Audio platform based in India Pocket FM has secured $103 million in Series D funding led by Lightspeed Ventures, with participation from Stepstone Group. The company, which counts Tencent and Times Internet as backers, aims to expand to Europe and Latin America after looking at positive results in the US market.

The company has now raised $196 million in multiple rounds and is valued at $750 million, according to TechCrunch exclusively.

TechCrunch reported last year that the company was in talks with Lightspeed to lead the funding round it announced today.

How does the platform work?

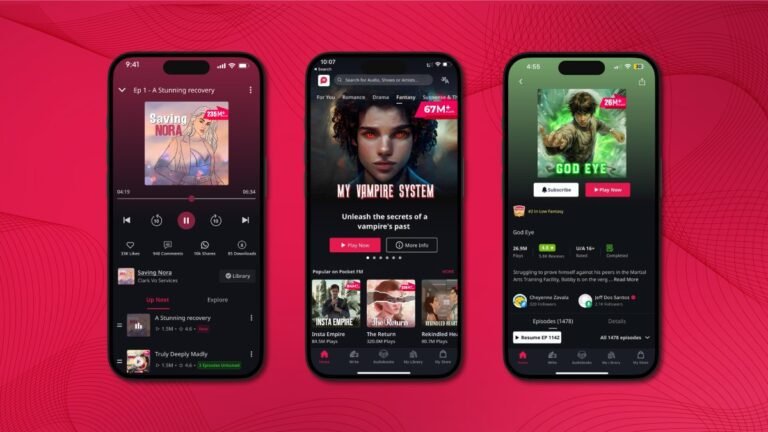

Pocket FM mainly offers audio series based on short episodes: Users can listen to some series or episodes for free and unlock others by purchasing coins. Instead of taking a subscription-based approach to allow users to access all content like Netflix or Spotify do, Pocket FM has found that the pay-as-you-go model is a better fit for the company.

The downside, from a revenue perspective, is that users aren’t locked into recurring payment cycles. But it can still pay dividends and attract repeat purchases: If users want to listen to more content in a row, they have to buy coins — like buying high-level items in a game.

The company is also doubling the creator economy. Last month, the company said it plans to invest $40 million in the Wattpad-like writing platform Pocket novel. Last week, the company’s co-founder Rohan Nayak made a post on LinkedIn that more than 90,000 authors had signed up to the platform as of February 20. Pocket Novel also prompts users to purchase coins to unlock content.

However, while both apps have a mechanism to purchase coins to unlock content, there is no integration between them at this time. This means that you cannot use the coins you purchased in Pocket FM to unlock Pocket Novel product content and vice versa.

Pocket FM also has a limited audiobook vertical where it competes with the likes of Audible with a similar pay-to-unlock strategy. The company only makes this product available in India with existing partnerships.

Game with numbers

Pocket FM usually optimizes for users who spend more time on the platform. To this end, the audio platform has more than 100,000+ hours of content and over 400,000 episodes in various genres and languages.

The company’s expansion into the US — which opened for business there in 2021 — has proven to be a major revenue driver. He said Pocket FM has crossed $150 million ARR this year — with $100 million ARR contribution from the US. The company is present in other markets, but counts the US and India as its biggest markets.

The platform has also seen a high level of engagement from its US user base. While globally, users spend 115 minutes on the audio platform, that average reaches 135 minutes in the US

The Pocket Novel authoring platform, which has local competitors like Omidyar Network-backed Pratilipi, has more than 250,000 authors. The company wants Pocket Novel to reach $100 million in ARR by 2025.

Efforts in GenAI and the creator economy

It’s no surprise that Pocket FM is keen to test AI-based production capabilities. It has already begun testing a tool for writers in the US to turn their writing into audiobooks. The company is partnering with Eleven Labs to provide writers with a range of 50 AI voices.

The startup noted that it is also working internally on AI-powered tools that will help creators write their stories faster.

While Pocket Novel authors earn through a revenue-sharing program, the startup provides incentives for reaching writing goals. But the use of artificial intelligence tools that often produce unreliable or low-quality results means that there is a lot of mediocre content on the platform.

Nayak told TechCrunch that it’s essentially a platform’s job to filter out the noise.

“You have to filter out the noise and make sure you’re filtering out the high-quality content that you then put out there for listeners. The way we look at AI at least in our context is more about how you use AI to unlock productivity and efficiency gains for creators for writers,” he said.

Pocket FM says some writers on the platform earn more than $3,000 a month, but did not provide information on the average total income. The company doesn’t enforce an exclusivity clause when creators are on the platform, but the startup said it has some deals in place to own the IP.

Lightspeed partner Harsha Kumar said that while the appetite for audio content is global, Pocket FM should cater to local tastes in different geographies.

Platforms based on user-generated content often lean towards popular creators in terms of visibility and earnings. Kumar believes that a refined recommendation algorithm will play a key role in ensuring parity.

“This is always a difficult balance. Companies can try many things from hyper-personalizing consumers to using AI assistants to help creators become better and increase their profits. I think the platform’s recommendation algorithms have a huge role to play — whether the platform recommends popular content or recommends content based on your taste,” he said.

Future plans for investment and expansion

Separately, the company is already talking to investors for its next round. Abu Dhabi’s sovereign wealth fund ADIA has been in talks with Pocket FM for a potential mega funding round, TechCrunch reported last week.

The company did not immediately respond to this development, but said it has received significant investment interest.

“As you scale, you see a lot of investment interest in general. But whether it will be the new round or not depends on what kind of scale-up plan we have and it depends on something materializing,” Nayak said.

“The biggest challenge is adapting the content to appeal to local preferences and the local context. We’ve found that some regions prefer stories that have more local appeal — where characters have similar names and familiar and prominent locations, for example. A separate execution challenge is of course building and running a global organization that absorbs the same culture,” said Lightspeed’s Kumar.

Nayak also mentioned that the company is not yet profitable, but has a high gross margin and is focused on scaling. The startup has about 800 people and plans to add 500 people worldwide.