More than 10,000 founders, investors and technology internal will convene at Moscone West in San Francisco from October 27-29 for TechCrunch disturbs 2025 – One of the most expected technological conferences of the year.

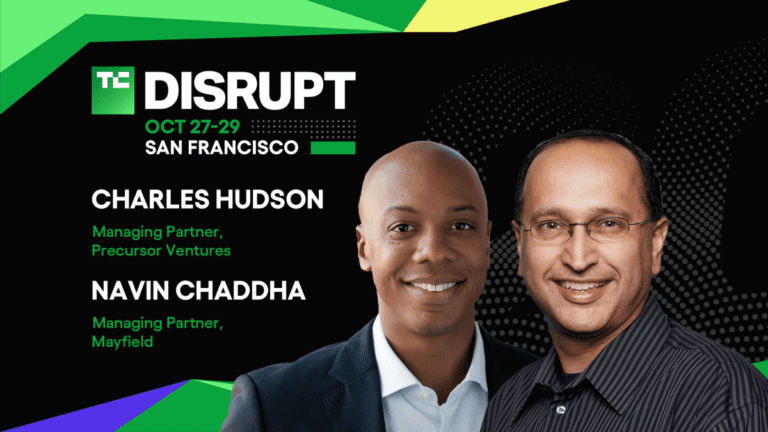

Out of the 250+ technological leaders taking the sceneDon’t miss this standout panel at the manufacturers’ stage that characterizes two of the most respected early stages in business: Charles Hudson Business precursors and Navinos Chandda of Mayfield. Their session dives in one of the most difficult times on the journey of each start: increasing your first round when all you have is a vision.

Why participate in this discussion at the manufacturers’ stage?

This honest and regular conversation It will cover what really matters when increasing your first institutional control, from telling a fascinating story about building a non -attraction. Hudson and Chaddha will share the features that are consistently looking for zero -to -one founders, red flags that increase eyebrows and the most common mistakes made by first entrepreneurs when raising capital.

Bet on people before the product

Promoter and concentration of seeds often occur before there is a product, user base or attraction. This means that investors bet on the founder, not the business. And few know how to make this phone call better than Hudson and Chaddha. Among them, they have supported hundreds of founders in the early stages, before the polished decks, before they show measurements and often before sending a code line.

Charles Hudson, Managing Director of PrecursorsHe has invested in more than 400 companies and has supported over 450 founders. He has built his reputation to support people with bold ideas and unique perspectives, recently saying, “The earlier you invest, the more important it is to believe in the founder’s narrative and ability to adapt.

Navin Chaddha, Managing Director at MayfieldIt brings decades of experience in recognizing the founders and to scale guides. With more than $ 120 billion in shares value created through its investments, Chaddha believes that the early stages are when the founders’ values are more important. “We first invest in people, the second and the product markets third.” he said. “We are looking for founders guided by the mission and wired for durability.”

Active knowledge to increase your first round

Whether you are increasing or planning for the future, this session will equip you with real navigation tips in early business with clearly and belief. Don’t miss it alive, except 200+ sessions performed in five stages of industry. Sign up now for storage To $ 675 before prices rose after July!

TechCrunch event

Francisco

|

27-29 October 2025