The US Department of Justice and attorneys general from 16 states and the District of Columbia sued Apple for antitrust this morning in federal court. The lawsuit alleges that the company has a monopoly on the premium smartphone market and is using a variety of illegal tactics to perpetuate that monopoly.

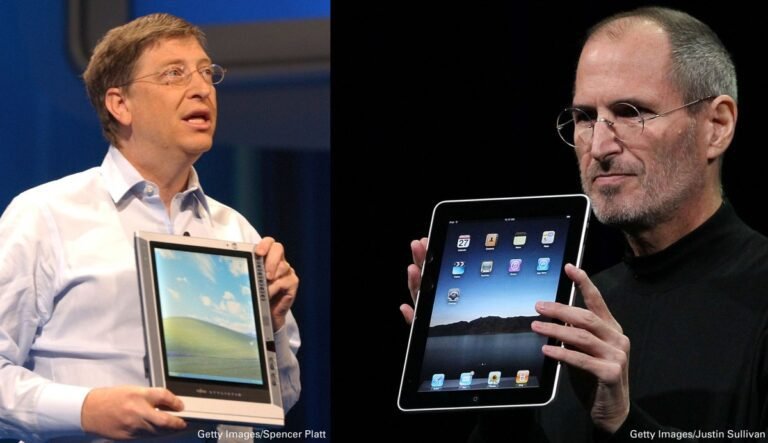

Leaving aside the details of these tactics and their legality (if you’re interested, you can read the full lawsuit here) the case has many parallels to the DOJ’s antitrust lawsuit against Microsoft in the 1990s, which I covered in Instructions for Microsoft from 2000 to 2010. Even Attorney General Merrick Garland noted these parallels, saying, “Microsoft’s landmark case held a monopoly liable under the antitrust laws for leveraging its market position to undermine technologies that would they made it easy for users to choose different functions of computer systems. Today’s complaint alleges that Apple has engaged in many of the same tactics used by Microsoft.”

But there is a crucial difference between the cases: Microsoft had a clear monopoly on the relevant PC operating system market. Apple’s monopoly position is not so clear.

It is not illegal to have a monopoly, as Garland noted in his press conference. It is, however, illegal to use certain tactics to perpetuate or maintain that monopoly — but to prove that, you must show that the defendant has sufficient market power to exclude competitors.

Microsoft Windows had over 90% market share in the relevant PC operating system market. It was so prevalent in the pre-smartphone era, in fact, that Goldman Sachs estimate Reportedly, 97% of all computing devices had Microsoft operating systems in 2000.

While the actual outcome of Microsoft’s antitrust case could be described as a mixed win for the DOJ, with many of the penalties — including breaking Microsoft into two companies — overturned on appeal, the findings of fact in that case are clearly demonstrated Microsoft had monopoly power. This paved the way for a series of private follow-up lawsuits that Microsoft mostly settled.

In pure numbers, Apple’s market share is much lower.

In its filing, the Justice Department argues that Apple has more than a 70% share of the US smartphone market, if you measure by revenue. That’s different from the measurement by units shipped — there, Apple’s share is closer to 64% as of the final quarter of 2023, according to statistics from counterpoint research, well ahead of No. 2 Samsung at 18%. The DOJ argues, however, that there are other metrics that demonstrate the iPhone’s dominance, such as the fact that most new users choose iPhones over phones from Samsung running Google’s Android operating system, for example. Households with higher demographics also tend to opt for the iPhone.

The government also argues that the US is a relevant market because most consumers buy smartphones through carriers and because potential entrants must comply with US telecommunications laws, among other things. This argument is important because Apple’s market share is much lower globally (just 23%, with No. 2 Samsung at 16%). The No. 1 position is listed as “Other,” which is mostly made up of low-cost Android phones. This is clearly a fragmented global market, which changes competitive dynamics — developers have significant incentives to build apps for Android, for example. Unlike Microsoft’s market dominance, which was global — there was hardly any viable alternative at the time.

The key section in the DOJ’s case begins on page 66, titled, “Apple Has Monopoly Power in the Smartphone and Performance Smartphone Markets.” The argument boils down to barriers to entry.

First, the DOJ says most people already have a smartphone and upgrade when they buy a new one — and because most of those users already have an iPhone, they’re more likely to choose another iPhone. The Justice Department alleges that Apple has put up several artificial barriers that make switching difficult, such as the difference between blue and green messaging bubbles for iPhone and Android phone users and allegedly restricting third-party video functionality between platforms and apps, instead to direct users to FaceTime, which only works on Apple products. If users switch, they face costs and frictions like learning a new interface, buying new apps, transferring data, and so on.

Second, the DOJ cites a list of technical barriers to entry, such as sourcing expensive components, designing sophisticated hardware and software, securing distribution agreements, etc. There is also a number of circumstantial evidence, such as Apple’s huge and durable profit margins on iPhone sales.

These arguments may prove compelling to a trial judge. But in terms of barriers to entry, Apple could argue that product differentiation and integration is not the same as foreclosing competition. A fully integrated platform with built-in apps for specific functions like web browsing and video conferencing is easy and convenient, and customers choose it and continue to choose it because they prefer it, not because they want to switch to Android and are blocked by artificial barriers .

In the second case, Apple could point to the massive investments it has made over the past 15 years building these supply chains and relationships with carriers and developers, and rightly ask why it should be penalized now that it has done the work necessary to create leading position.

This is often the case with antitrust cases in the tech world. An innovator rises to the top through a combination of hard work, luck and tough business tactics. They create an undisputed lead largely through network results. Competitors protest. Governments intervene. The dominant player has lingered long enough for new competitors to find a way to gain entry—as Apple and Google did against Microsoft in the 2000s, as their smartphone operating systems made desktop computers and Windows very less relevant.

And then the cycle starts all over again.