Nick Pompa, founder of Lootlock – an application that prevents children from running unauthorized gambling accounts on their parents’ credit cards – is a greedy player and software programmer working in Fintech.

As a dad of two under two, he is looking forward to sharing his passion for gambling with his children when they grow older enough to play. He started playing at the age of 6, he told TechCrunch. Lootlock was selected for TechCrunch for 2025 Battlefield 20025 and will exhibit the TechCrunch Disprint, October 27 to October 29 in San Francisco.

As he ran for gambling with other parents, or just read the news, he continued to hear terror stories for children stealing their parents with Surprise Credit Card Accountssometimes inadvertently runs thousands of dollars.

The gambling industry has a known delicate side of using “design arts” such as the Financial Consumer Protection Office It was described last year. They often target children, enticing them to unlock the features of the game. Other Organizations, as the FTC has been issued Similar warnings.

“The gaming industry uses smart design, social engineering and players’ monitoring to encourage children to spend more money while playing,” Pompa said. “I am a greedy player, so I have seen firsthand the drastic shift to micro-successes in the industry for the last eight to nine years.”

Although FTC is forcing the fortnight earlier this year for a refund 126 million dollars to people who submitted claims, This is rare. Parents generally have no appeal than to pay.

Typical advice is for parents to use parental control elements at device level that prevents in -application markets. But, said Pompa, many of his parents are good by letting children spend a little money on such markets under the right circumstances.

TechCrunch event

Francisco

|

27-29 October 2025

He said to the story of a friend called Joe who inspired Pompea to build the lootlock. Joe is a dad to three children, all the greedy players. Joe gives each child a allowance every month and children use the money to buy gambling products, creating a ridiculous system where they handed them cash and gave it back to pay the credit card. And he had to watch their purchases carefully.

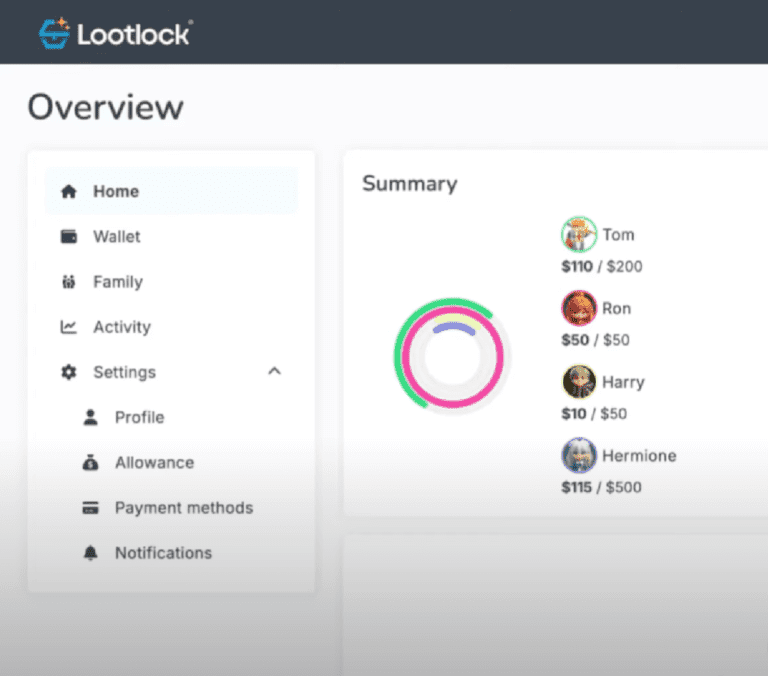

Looklock allows parents to automatically load a digital, prepaid credit card issued by Lootlock’s partner, Transcard, that children add to their device’s digital wallet.

Parents can automate a specified amount of compensation to be added to the card, they say weekly or monthly and can then do any part of what is not immediately available. The child may unlock more, for example, to complete their jobs. Parents can approve increases in the card via text message.

“We give parents super granular checks on how their children can pass and when their children can pass,” Pompa said.

Lootlock is also the gamifying chores, with an upcoming feature available in October called “Bounty Boards”. The parents created these boards that are essentially lists of child jobs. As their children complete – cleaning their room, pet care, etc. – they gain a “generosity”. And when they hit the bounty limit, a parent, the application will unlock additional compensation to spend.

There is also a Gamified Financial Education item. Children choose an avatar and as they exercise good expenditure habits, such as checking the lootlock control panel that tells them the rest of their account, they earn points that add to their equipment for their avatar: swords and armor etc. Their avatar is persistent throughout LootLock.

“We show all the financial concepts in an idea of video games,” Pompa said.

The rest of the lootlock are also limited to spending only for gambling products and cannot be used for other internet markets. Thus, parents do not have to carefully monitor what kinds of items the child is buying. The idea, for the time being, is to focus on teaching children’s gambling.

The start is currently using seven people and is fully bootstrapped.

If you want to learn from firsthand lootlock and see dozens of extra stadiums, valuable workshops and make connections that drive business results, Proceed here to find out more about this year’s disorderIt took place on October 27 to October 29 in San Francisco.