It can be difficult to pick up and move to a new country, made even more difficult if you are not used to the style of banking in that country.

The rise of immigrants in the United States — about 50 million foreign-born in total live in the U.S. now, according to the immigration think tank Center for Migration Studies — presents an opportunity for startups to tailor financial services to this population. Companies like Comun, Maza, Alza and Welcome technologiesfor example, help Latino immigrants open bank accounts.

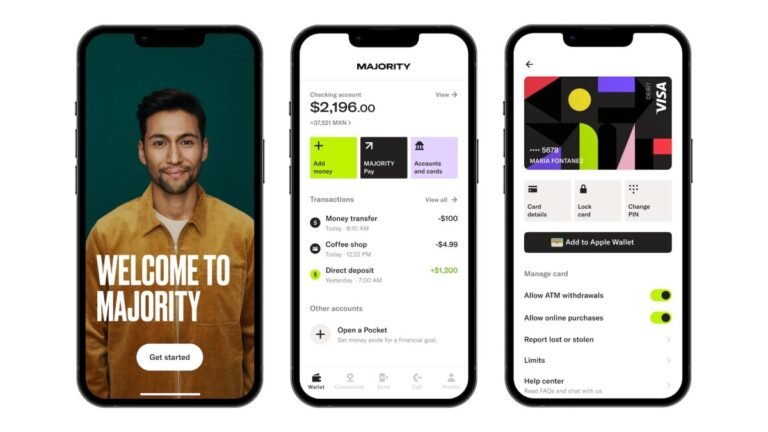

Magnus Larsson, himself an immigrant from Sweden, faced similar problems and created the Miami-based The majority in 2019 to deal with them. For a monthly membership fee of $5.99, expats can open a bank account and receive a debit card, community discounts, free international money transfers and discounted international calls. There is also a peer-to-peer payment feature.

Accounts do not require a social security number or US documentation, just a government-issued international ID and proof of US residency. They also have no overdraft fees or minimum balance requirements. In addition, users have access to Majority’s “Advisor Program,” a nationwide network of trained support staff who are immigrants themselves.

“For many customers, we are the primary relationship they have when it comes to their financial services and services to connect back to their country,” Larsson told TechCrunch. “Most immigrants are hit with a lot of predatory fees. When it comes to financial services, remittances and cross-border money movement, you pay a flat fee, but we deduct the other fees.”

The majority approach prevailed: Over the past year, the company has tripled its revenue while doubling its user base. In April, Majority reached $40 million in annual recurring revenue and $200 million in monthly new deposits, Larsson said. Overall, transaction volume increased fivefold, while remittances increased fourfold in 2023. Remittances are how someone in the US sends money to someone across the border, such as family members back home.

TechCrunch has followed Majority’s growth journey since it closed a $19 million seed round in 2021. The company has since gone on to raise $27 million in Series A and several tranches of Series B funding, most recently a round 9, $75 million in 2023, which included backing from existing investors Valar Ventures and Heartcore Capital.

All that growth led Larsson to consider raising additional funding to help pay for more growth. Of the $20 million in capital raised, $12.5 million is equity, another Series B tranche. The round was led by fintech founders, including Klarna co-founder Victor Jacobsson and Swedish serial entrepreneur Hjalmar Winbladh. Valar Ventures, Heartcore Capital and another existing investor Avid Ventures returned to participate, and Zettle co-founders Magnus Nilsson and Jacob de Geer also joined.

The rest of the money was $7.5 million in debt financing from an unnamed bank. In total, Majority has raised $90 million in equity funding to date. Larsson also declined to give the company’s valuation, but said it was a solid round.

Additionally, the company recently hired Abhi Pabba to serve as Chief Risk Officer. Pabba previously served as Apple’s credit risk manager for Apple Card. It will support Majority’s upcoming product expansion efforts.

With the new funding, Larsson plans to continue developing products, including helping users build a credit score and access credit products. The company also makes redundancy products to better manage risk.

The recent funding is also the final step toward profitability, Larsson said.

“That was always the goal and it could come next year,” he said. “We’re at that stage where we know our customers well, we know they love our product and we know how to expand that market very well. What we do is make people thrive and succeed better and faster. It’s something that’s needed, and going forward, we’re evaluating how we can make it for 300 million people.”