Fintech based in UK Tide It has entered the Unicorn Club with a new $ 120 million funding led by TPG, as the launch now serves more than 1.6 million small businesses worldwide-with more than half-based in India, its largest and fastest growing market.

The new round-a mixture of primary and secondary investment, although the start has declined to confirm the precise split-it estimates the start of the eight-year starting at $ 1.5 billion. Includes sales of workers, early angels and some minority investors. TPG has supported the round through the multi -sector vehicle, the Rise Fund, which has invested in more than 85 mission -based companies. The existing investors, the APAX digital funds, also participated.

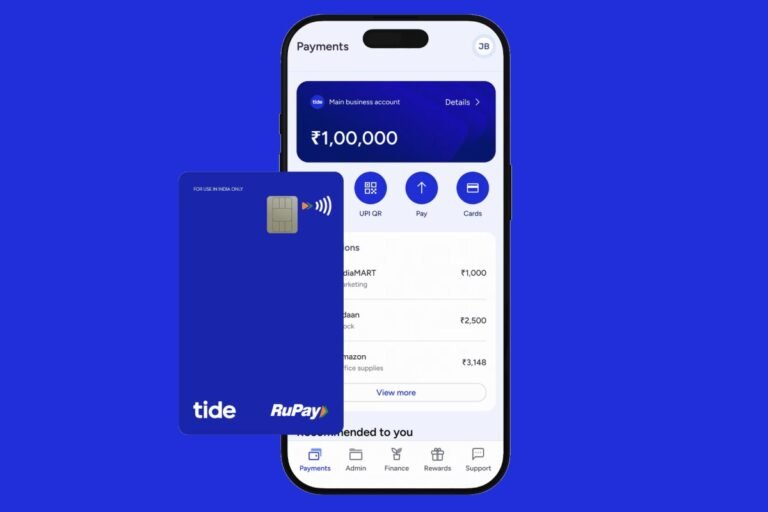

At the global level, small and small businesses, including contractors, freelancers and solopreneurs, spend a significant time on business management duties such as accounting, pricing, taxes, loan securing and management of payments and expenses. While traditional banks and newly established businesses offer services in this department, most solutions are not designed for their unique needs. Tide aims to change this with its consolidated business platform, offering customized tools such as accounting integration, pricing, business loans, asset financing, payroll, spending cards and even companies registration.

Initially started in the United Kingdom in 2017, Tide expanded to India in December 2022 to use the huge base of the country’s small businesses – About 60 million small and small businesses Employing over 250 million people, according to recent data from the Indian government. From its entrance, Tide has boarded more than 800,000 Indian companies, which is referred to as “members” – overcoming the UK member of about 800,000. In the United Kingdom, where Tide is already profitable, the company serves about 14% of the country’s small and average business market.

“There is a huge tendency for standardization. Thus, our biggest enemy is cash and not competitors,” said Oliver Prill, Tide’s chief executive, in an interview.

“In India, there is a debate as growth has slowed down a bit, but it is still an extremely impressive growth rate. You are considering mainland Europe or the United Kingdom, growth is much lower,” he told Techcrunch.

Tide estimates that about four million small and small businesses start in India every year. These companies usually seek support in areas such as access to official credit, accepting the interface of consolidated payments supported by the Indian Government (UPI) for payments and navigation to the country’s indirect tax system, the tax and services tax. Their tide serves through its digital platform, available as an application on both iOS and Android.

TechCrunch event

Francisco

|

27-29 October 2025

The start of the United Kingdom expects to board a million businesses in India by the end of this year and is already seeing intense demand from Tier-3 cities (referring to smaller, less urbanized cities with limited digital and economic infrastructure).

In India, Tide works with about 25 lenders on its platform to facilitate the credit for small businesses, constituting partners based on the needs of each business. The company also offers services such as fixed deposits, bill payments, banking and ATM cash withdrawals.

Except for the United Kingdom and India, Tide began in Germany in May 2024 and expanded to France earlier this month. The start offers a custom experience in every market, including local language support.

With the new funding, Tide plans to further expand geographically, strengthen its product and invest in Agentic AI.

The start already covers a number of funding and administrator services, but there are still some gaps to fill. “In the coming months and quarters, you will see some important developments in this area,” Prill said, referring to the upcoming launches of products activated by the last round of funding.

Tide currently employs more than 2,500 people in all its worldwide activities.