Many observers of the business risk industry I was wondering Either Andreessen Horowitz, a business that she manages $ 45 billionIt has a look at a public negotiation company.

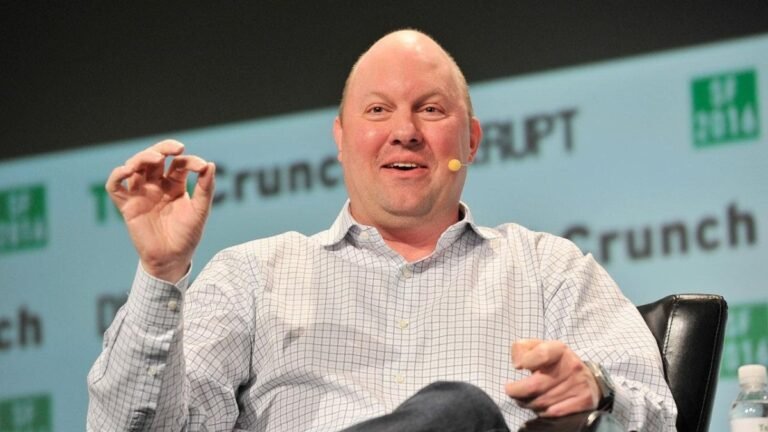

Co -founder Marc Andreessen said not “chomping on the track to get the fixed audience” this week Invest like the best podcast. But he discussed his goal of building A16Z in a constant company, drawing inspiration from JP Morgan and public private shares.

Historically, business capital companies were corporate relationships consisting of a “small breed of people sitting in one room together, trying to bounce ideas from each other when they are investing,” Andreessen told Podcast.

The problem with the corporate relationship model, he said, is that it depends to a large extent on the ideas and know -how of these people on the table with “no underlying value of assets” as he described it. As soon as the original partners retire, the business loses a lot of its value, even if a new generation of investors is taking over.

“But even if they can keep it, there is no underlying asset value. This next generation should deliver it to the third generation,” he said. “This will probably fail in the third generation. It will be on wikipedia one day: this business existed, and then left.”

The corporate relationship model can be lucrative. Billions of billions of A16Z create significant money management fees for the business, in addition to the profits made when its investments succeed.

However, Andreessen said he is constantly reminded of internal staff and limited partners that the company does not only raise money to harvest the fees. It is to give the company cash to invest in growing companies.

“When we go for a scale, it is because we believe that it is necessary to support the types of companies we want to help our founders build,” he said.

Andreessen says his biggest goal for the A16Z is to create a lasting company. An alternative to a partnership is to build an investment company that manages as a business, which means it has management, multiple levels of staff, division of specialties and educational programs, Andreessen said.

There are certainly previous small partnerships that evolve into large companies that Andreessen can use as a model for the A16Z ambitions.

“Goldman Sachs and JP Morgan, 100 years ago, looked like small business capital businesses,” he said. “Then their leaders, over time, transformed them into huge franchises and large public companies.”

It was also named other examples of private corporate relations, turned into large public companies, such as large private share companies. Blackstone, which now has a market capitalization of more than $ 200 billion, was released in 2007. Apollo, KKR and Carlyle held their IPOs shortly after Blackstone and the TPG listed in Nasdaq in the early 2022

Andreessen argues that as these companies have increased by partnerships in large companies, their long -term success became less dependent on some key investors.

“Much of what we are trying to do is build something that has this kind of constant aspect in it,” he said.

In many ways, Andreessen Horowitz already looks more like a business than many VC companies. The A16Z has dozens of people in the marketing team and large teams that help portfolio companies hire talent and sell their products. The company manages separate encryption, biological and health and American dynamism strategies.

But maybe there is another reason Andreessen is willing to restructure away from the classic VC system. When it comes to collaborations, he says: “In fact it is proven in most cases, what you discover is that people really don’t like them so much.”