New report highlights the demand for startups creating open source tools and technologies for the AI revolution to snowball, with the adjacent data infrastructure also heating up.

Runa Capitalthe venture capital (VC) firm that upped sticks from Silicon Valley and moved its headquarters to Luxembourg in 2022, published Runa Open Source Startup (ROSS) index for the past four years, shining a light on the fastest growing commercial open source software (COSS) startups. The company publishes quarterly updates, but last year it produced its first annual report with a top-down view of all of 2022 — something it’s now repeating for 2023.

Trends

Data is closely aligned with AI because AI relies on data to learn and make predictions, and this requires infrastructure to manage the collection, storage and processing of that data. And these tangential trends collided in this report.

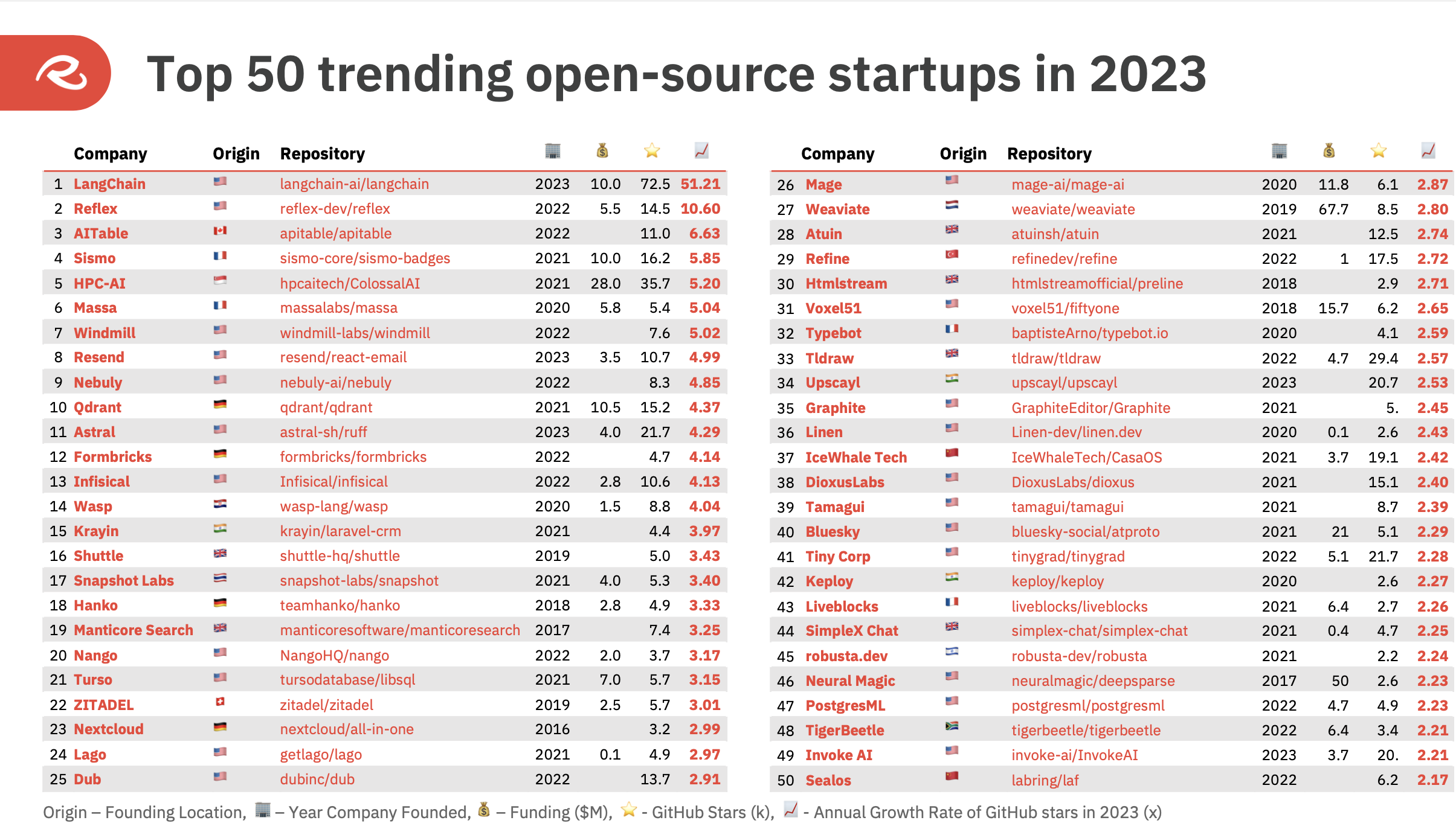

At the top of the ROSS index for last year was LangChaina two-year-old San Francisco-based startup that has grown an open source framework for building applications based on large language models (LLM). The company’s main project exceeded 72,500 stars in 2023, with Sequoia continuing lead a $25 million Series A round in LangChain just last month.

Top 10 COSS Startups in ROSS Index 2023 Image credits: Runa Capital

Elsewhere in the top 10 is Reflectionone open source framework for building web apps in pure Python, with the company behind the product recently securing a $5 million seed investment. AITablea spreadsheet-based AI chatbot builder and the like an open source Airtable antagonist; Seismoa privacy-focused platform that allows users to selectively discloses personal data in applications; HPC-AI, which is building a distributed AI development and deployment platform in a push to become something like Southeast Asia’s OpenAI. and open source vector database Qdrant, which recently secured $28 million to capitalize on the rapid AI revolution.

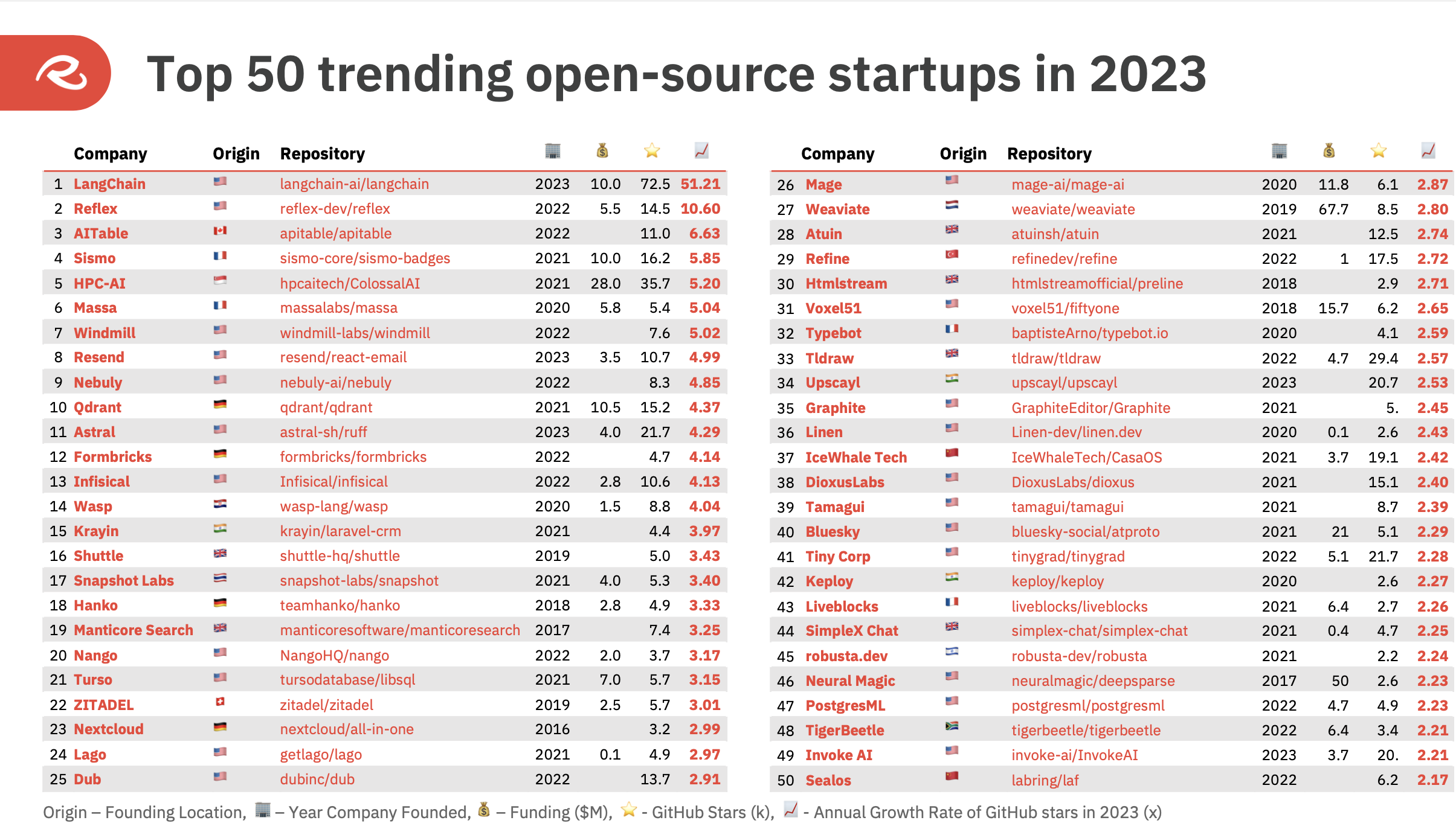

A broader look at last year’s “top 50 trending” open source startups reveals that more than half (26) are related to artificial intelligence and data infrastructure.

Top 50 COSS Startups in ROSS Index 2023 Image credits: Runa Capital

It is difficult to properly compare the 2023 index to the previous year from a vertical perspective, mainly due to the fact that companies often rotate or reposition their products to match what is hot today. With ChatGPT’s Hype Train hitting full throttle last year, this may have led startups to shift their focus or simply put more emphasis on the existing “AI” component of their product.

But like breakthrough year of Generative AIit’s easy to see why demand for open-source components might skyrocket as companies of all sizes try to keep up with proprietary AI makers like OpenAI, Microsoft and Google.

Geographies

Open source software has also always been very popular, with developers from all over the world contributing. This ethos often translates to commercial open source startups that may not have a traditional center of gravity anchored by a brick and mortar headquarters.

However, the ROSS Index goes some way to bring geography into the picture, reporting that 26 companies on the list are based in the US, although 10 of those companies are from elsewhere and still have founders or employees based in other locations .

In total, the top 50 came from 17 separate countries, with 23 of the companies based in Europe — a 20% increase on the previous year’s index. France counted the most COSS startups with seven, incl Seismo and Scoff which are in the top 10, while the UK jumped from just one startup in 2022 to six in 2023, placing it in second place from a European perspective.

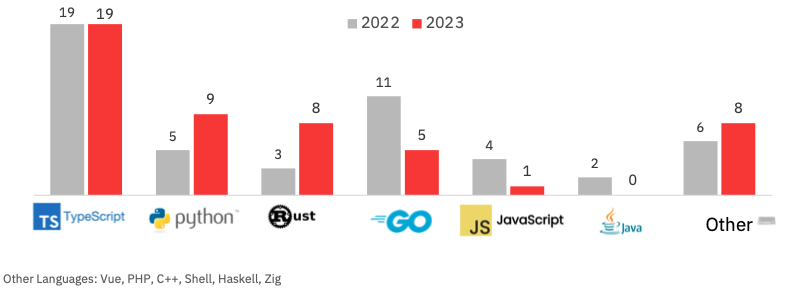

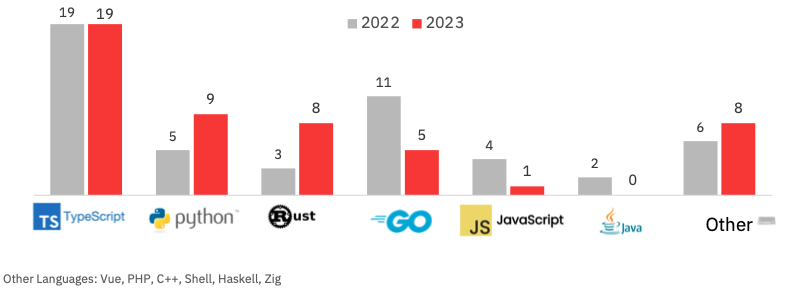

Other notable figures to emerge from the report include programming languages — the ROSS index recorded 12 languages used by the top 50 last year, up from 10 in 2022. Typewriter, a JavaScript superset developed by Microsoft, remained the most popular and was used by 38% of the top 50 startups. Both Python and Rust rose in popularity, with Go and JavaScript falling.

ROSS Index: Trending programming languages. Image credits: Runa Capital

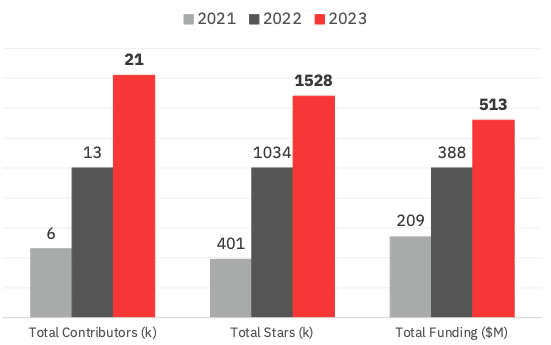

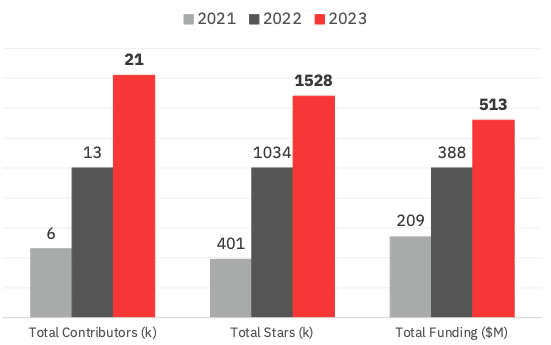

The top 50 contributors to the ROSS Index collectively gained 12,000 contributors in 2023, while the total number of GitHub stars increased by nearly 500,000. The index also reveals that funding in the top 50 COSS startups last year reached $513 million, an increase of 32% in 2022 and 145% in 2021.

ROSS Index: Contributors, Stars and Funding Image credits: Runa Capital

Methodology & framework

It is worth seeing methodology behind it all — what factors influence whether a company is considered “top trending”? For starters, all companies are included must have at least 1,000 GitHub stars (a GitHub metric similar to a social media like) to be considered. But the star count alone doesn’t tell us much about what’s trending, since stars accumulate over time – so a project that’s been on GitHub for 10 years is likely to have more stars than one that’s here and 10 months. Instead, Runa measures the relative growth of stars over a given period using an annual growth rate (AGR) — this looks at the price of stars now relative to a previous corresponding period to see what has grown most dramatically.

A degree of manual diligence is involved here, too, since the goal is to specifically build open source “startups” — so the Runa investment team is pulling projects that belong to a “product-focused commercial organization” and must have been founded less than ten years with less than $100 million in known funding.

Defining what constitutes “open source” also has its own inherent challenges, as there is a spectrum of how “open source” a startup is — some are more like “open core,” where most of their main features are locked down behind a premium paywall, and some have licenses that are more restrictive than others. So, for this, the curators at Runa decided that the startup should simply have a product that is “rreasonably linked to open source repositories,” which obviously involves a degree of subjectivity when deciding which ones make the cut.

There are other nuances at play. The ROSS Index adopts a particularly liberal interpretation of “open source” — for example, both tires and MongDB abandoned their open source roots for “available source” licenses to protect themselves from exploitation by the big cloud providers. According to the ROSS Index methodology, both of these companies would qualify as “open source” — even though their licenses have not been officially approved as such by the Open source initiativeand these particular example companies are no longer referred to as “open source”.

So, in keeping with Runa’s methodology, she uses what she calls the “commercial perception of open source” for her report, rather than the actual license the company ascribes to her work. This means that the restricted source licenses such as BSL (business source license) and SSPL (server-side public license), which MongoDB introduced as part of its transition from open source in 2018, is very much on the menu when it comes to ROSS Index trading companies.

“Such licenses preserve the spirit of OSS — all its freedoms, except for slightly limited redistribution, which does not affect developers, but gives original vendors a long-term competitive advantage,” Konstantin Vinogradov, general partner at Runa, explained to TechCrunch Capital based in London. “From a VC perspective, it’s just a sophisticated playbook for the exact same type of companies. The definition of open source applies to software products, not companies.”

There are other worthy filters in their place. For example, companies that focus mostly on providing professional services or side projects with limited active support or no commercial component are not included in the ROSS index.

For comparative purposes, there are other indexes and lists out there that give a look at “what’s hot” in the open source landscape. Another VC firm called Two Sigma Ventures maintains the Open Source Indexfor example, which is similar in concept to Runa, except that it covers all kinds of open source projects (not just startups) and has additional filters, including the ability to view from GitHub’s “watchers” metric, which some argue for a more accurate picture of a project’s true popularity.

GitHub itself also publishes one modern repositories page, which similar to Two Sigma Ventures, does not focus on the business behind the project.

Thus, the ROSS Index has emerged as a useful complementary tool for figuring out which open source “startups” are specifically worth watching.