Cap VC is launching a tool for VC firms and plans to expand its offering to startups raising money. The idea is to make better investment decisions, faster, using the power of artificial intelligence.

VC is above all a people business, but as AIs get closer and closer to becoming human, there are a number of new tools hitting the market. Some of these (like Connetic Ventures’ tools) are developed in-house and maintained as proprietary tools giving VCs an edge, while others (DeckMatch and Headline) are spun off from VC firms in an effort to free up the startup investment space.

As a VC-backed startup that prides itself on leveraging AI-powered tools to streamline VC operations, VC cap stabs at upsetting the people who fund the troublemakers.

The startup says it saw opportunity in the inefficiencies of the venture capital industry, recognizing a largely unmet need. In particular, he found that VCs are being overwhelmed by complicated PDFs, which is where Cap VC comes in.

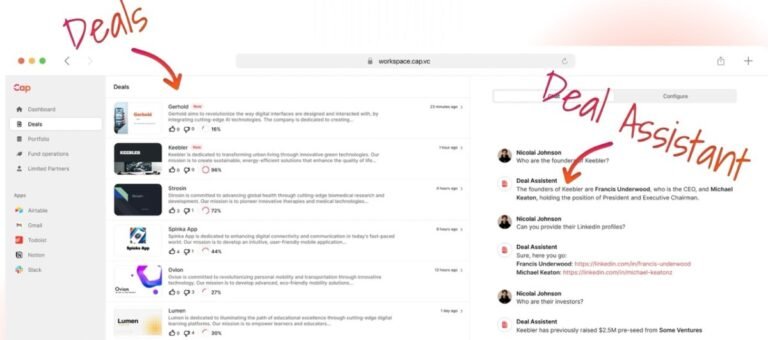

“We transform unstructured data from PDF files, balance sheets, income statements and P&L accounts into structured data,” explains Patrick Theander, CEO of Cap VC, in an interview with TechCrunch. “An ‘operating system for VCs’ was really the only description that seemed appropriate for what we’re building. We build native apps on Mac and Windows and launch an API so developers can build on top of our platform. We are building a set of powerful ecosystem tools for the VC industry.”

The process doesn’t end there, Cap VC aims to go a notch higher and provide context to portfolio companies. This allows for a stable platform for potentially the entire history of a VC-interested startup. “We want to give VCs a full context of their portfolio and the companies they might invest in: The context of that company, the different funding rounds, the historical data and everything else,” added Theander.

In addition to developing a platform, Cap VC is also creating a more accessible space for LPs and controllers. They are leveraging partnerships, leveraging insights from audit firms like Deloitte to create a capital management tool that can be used by different stakeholders, even regulators.

Despite being unsure of the specifics of team size, Theander is clear about keeping the team small without compromising on efficiency. In his words: “It’s not my intention to become a huge team, I want to build a small, fairly compact team… if you have the right set of people, you can build much faster and much better. .”

A big question is becoming increasingly apparent: Why haven’t VCs built something similar? Theander’s theory is that VCs don’t know how to build, saying that building a platform like the one Cap VC is launching requires a nuanced understanding of the tech startup ecosystem.

Knowing what I know about VCs and the amount of money they spend to gain an edge over the competition — NfX’s suite of tools, such as signal, which helps founders find the right investors for their funding round, is one example — it makes me wonder if Theander’s view is a bit naive. On the other hand, software development is a specialized skill, and he says Cap VC has a waiting list of eager investors ready to take the company’s tools for a spin.

At the same time, Theander sensed that there might be another dynamic at play.

“I’ve also realized that most VCs are just lazy. If it works, it’s fine, and they don’t care. But I think this is too good to be honest. We’re building an extremely simple platform that’s easy to get started with,” says Theander. If there is any truth to this, the intolerant attitude on the part of the VCs may have inadvertently given Cap VC an opportunity.

The platform hopes to go public in February.