The last several quarters have seen a lull in the expansion of the cloud infrastructure market, with lower growth numbers than we’ve been used to seeing in the past. That changed this quarter thanks in large part to interest in genetic AI. The new revenue wave only started last year, driven by the ChatGPT hype cycle, but it has already pushed cloud infrastructure revenue in the fourth quarter of 2023 to $74 billion, up $12 billion from last year at this time and 5, $6 billion over the third quarter, the largest quarter-over-quarter increase the cloud market has seen; per Synergy Research.

The full-year cloud infrastructure market grew to $270 billion, up from $212 billion in 2022. Synergy’s John Dinsdale predicts that the growth we’ve seen over the last year is here to stay, even as the market continues to mature and of large numbers takes effect more and more. “Cloud is now a huge market and it takes a lot to move the needle, but AI has done just that. Looking ahead, the law of large numbers means that the cloud market will never return to the growth rates seen before 2022, but Synergy predicts that growth rates will now stabilize, resulting in massive continued annual increases in cloud spending “, he said in a statement.

Jamin Ball, partner at Altimeter Capital, writes in his masterpiece Clouded Judgment Newslettersees an equally bright future for these suppliers:

Hyperscalers are really starting to see the tailwind of new workload growth outweigh the headwind of optimizations. Sometimes new workloads are related to artificial intelligence. Sometimes they are classic cloud migrations. Hyperscalers benefit from massive scale, distribution, trust and depth of customer relationships in ways that other software companies do not. They also see AI revenue (largely from computing) emerging earlier than anyone else.

Ball’s data supports Dinsdale’s claims about declining growth rates, but in such a large market, growth for growth’s sake becomes a far less important metric:

Image Credits: Jamin Ball, Clouded Judgment, Altimeter Capital

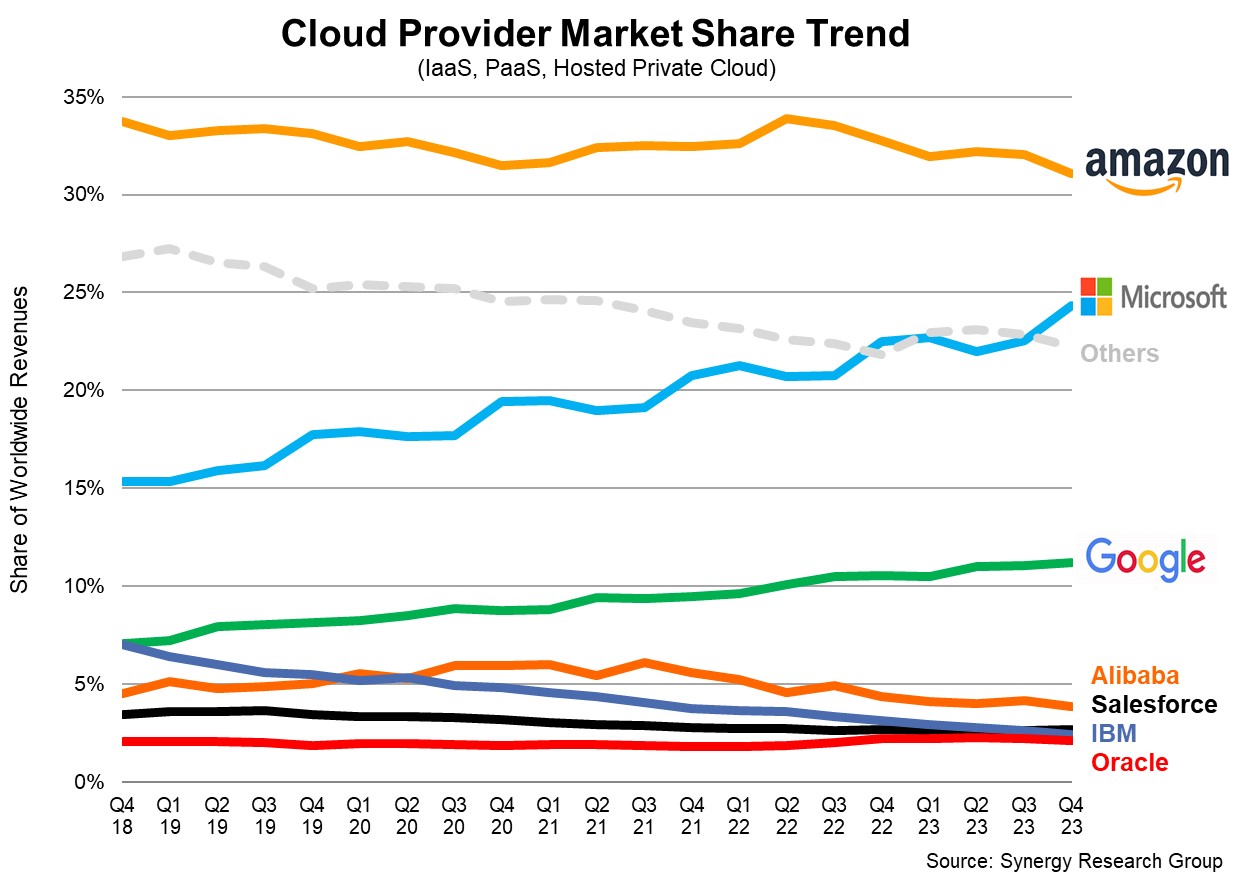

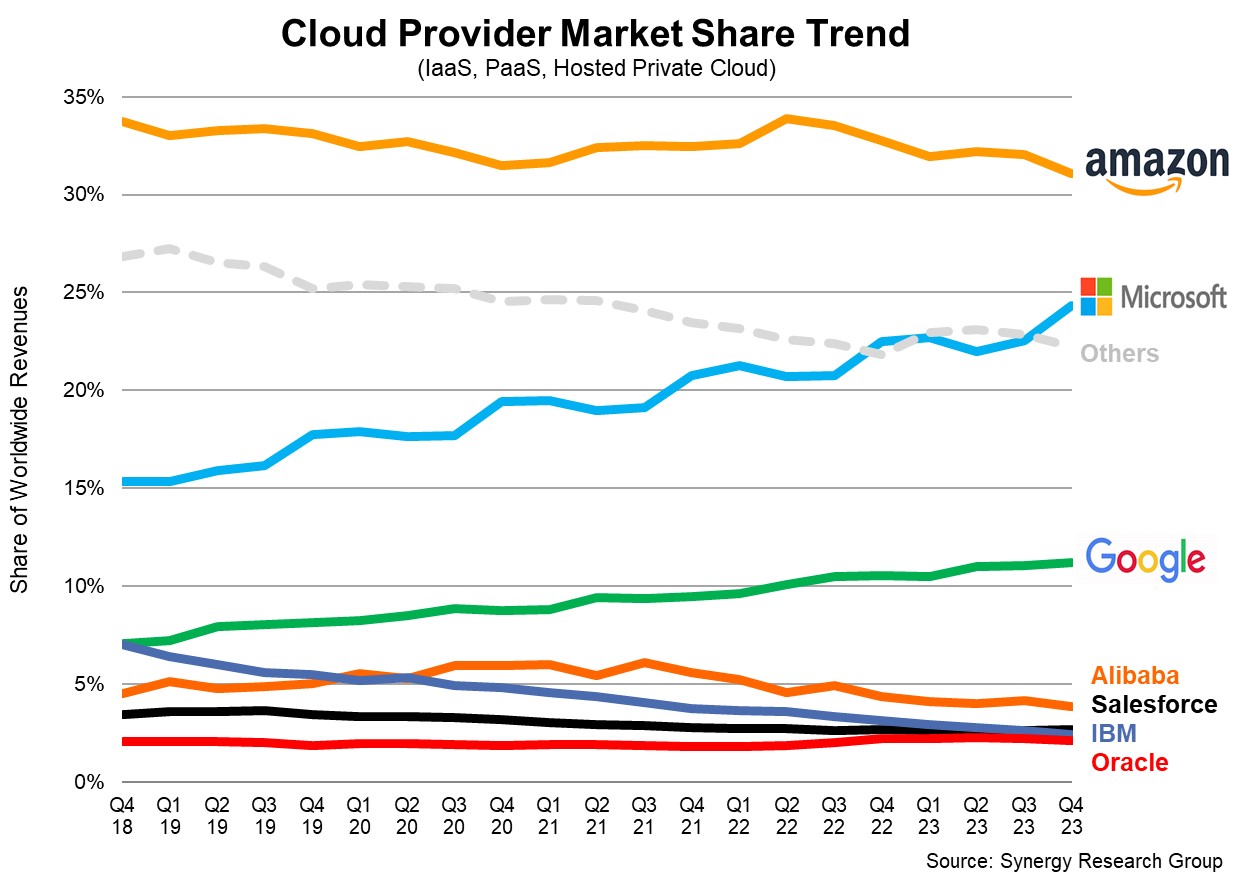

For now, it looks like Microsoft’s lucrative investment/partnership with OpenAI is giving it an edge in the market as we saw the company’s market share grow two full percentage points to 25% in the fourth quarter, a remarkable quarter-on-quarter increase. Amazon is still king of the mountain with a 31% share, albeit down two points from the previous quarter. It would be easy to say that Amazon’s loss was Microsoft’s gain, although it’s probably not that simple, and there are likely more nuanced market implications. Meanwhile, Google held steady at around 11% share.

Synergy reports that the Big 3 make up 67% of the total market share, or about $50 billion in total cloud revenue coming from the three biggest companies in a single quarter.

In terms of dollars, the numbers are, as usual, a bit odd, with Amazon coming in at $23 billion, Microsoft at $18.5 billion, and Google at around $8 billion. If these numbers don’t exactly match the reported numbers, that’s because these companies often combine different types of cloud revenue to arrive at the reported figures. Synergy looks at IaaS, PaaS and hosted private cloud services, and companies’ reported cloud numbers may include SaaS and other revenues that Synergy does not measure.

Image Credits: Synergy Research

In terms of quarterly percentage growth, taking into account these caveats about how companies measure revenue, AWS was up 13%, Azure was up 30%, and Google Cloud was up about 25% (although they don’t break out the SaaS revenue in this number).

One thing was clear last year, Microsoft was putting the fire on Amazon and leaving the company on its heels, perhaps for the first time, with its aggressive deal with OpenAI.

Scott Raney, a partner at Redpoint, told TechCrunch at re:Invent in December that Amazon was clearly playing catch-up when it came to artificial intelligence, and that it was an unusual place to find the company. “This may be the first time that people have looked and said that Amazon is not in a position to take advantage of this huge opportunity. What Microsoft did around Copilot and the Q event comes to light [this week] means that in reality, they are playing absolutely 100% catch-up,” Raney said at the time.

While genetic AI represents a huge opportunity for all cloud vendors, it is still very early days. We always like to say that first to market is a huge advantage, and it certainly has been for Amazon over the years. Whether Microsoft’s aggressive approach to AI represents a similar advantage isn’t yet clear, but it’s hard to ignore a two-percentage-point increase in market share in a single quarter. For now, it looks like Microsoft has taken the lead when it comes to AI in the enterprise, but Google and Amazon still have a long way to go to figure it out.