Technology has infiltrated many aspects of wedding planning over the past decade, from registries to ring design to vendor organization. And rightly so — marriages, in the United States alone, are a A $76 billion industry.

Within this area, Poppy is one of the startups smelling success with its proprietary technology for booking and fulfilling wedding flowers, a $5 billion opportunity in itself, according to Cameron Hardesty, Poppy’s founder and CEO.

Cameron Hardesty, who is expecting her second child, is the founder and CEO of Poppy. Image Credits: Poppy

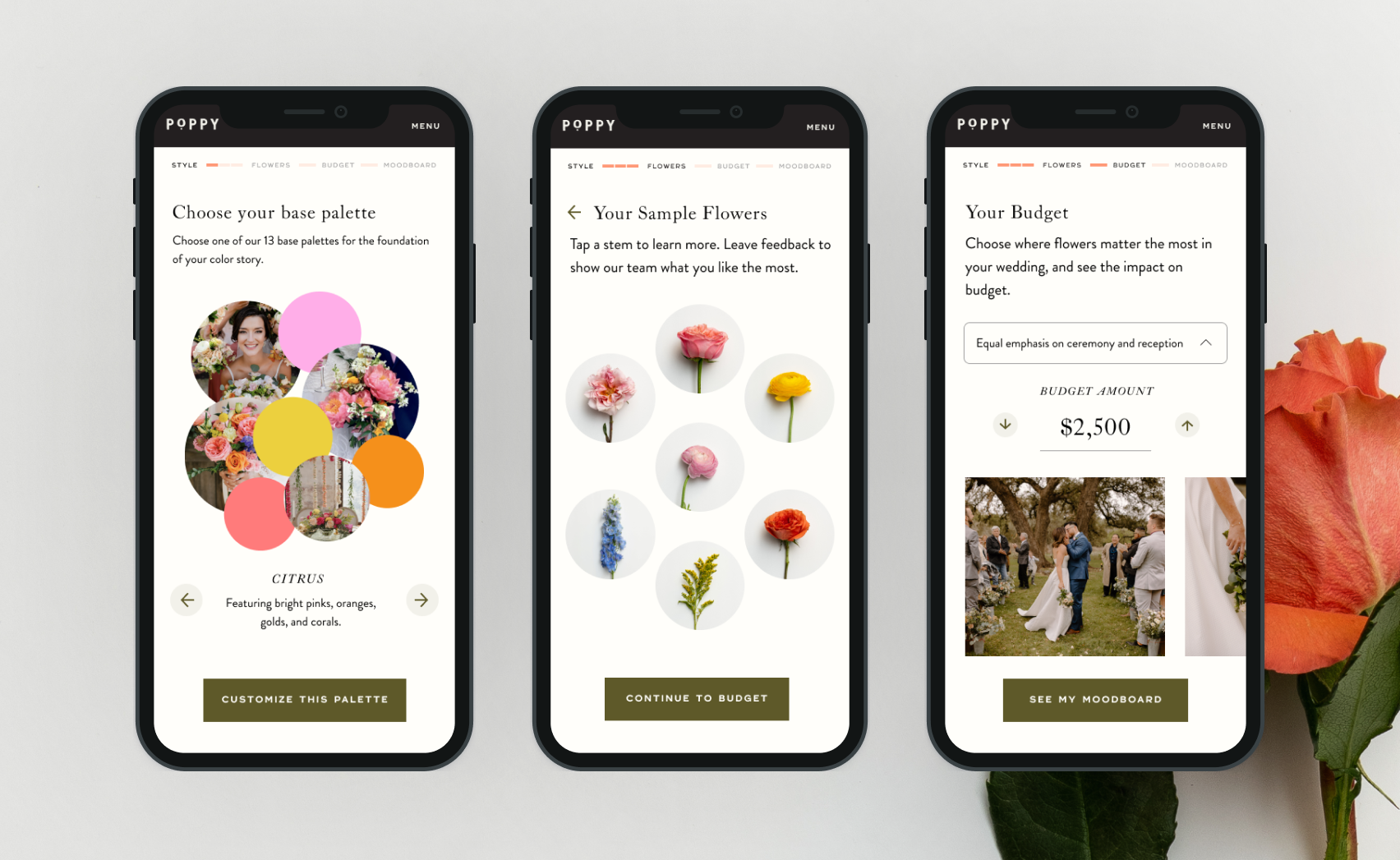

Before starting Poppy, Hardesty gained merchandising executive experience at UrbanStems and trained under the White House’s chief floral designer. The company, with bases in Charlottesville, Virginia and San Francisco, provides couples with a personalized and transparent process for finding wedding flowers.

In addition to couples, Poppy’s digital platform brings together a network of flower designers and a number of family farms based in Latin America. The company also has an in-house team of floral consultants, coordinators and designers.

Florists use Poppy to create custom floral wedding proposals, with images, and provide on-demand pricing for couples. They can then leverage the supply chain directly to the farm for fulfillment and then ultimately create the plan.

It grows like a weed

Since the company’s founding in 2019, Poppy has facilitated flowers for more than 3,000 weddings in 52 US cities. Poppy targets customers who spend $1,500 to $5,000 on flowers, which appeals to customers honored by custom wedding flowers, Hardesty said. To put that into perspective, in 2022, couples spent, on average, $2,400 in wedding flowers.

In late 2020, Hardesty raised $2.2 million in seed funding. At the time, Poppy was working with 50 floral designers and was mainly involved in direct-to-consumer business. Today, Poppy works with more than 600 floral designers, and the DTC line of business is only about 5 percent of its revenue, he said.

In terms of financial growth, the company has bookings and revenue. “Bookings translate one-to-one to revenue for us because we actually have an upsell after the initial booking to sell, so revenue lags because we hold customers, on average about five to six months before we can recognize revenue when “re-delivery,” Hardesty said. “Top revenue from 2022 to 2023 is about 100% growth.”

Typically, about 2 million weddings take place each year. But during the global pandemic, weddings were canceled or scaled back and the wedding industry took a hit from which it has yet to recover, Hardesty said.

There is also what he calls “engagement gap“, meaning that due to the pandemic, people who would normally have met in 2020, dated for a few years, and then married in 2023, didn’t happen. Despite the continued slowdown in ring sales, some jewelers say 2024 and 2025 will be great years for engagements.

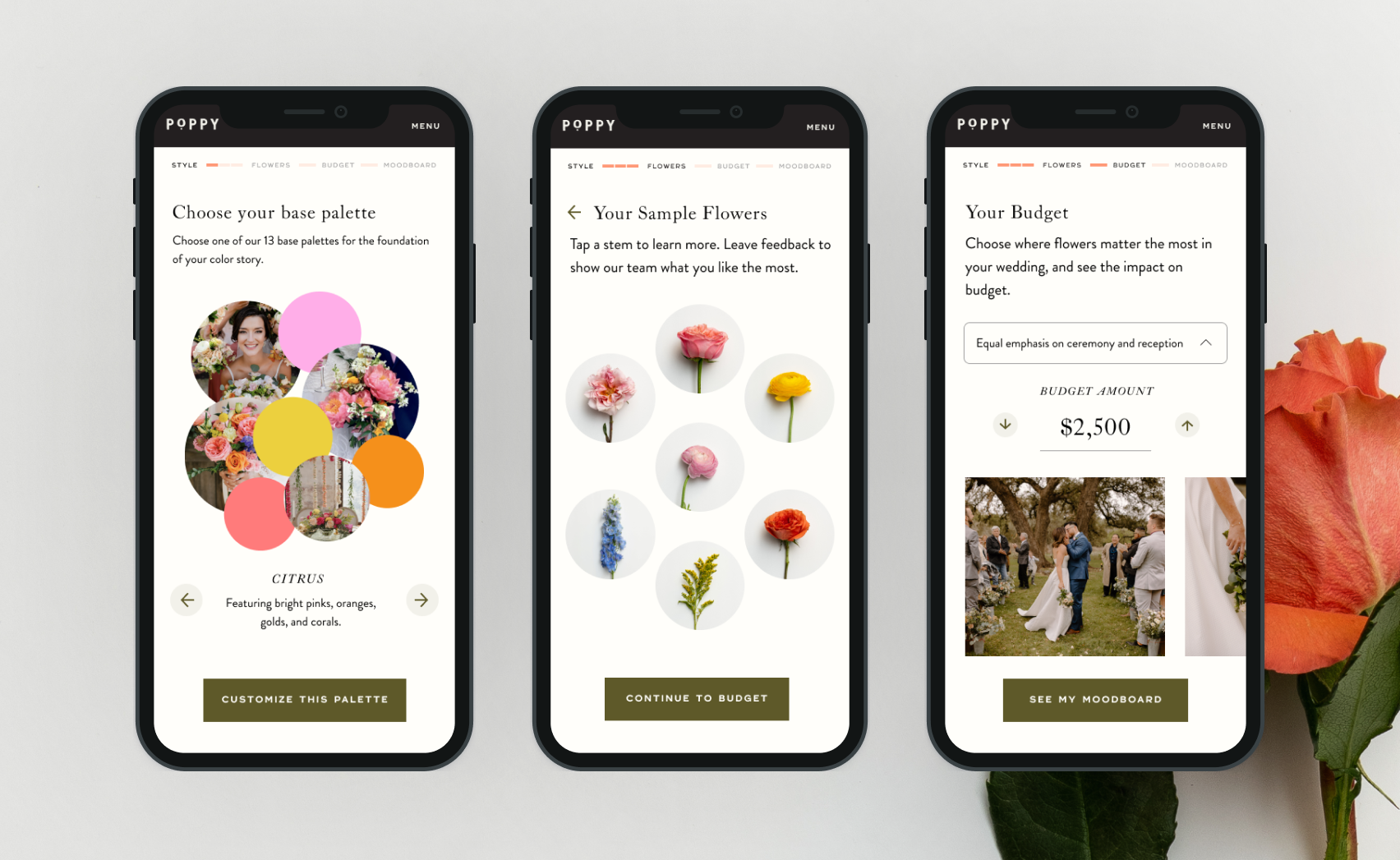

Poppy’s mobile platform for planning and ordering wedding flowers. Image Credits: Poppy

It is flourishing with new funding

Poppy is already seeing some of the activity. In the past nine months, the company has tripled its conversion rate for wedding flower sales.

“That put us on a very clear path to profitability,” Hardesty said.

That’s one reason Hardesty decided to seek additional capital. The company closed on $6.5 million in Series A funding in November. The round was led by Michigan Capital Network and included IDEA Fund Partners, Techstars, Angeles Investors, Riptide Ventures and Front Porch Ventures. The company raised a total of $8.7 million, and the post-money valuation from the production round to Series A grew 3.15 times, Hardesty said.

He plans to invest the new capital in marketing and sales, rounding out Poppy’s leadership team, expanding into more states and product development. The company already has a large presence in New York, DC, Maryland, Virginia, California and Texas.

“2024 is projected to be above the pre-COVID average for weddings, so we’re ready to attack that,” Hardesty said.