India’s central bank has imposed several measures to curb high growth in consumer credit, in a move that will affect consumer spending and many startups in the South Asian market, industry officials said.

The Reserve Bank of India has increased risk weights for unsecured personal loans, credit cards, consumer standing loans from banks and non-banking financial companies (NBFCs) by 25% to 125%. The new measures exclude home loans, loans for vehicle purchases and education as well as gold-backed debt, the RBI said.

A similar measure has been announced for banks. It has increased the weighting factors for credit card receivables for banks and NBFCs to 150% and 125% from 125% and 100%, respectively.

The decision comes after data showed that the rate of growth in unsecured loans is almost double that of overall credit growth. The measures show that the RBI is “increasingly cautious about the growth of these loans,” Goldman Sachs analysts said on Friday.

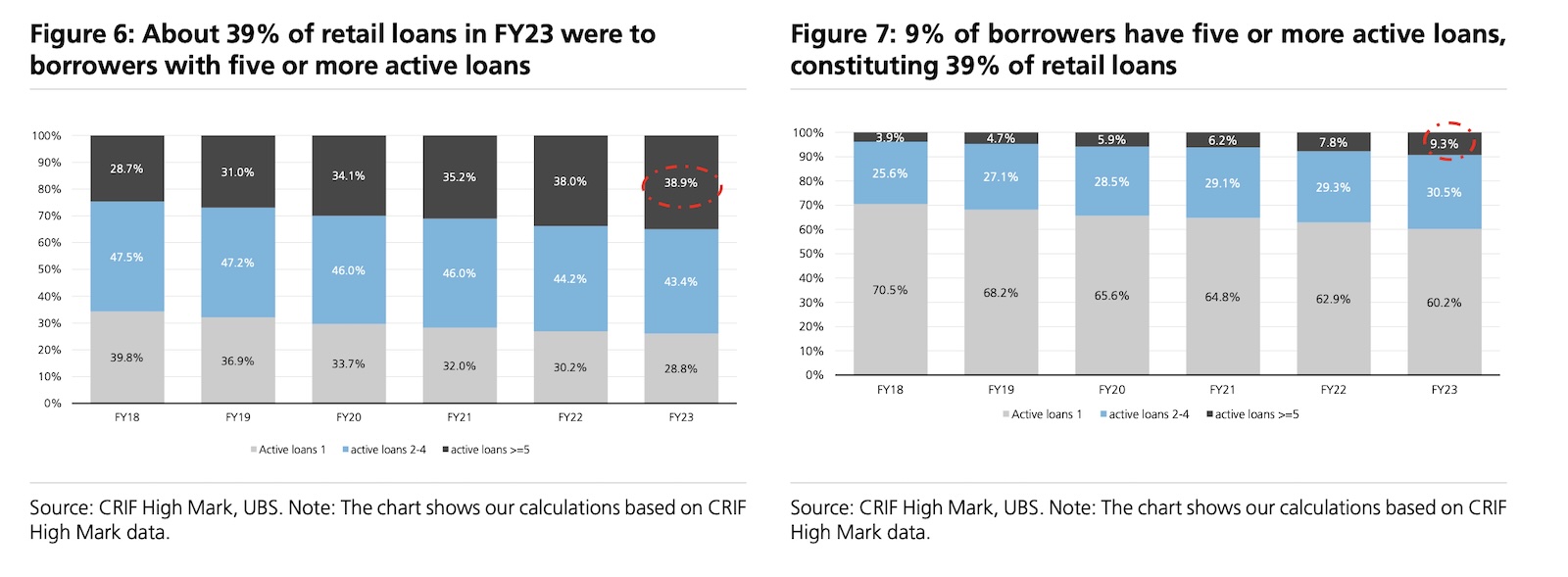

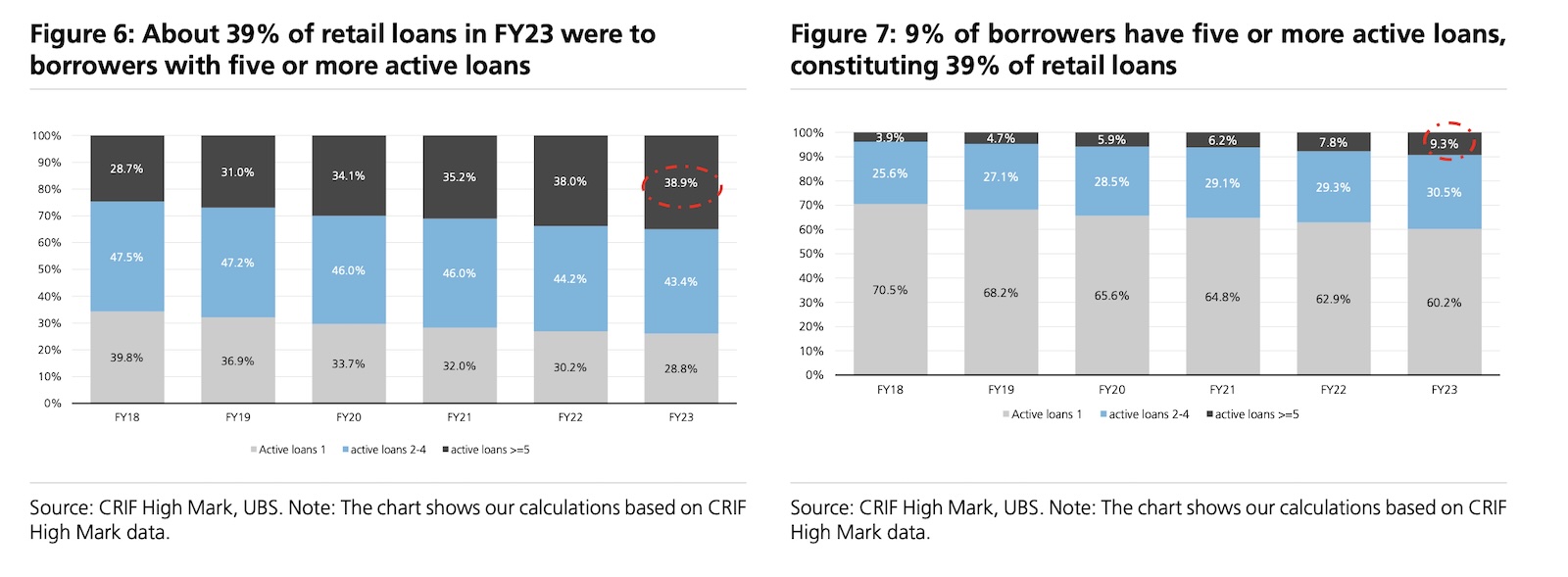

Image and data: UBS, accessed via S&P Global Market Intelligence

The tightening by lending partners will affect many startups, most of which rely on NBFCs to provide consumer loans. A fintech founder, who spoke on condition of anonymity to avoid any fallout, said the move would slow growth “a bit” and also increase the cost of capital at which startups borrow money.

“For Paytm’s lending partners, higher funding costs and increased capital requirements will impact product profitability at BNPL/PL. They may respond by tightening credit standards and/or moderating growth from currently high levels,” Jefferies analysts wrote in a report.

The measures suggest that the RBI is concerned about the heady growth of unsecured loans and increased reliance of NBFCs on bank funding, analysts said.

“We believe that the implementation of these measures, at least in theory, will reduce structural ROEs in consumer lending, particularly for NBFCs in a higher cost of capital than the banking system as well as a tighter intensity of competition, as we pointed out earlier that higher competition would means lower unit financials, slower growth and/or asset quality challenges,” Goldman Sachs analysts said.

Many lenders, including Bajaj Finance, IDFC First and SBI, which have traditionally had the highest share of unsecured personal loans as a percentage of their books, are expected to be among the worst affected.

“In recent years, bank financing to NBFCs in the Indian financial sector has been on the rise and now constitutes >50% of NBFC loans. On the other hand, the ratio of loans from mutual funds/insurance companies has declined. As per RBI’s earlier comment, this led to their action which, in turn, would make borrowing from banks more expensive for NBFCs. In addition, we believe this will likely also increase competition in alternative sources of borrowing by increasing the overall cost of funds,” Goldman Sachs analysts added.