TV manufacturers need to get more lifetime value from a customer after a unit is sold. With more competition in the market, companies often need to sell televisions at a reduced price with lower profit margins. The best way for them to recoup the money is to make impressive partnerships with channels, streaming services and advertisers.

This is the basic thesis around Barcelona Titan OSwhich provides a smart TV operating system to TV manufacturers with the promise of getting better customer lifetime value.

The company announced today that it has raised €50 million ($58 million) in Series A funding, led by Highland Europe, with participation from Mangrove Capital Partners. The company didn’t say how much money it has raised to date, but said the seed round, raised in 2023, was in the double-digit millions.

The startup was founded in 2023 by Jacinto Roca, Timothy Edwards, Miquel Barba and Tobias Pfalzgraff. Roca previously founded a streaming startup called Wuaki.tv and sold it to Rakuten. Other co-founders have also held various roles at Rakuten.

Titan OS now serves 18 million users, largely across Europe and Latin America, through partnerships with Philips and JVC.

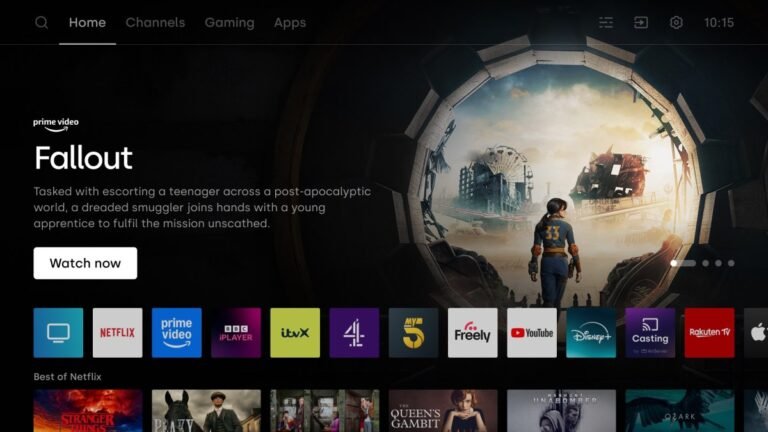

The software is designed to help users discover content easily, as Nielsen said in 2023 that time spent trying to find content to watch has increased. Titan OS aims to use data insights from users and its vast content portfolio to reduce this time. Across the OS, users have access to a mix of TV shows, streaming apps they’re subscribed to, along with FAST (ad-supported free TV) channels from Titan OS partners.

For the company, the revenue opportunity lies in a few key areas. First, it partners with many FAST services to help them reach local audiences. Second, there are advertising opportunities on the TV home screen and during streams that reach millions of users. The company said its content partners are eager to reach new audiences through advertising, especially content channels that show sports.

Titan OS also offers shoppable ads that prompt customers to perform actions such as scanning a QR code to purchase an item. The startup said that through these areas, it has grown 10 times in revenue in two years.

While TV makers like Sony may not ditch their basic operating system, they are willing to cooperate companies like Titan OS to offer more FAST channels to their customers. Multiple exhibitions suggest that for TV manufacturers, advertising is becoming a more lucrative option for revenue than the hardware itself. Titan OS COO Edwards lives up to this ethos.

“It used to be that hardware manufacturers made most of their profits from selling the device itself. But now, some hardware manufacturers that have their own operating system make more profit from current content and advertising revenue than from actually selling the hardware. And that’s a big change,” he told TechCrunch on a call.

“What we offer them [TV companies] it’s an ability to generate ongoing content and ad revenue after the device is sold, which is not the status quo in the market.”

Edwards said that to expand the company’s footprint in Europe, the company is strengthening its portfolio with channels supported by local languages and targeting each geographic region. With this strategy, the startup, which competes with its peers Whale TV and Xperi’s TiVOoffers over 100 channels in these markets.

The company currently has 200 people in three offices in Barcelona, Amsterdam and Taipei. The additional funding will help Titan OS strengthen product and sales staff, work on new partnerships and create new advertising projects. The company aims to maintain its growth curve and raise additional funding next year.

Laurence Garrett, a partner at Highland Europe, likened Titan OS to WeTransfer, the VC investment firm that was acquired by Bending Spoons.

“With Titan OS, there’s the beauty of the advertising model over the actual core operating system. It was something we could identify with [from their experience with WeTransfer]and the partners loved it,” he said.

Garrett added that with Titan OS’s European roots, the company can better understand the robustness of the local market compared to players coming from abroad.