Ballistic Ventures, a venture capital firm dedicated to financing and incubating cybersecurity startups, is looking to raise up to $300 million for a new fund, according to a regulatory filing.

The San Francisco-based VC firm on Wednesday filed with the US Securities and Exchange Commission raising $300 million for its second fund — more than a year after its launch first balance fund in May 2022.

Ballistic spokeswoman Michelle Kincaid declined to comment on the filing when reached by TechCrunch.

Aimed at early stage cybersecurity and cyber-related startups, Ballistic projects is co-founded by Kleiner Perkins general partner Ted Schlein, with Barmak Meftah, Jake Seid and Roger Thornton as the other three general partners and Mandiant founder Kevin Mandia as strategic partner. The VC firm also has Derek Smith as a strategic advisor and Agnes So as the company’s head of finance and operations.

So far, Ballistic has backed a dozen startups, according to details available on the company’s website. Ballistic says it has founded, operates and funds more than 90 cybersecurity companies. To date, the company has invested in AuthMind, Oligo and Nudge Security, among others. The company too recently appointed Former US National Cyber Security Director Chris English and US Cyber Security Agency CISA former Chief of Staff Kirsten Todd as advisors.

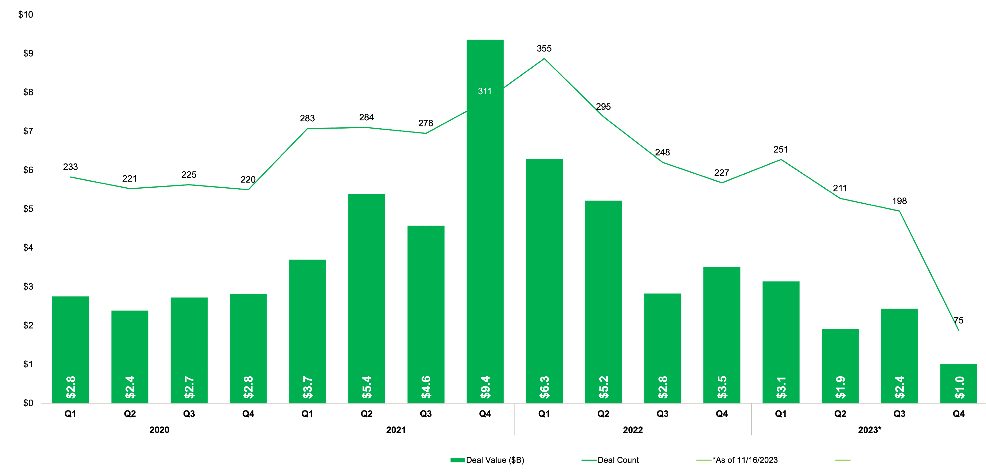

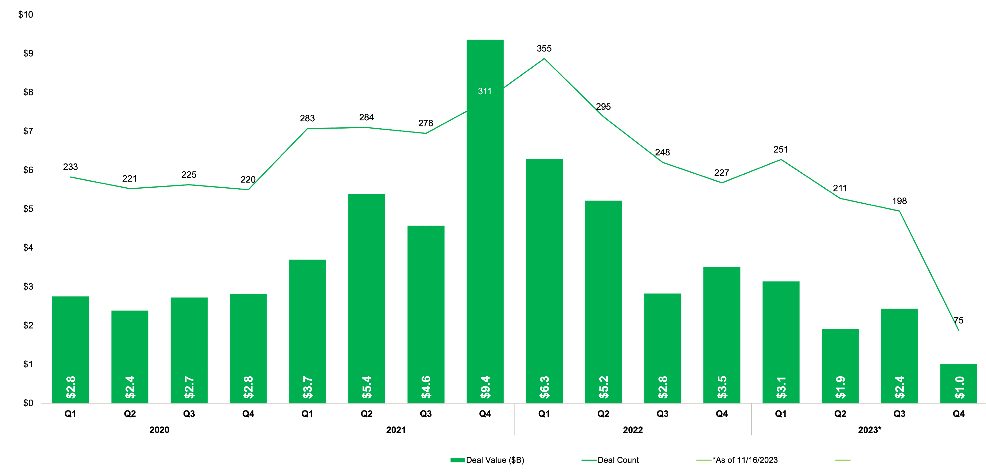

Investments in cybersecurity in 2023 to date have been well below the record highs of previous years. Venture funding for cybersecurity startups worldwide fell more than 14% to $2.4 billion in the third quarter of 2023, from $2.8 billion in the same quarter last year, according to data from PitchBook shared with TechCrunch.

The number of deals made in the most recent quarter also fell from 248 to 198.

However, as the digital economy expands globally, cyber-attacks and cybercrimes have become more prevalent. Investors are also bullish on growth in startups and investments in cybersecurity with dominant advances in artificial intelligence and cloud development.

Image Credits: PitchBook data