India’s smartwatch market it has transformed, seemingly overnight. For years, it has been dominated by its domestic players, while global giants such as Apple and Samsung jockey for presence amid hundreds of millions of annual shipments. Suddenly, however, the category has been flooded with unknown brands, which have no previous and significant existence. These have started to gain customer focus and are expected to eventually push the market towards a stage of consolidation.

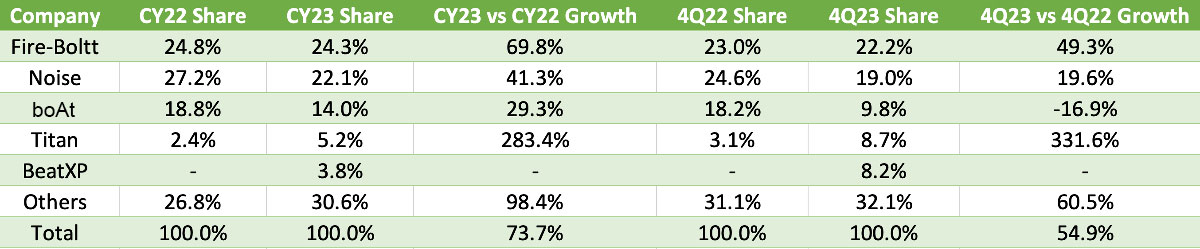

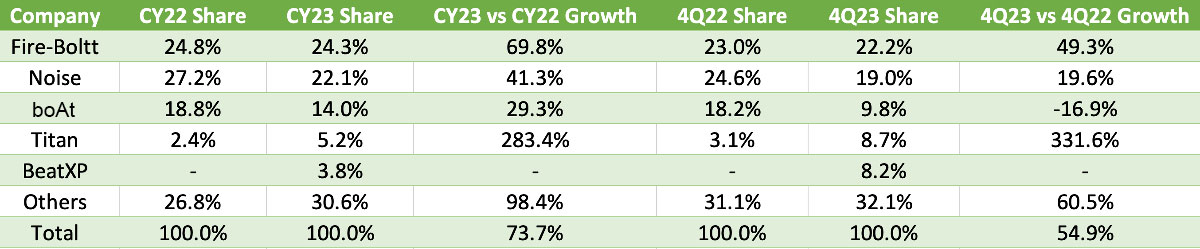

Domestic brands such as Fire-Boltt, Noise and boAt have dominated the category, accounting for over 60% of the total market. Apple and Samsung, on the other hand, fell from 4.5% to a share of just over 2% combined, with 1.1 million units shipped in 2023. according market intelligence firm IDC.

Meanwhile, new entrants have seen their market share increase from three to 3-5% in 2020 to 15-20% last year. Vikas Sharma, senior market analyst for mobile devices, IDC, told TechCrunch that this category now accounts for 134.2 million units annually.

These brands sometimes carry an unrecognized name or are legacy products of established products. Many are direct copies of big global brands like Apple and Samsung, priced at less than $12 (1,000 INR). The Apple Watch price in India starts at $360 (INR 29,900) for the Apple Watch SE, while the Samsung Galaxy Watch 4 retails for $290 (INR 23,999). Indian smartwatches from brands like Fire-Bolt, boAt and Noise start at $12.

The Apple Watch Ultra appears to be available online in India for around $9. Image Credits: Flipkart

Unlike more expensive models, off-brand products generally have no warranty. In some cases, the retailer offers customers a replacement warranty, but this too is not provided by the manufacturer and is simply given on a piece of paper or even verbally. Fitness tracking metrics are often inaccurate due to inferior sensor selection to save cost, while the hardware/software mix leaves a lot to be desired. However, accuracy – even in smartwatches offered by established Indian players – sometimes doesn’t match that of the Apple Watch or Samsung Galaxy Watch, as these vendors compromise on sensor quality to maintain affordability.

“The accuracy of the sensors is not good enough [across most affordable smartwatches] to provide the same level of user experience that users have on a premium model,” Counterpoint senior research analyst Anshika Jain told TechCrunch.

Sharma pointed to the aesthetics, which make these unknown branded models look like the Apple Watch and Apple Watch Ultra or some rounded high-end smartwatches, as well as the affordability, help them gain customers’ attention.

Hong Kong-based market analyst firm Counterpoint Research has observed that the number of unknown brands in the Indian smartwatch market has increased from 78 in 2021 to 128 in 2023.

“There has been almost an 80-90% increase in the number of unknown brands,” Jain said. “This clearly shows how the market has become more saturated now.”

He noted a pattern the analytics firm has observed over the past two years: Most unknown brands appear in the third quarter — around the country’s holiday season — and stay active for a quarter or two before disappearing entirely. Additionally, these are likely white-label products imported from China at low prices or assembled by an Indian electronics manufacturing services partner, he said.

Falling prices

The growth of unknown brands in the Indian smartwatch market has yet to significantly impact all the local companies that dominate the market. However, existing players are wary. Some established local brands are starting to feel the heat. In addition, the increasing market share of unknown brands reduced the average selling price (ASP).

Sameer Mehta, co-founder and CEO of Warburg Pincus-backed BoAt, told TechCrunch that the reduction in ASPs is as high as 90%.

“Overall volumes have started to decline,” he said. “ASPs are down by, say, 90%, which is basically not doing well for any industry. Tell me an industry where price erosion reaches 90% in just one year.”

Market analysts also noticed a huge drop in ASP, though not as significant as Mehta reported.

Jain of Counterpoint, meanwhile, said ASP is down about 39% to $36 in 2023 from $59 in 2022. “There’s a lot of froth at the bottom, just bringing in devices and getting it to market. Once that is gone, there will be some sanctity. Everyone will stop investing in the business if no one is making money in the business.”

boAt, India’s third-leading smartwatch brand, saw a 17% drop in year-over-year growth in the fourth quarter, according to IDC. The smartwatch business contributes about 20% of the startup’s revenue.

Image Credits: TechCrunch/IDC

Mehta said that despite seeing some impact from unrecognized brands, BoAt will continue to generate 15-20% of revenue from smartwatches over the next two years.

Unlike boAt, Fire-Bolt and Noise (the top two brands) saw year-over-year growth in the same quarter.

Gaurav Khatri, co-founder of Bose-backed Noise, told TechCrunch that the startup hasn’t seen any noticeable impact from the “constant influx of new entrants and brands.”

It moves to maintain the market

Market experts believe that the ongoing shift with unknown brands expanding their presence will affect all major players — unless the incumbents change their strategy and add more value to their future smartwatches.

Currently, market incumbents mainly target first-time buyers — similar to unknown brands. Instead, analysts believe established brands should target existing customers.

“People don’t choose these [established Indian branded] smartwatches for their next purchase with the same level of excitement for their first purchase… the main reason is obviously the customer experience and user interface of these devices, which is not as smooth,” said Counterpoint’s Jain.

Most established Indian players don’t focus on offering discrete valuable features in smartwatches, unlike their big tech counterparts like Apple and Samsung. Smart watch manufacturers in the country also sometimes use the same Chinese original design manufacturers [ODMs], limiting product differentiation. Many of these models even bear an uncanny resemblance to Apple and Samsung. However, Indian brands claim to develop PCBs locally and design in-house software experiences, setting themselves apart from global players. Local assembly essentially helps manufacturers avoid import duties of 20%.

Last year, smartwatch brands boAt and Noise entered the smart ring market in India to diversify their product portfolio. However, the smart ring market in India, which saw more than 100,000 shipments in 2023, is led by Ultrahuman, with a 43.1% share in the fourth quarter, according to IDC.

boAt’s Mehta told TechCrunch that the startup wants to focus on creating different categories in the smartwatch market, such as new models aimed at kids and seniors, sports and wellness, to maintain its presence. Likewise, it’s looking to design its new smartwatches for second- or third-time buyers who are more health and wellness conscious and looking for better quality devices. However, these changes will increase the pricing of boAt smartwatches.

That said, market analysts like IDC’s Sharma predicts that the Indian smartwatch market will see only single-digit growth this year due to stiff competition from unknown brands and declining ASPs. The market used to an increase of more than 150% year-on-year the past years.

Sharma also believes that the smartwatch market may consolidate over the next two years and fewer players remain.

“There’s going to be a flat line over the next couple of years … everything grew after COVID, and now it’s skyrocketed … we’re going to see a saturation point soon,” he said.