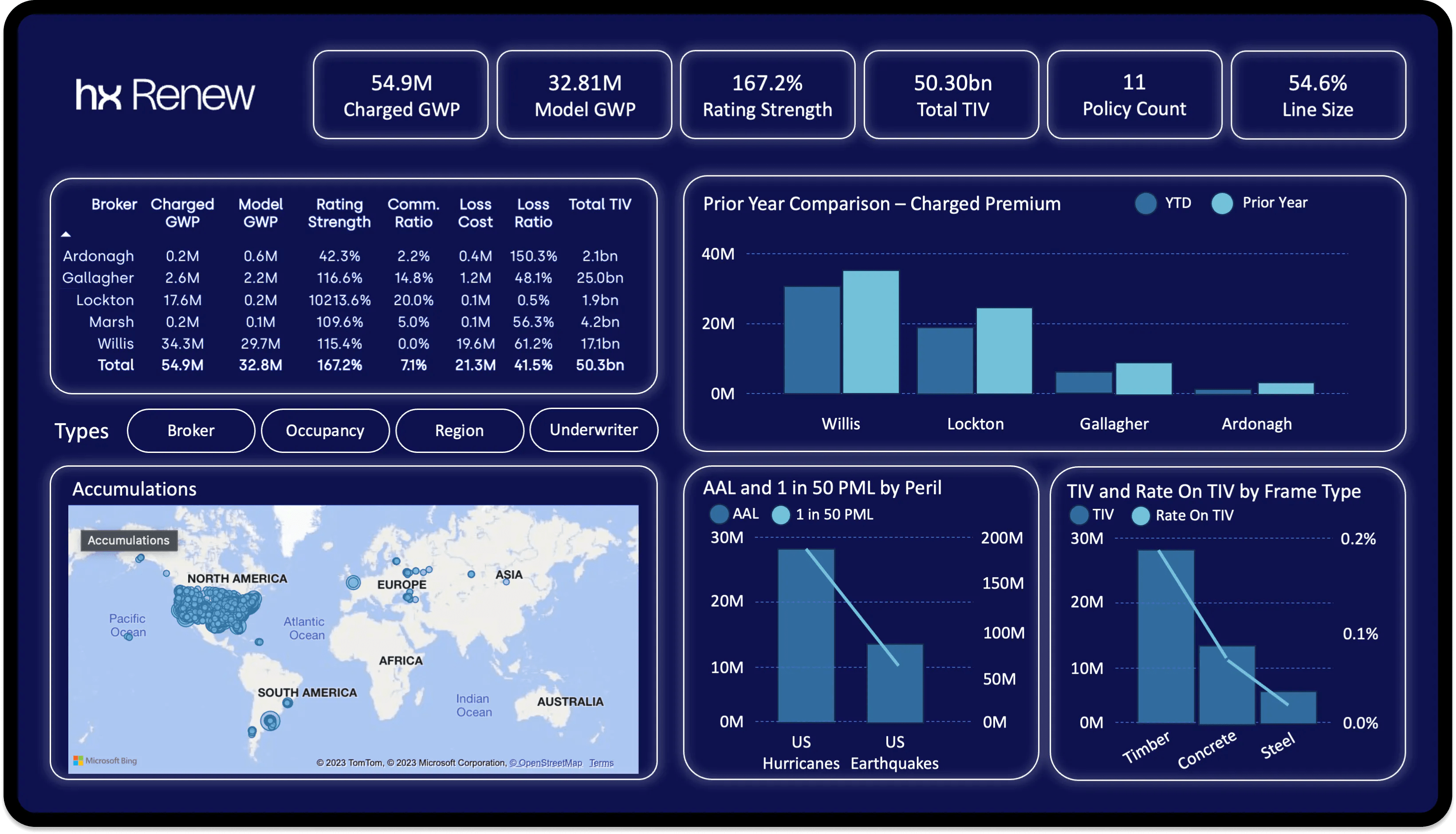

With Hyperexponential’s HX Renew softwareinsurers can build predictive models and access APIs to integrate data sources and workflows between systems, with automation and machine learning helping to assess risk and extract insights from ever-changing data.

Super exponential. Image Credits: Super exponential

Hyperexponential previously raised an $18 million funding round in 2021, and in the intervening years the company says it has increased its sales tenfold while remaining profitable – and claims major clients such as insurance giant Aviva.

And this latest investment tends to back up those claims. A $73 million equity-based funding round stands out like a sore thumb in the current economic climate, suggesting the targeted startup would have an attractive balance sheet and a solid growth trajectory to justify such a cash infusion.

Additionally, that Hyperexponential is bringing in high-profile US VC firms points to an international roadmap, with the company confirming plans to expand beyond its current operations in the UK and Poland into the lucrative US market.

“We have been focused on building an independent, capital-efficient business that has been both high-growth and sustainable from the ground up,” Hyperexponential co-founder and CEO Amrit Santhirasenan said in a statement. “While we have more cash than we have raised, we wanted to bring new expertise to our target markets as we continue our growth into new industries and geographies.”

The call of Europe

And with OMERS and with Coatue is emerging from the UK VC realm In recent months, this has raised some questions about Europe’s attractiveness to early-stage investors. However, two much more established VC firms have actually done the opposite, turning to London for their first international hubs last year — one of them was IVPand the other was Andreessen Horowitz, who opened its UK office in November.

Crypto, blockchain and related ‘web3’ technologies were among a16z’s key targets – an area the esteemed VC firm has been more than a little bullish on in recent years. And to be fair, it has keep investing in crypto startups, including London-based Pimlico a few months ago, but is also directing larger investments in companies such as artificial intelligence, Health Care and business — as evidenced by recent investments in Databricks and MotherDuck.

So while it would be wrong to say that crypto has fallen off a16z’s radar, it is clearly keen to target larger investments in proven technology that solves real industry problems today – the P&C insurance market has been connected as a $1.8 trillion industry last year, and coupled with Hyperexponential’s growth and profitability claims, it’s easy to see why this might appeal to any venture capital firm.

With another $73 million in the bank from two of the largest VC firms in the US, Hyperexponential is well-resourced to begin its global expansion this year, with plans to open an office in New York and double its headcount to more than 200. The company also said it plans to expand into adjacent markets, including SME insurance.