Sensor Tower, a leading app analytics company, is acquiring competitor Data.ai in a move that consolidates the mobile intelligence industry, creating a force that could dominate the field and provide aggressively competitive insights into the app economy.

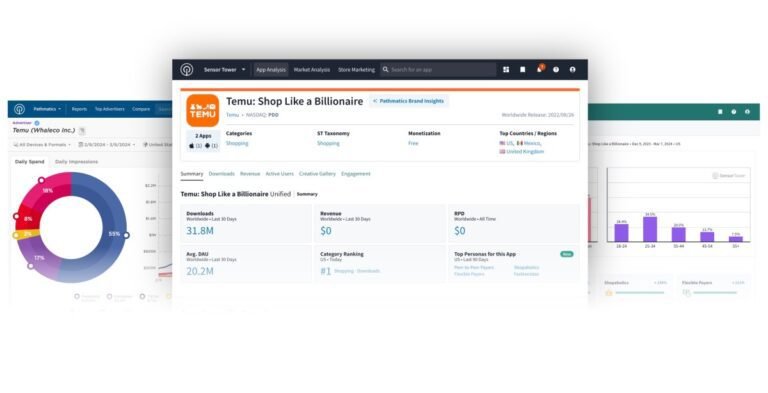

Sensor Tower and Data.ai help businesses and developers gain insight into how mobile apps are performing — offering estimates on downloads, active users, in-app revenue and traction within specific demographic benchmarks, and competition.

Sensor Tower said the platforms, whose typical services are priced in the tens of thousands of dollars, will remain available as standalone offerings for now, with no additional consumer-focused changes planned in the wake of the acquisition.

“We have admired for a long time Data.

Sensor Tower said that as part of the deal, it is laying off a number of employees from its Data.ai team.

“Beyond the platform infrastructure and customer integration, Sensor Tower will absorb some of it data.aithe team of 400 people and has therefore announced a reduction in the workforce,” the company said in a statement.

Sensor Tower did not disclose financial terms of the deal, but said Bain Capital is providing credit-based financing. Separately, Riverwood Capital and Paramark Ventures have invested an undisclosed amount in Sensor Tower independent of previous investments. Data.ai had $100 million in annual recurring revenue, TechCrunch reported.

Paramark managing partner Chunsoo Kim said this acquisition will have a big impact on the marketing world that measures the digital economy.

“We are particularly excited to support the team as they delve into the dynamic APAC market, where the digital economy is booming,” he said in a statement.

Although the companies also compete with other players, including SimilarWeb and AppFigures, they have been each other’s biggest rivals.

Company history

The acquisition is a surprise, at least in terms of who the buyer ended up being. Data.ai had secured over three times the amount of funding compared to Sensor Tower, according to Crunchbase. Data.ai had raised over $157 million in various rounds, while Sensor Tower had raised just $46 million with Riverwood Capital as the majority shareholder.

A regulatory sentence of three years may be the key.

In 2021, the US Securities and Exchange Commission (SEC) charged Data.ai with securities fraud. Bertrand Schmitt, the company’s co-founder and former CEO and chairman, and the company agreed to pay $10 million in a settlement. The SEC accused the company of “deceptive practices” for collecting data.

Data.ai told app developers that their data was not shared directly with third parties. However, the SEC found that from 2014 to mid-2018, the company shared intelligence data with third parties without properly anonymizing the information.

Sensor Tower has also had its share of controversies like critics raised questions about data collection practices. In March 2020, BuzzFeed News published a report claiming that many VPN and ad-blocking apps did not disclose their connection to Sensor Tower and collected data secretly. Sensor tower issued an APOLOGY in 2020 and said the company had taken the route it did to stay competitive.

In September 2023, it cut about 40 of its 270+ people, including executives in CMO and CFO roles.

Both Apple and Google have done as well changes to their mobile operating systems in recent years that somewhat hinder the ability of companies like Sensor Tower and Data.ai to collect important data.

While both companies have run into their share of problems, they continue to be extremely valuable to developers and businesses trying to better understand user preferences. This makes it a little surprising that both companies continue to be frequently mentioned by publications such as TechCrunch as well as The New York Times, The Wall Street Journal, CNBC, Bloomberg and The Verge.

Ivan Mehta can be contacted at im@ivanmehta.com via email and via this link on Signal.