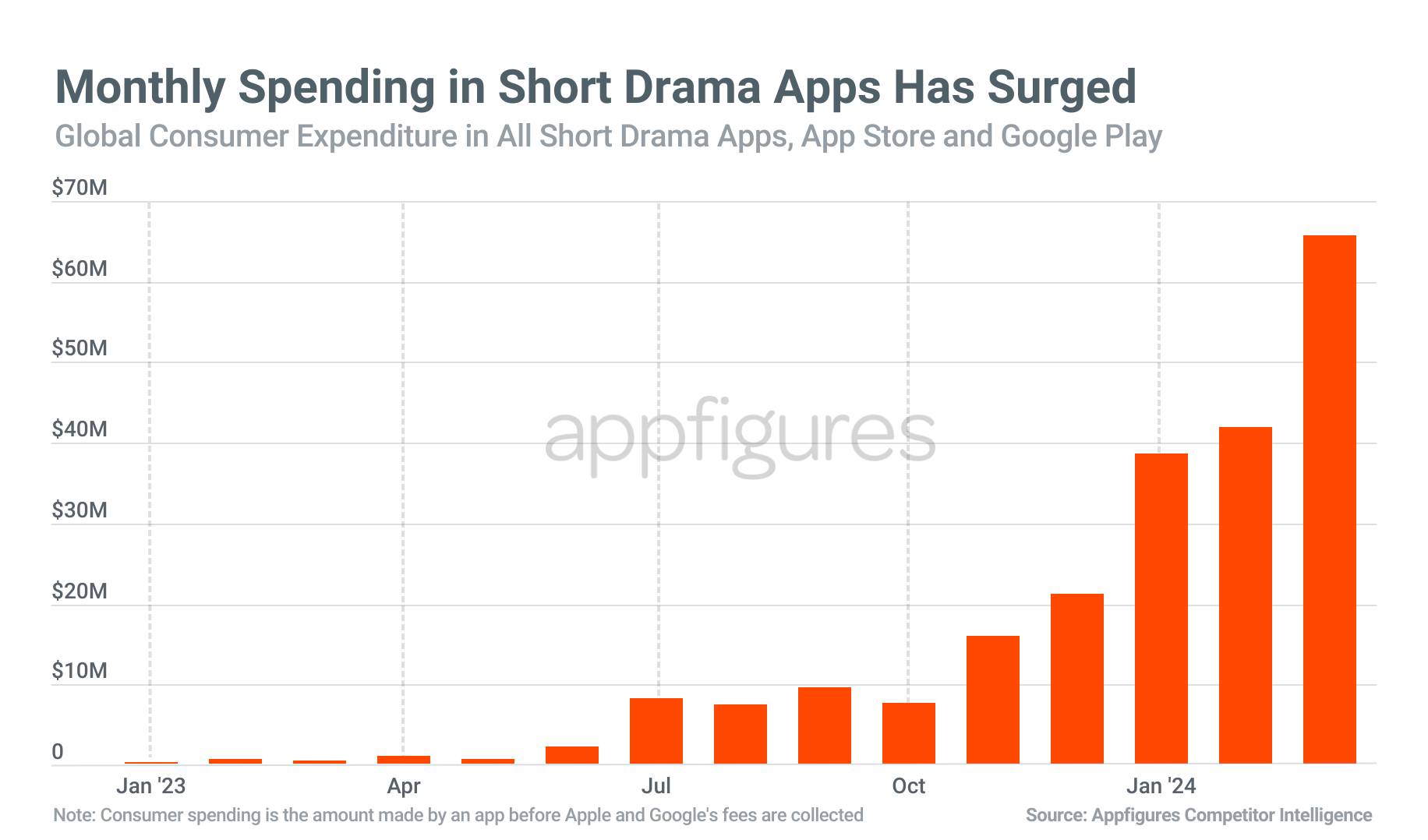

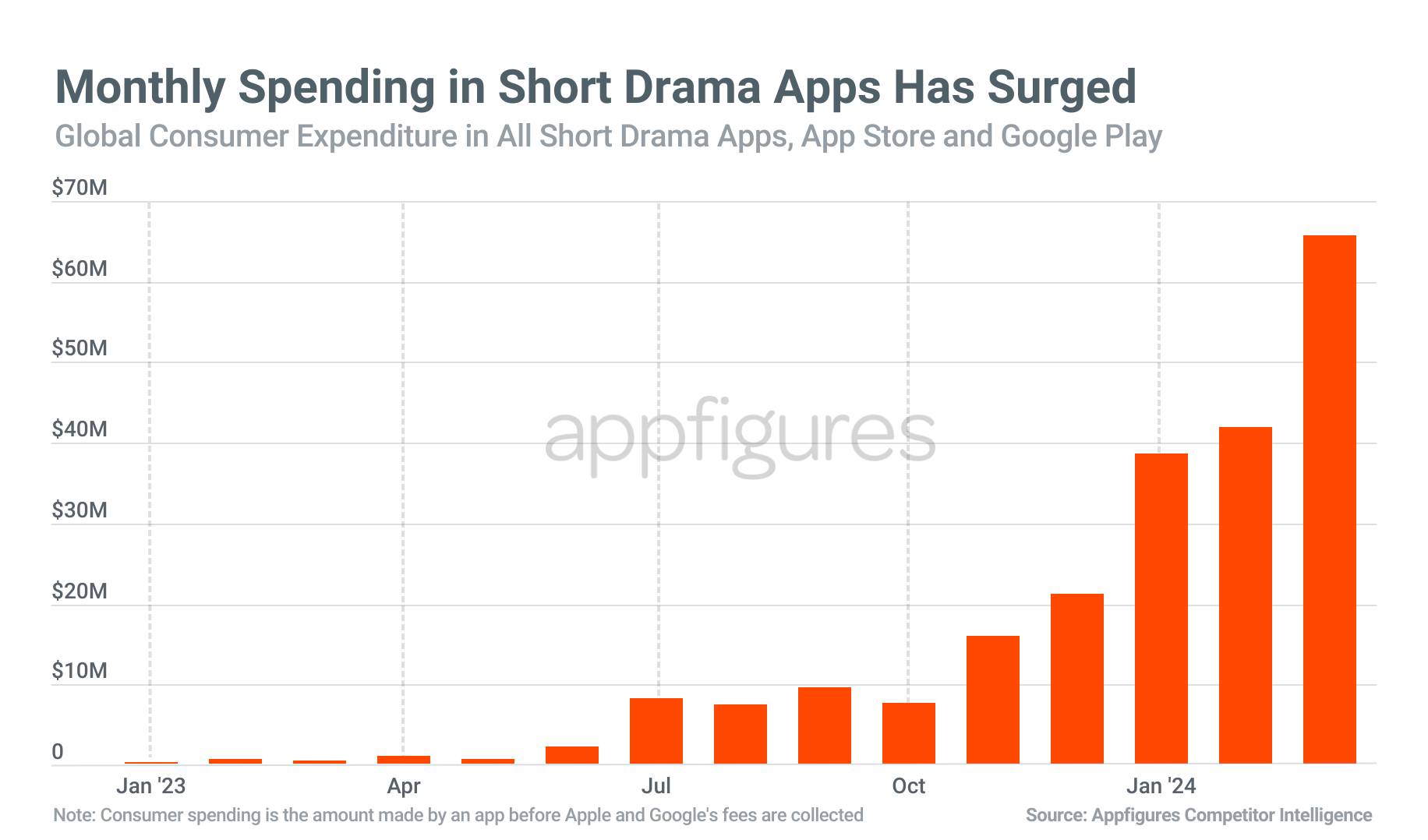

Was Quibi just ahead of its time? Quibi founder Jeffrey Katzenberg finally blamed the COVID-19 pandemic for the failure of his short-form video app, but it may have been too soon. New app store data suggests that the concept made popular by Quibi — original shows cut into short clips, offering quick entertainment — is now making a comeback. In the first quarter of 2024, 66 short drama apps like ReelShort and DramaBox generated a record $146 million in global consumer spending.

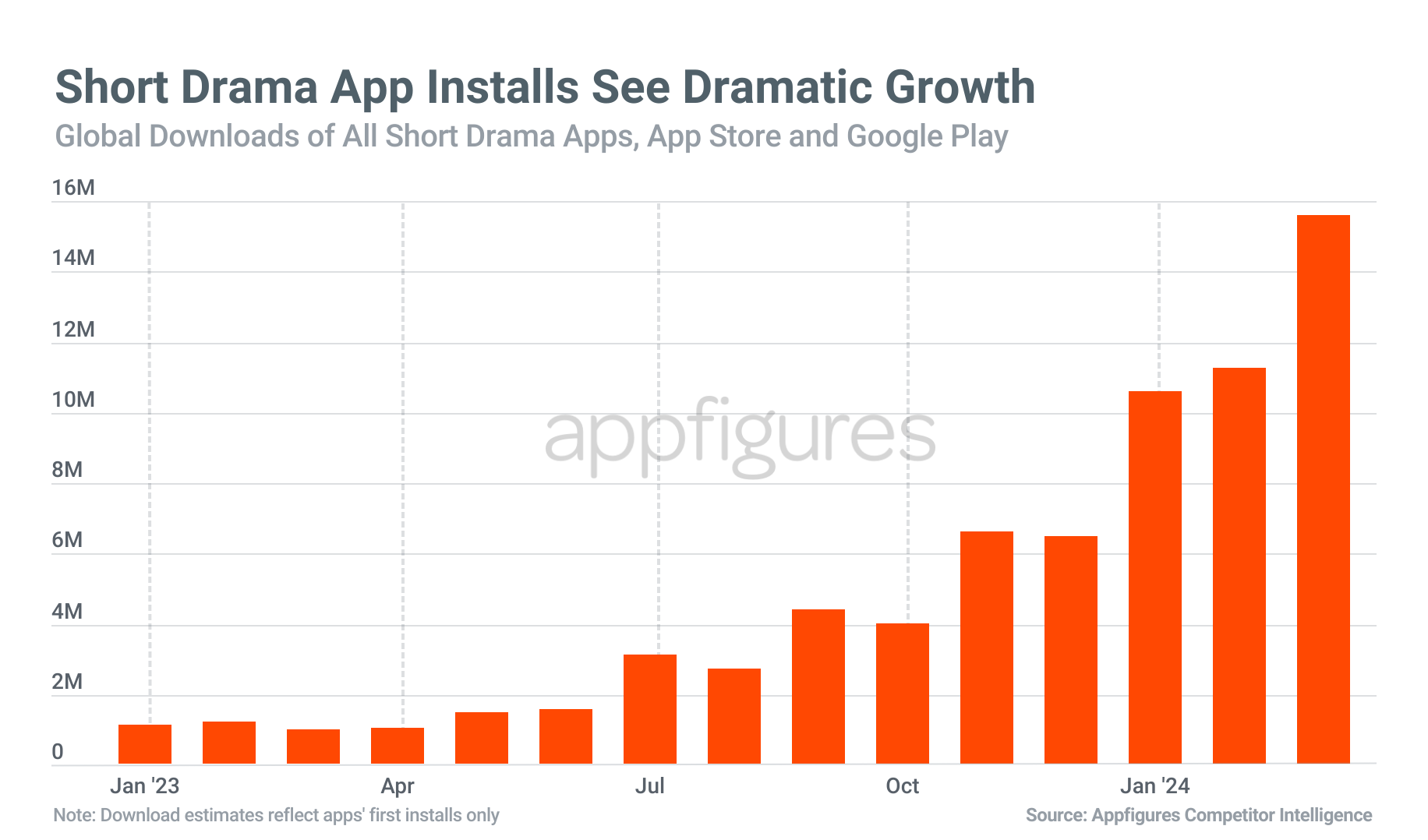

That represents an increase of more than 8,000% from $1.8 million in the first quarter of 2023, when only 21 apps were available, according to data from the app intelligence company Appfigures. Since then, 45 more apps have joined the market, earning approximately $245 million in gross consumer spending and reaching approximately 121 million downloads.

Image Credits: Appfigures

In March 2024 alone, consumers spent $65 million on short drama apps, up 10,500% from the $619,000 spent in March 2023.

It appears that revenue growth began to accelerate in the fall of 2023, per Appfigures data, leading to a huge jump in revenue between February and March of this year, when global revenue rose 56% to $65.7 million, from $42 million. In part, the increase in revenue is of course tied to the greater number of apps available, but marketing, ad spending and consumer interest also played a role.

The top apps by revenue — ReelShort (No. 1) and DramaBox (No. 2) — brought in $52 million and $35 million in Q1 2024, respectively. That’s about 37% and 24% of the revenue generated by the top 10 apps, respectively.

No. 3 app ShortTV earned $17 million worldwide in Q1, or 12% of the total.

What’s interesting about these apps, compared to Quibi’s previous attempt to carve out a niche in this space, is the quality of the content. I mean, it’s a lot, very worse than Quibi’s — and Quibi wasn’t always great. As TechCrunch wrote last year when it described ReelShort, the stories in the app are “like episodes of low-quality soap operas — or like those mobile storytelling games come to life.”

Regardless of the terrible acting and writing, the apps seem to have found a bit of an audience.

Image Credits: Appfigures

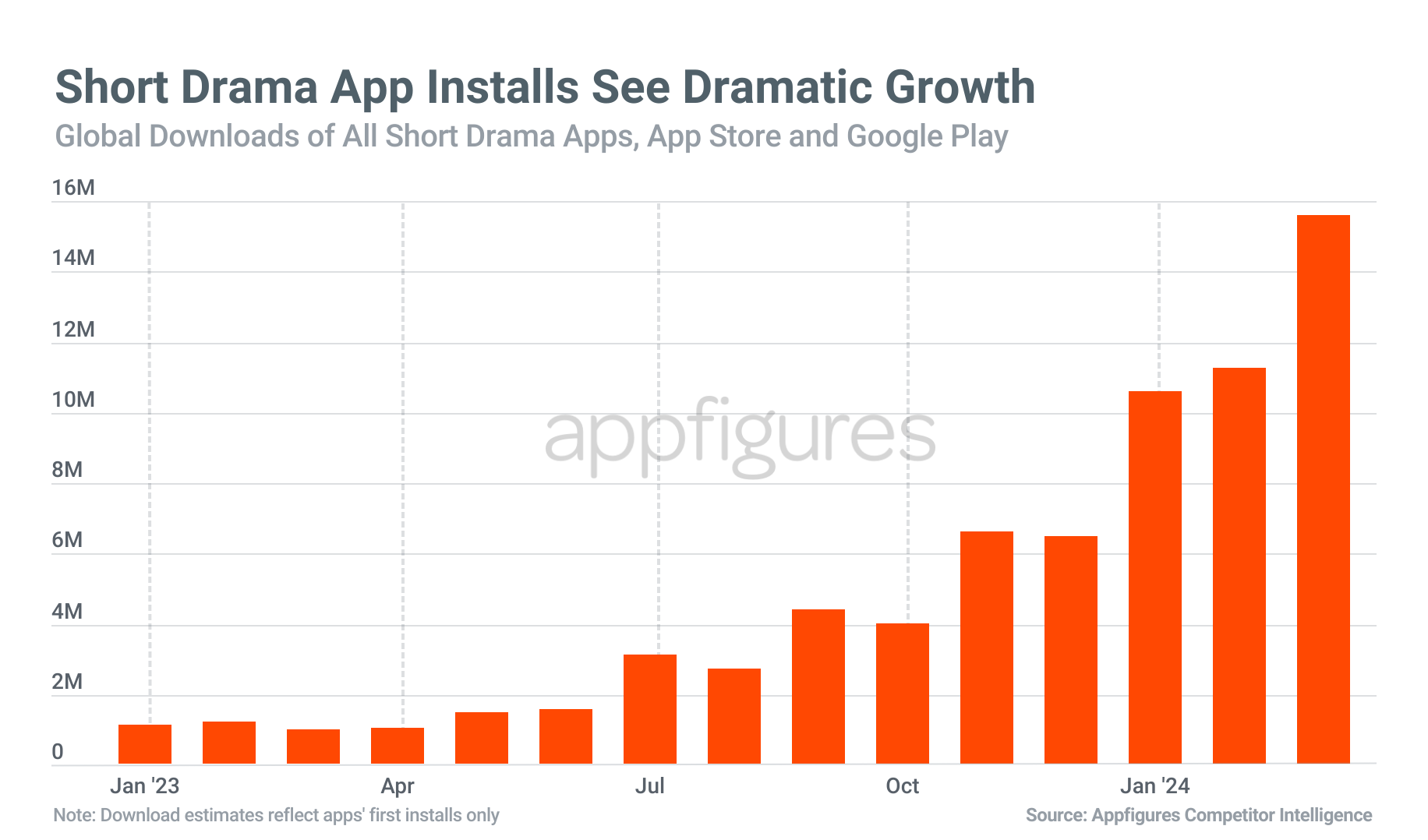

By both installations and revenue, the US is by far the leader in terms of the top markets for this cohort. However, overall, the charts vary in which countries are downloading versus paying for content.

By installations, the top markets after the US are Indonesia, India, the Philippines and Brazil, while the UK, Australia, Canada and the Philippines are the top markets by revenue, beyond the US

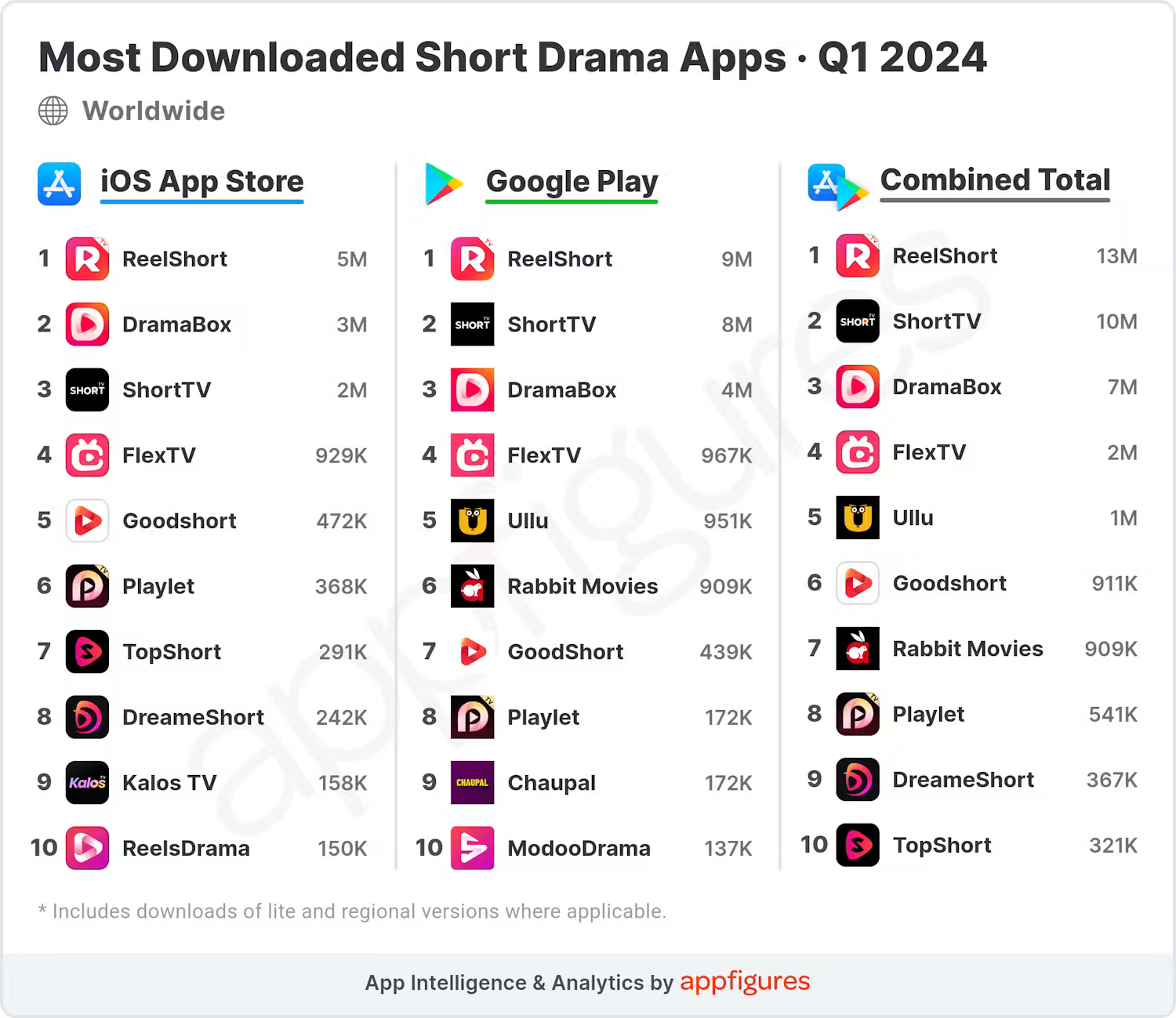

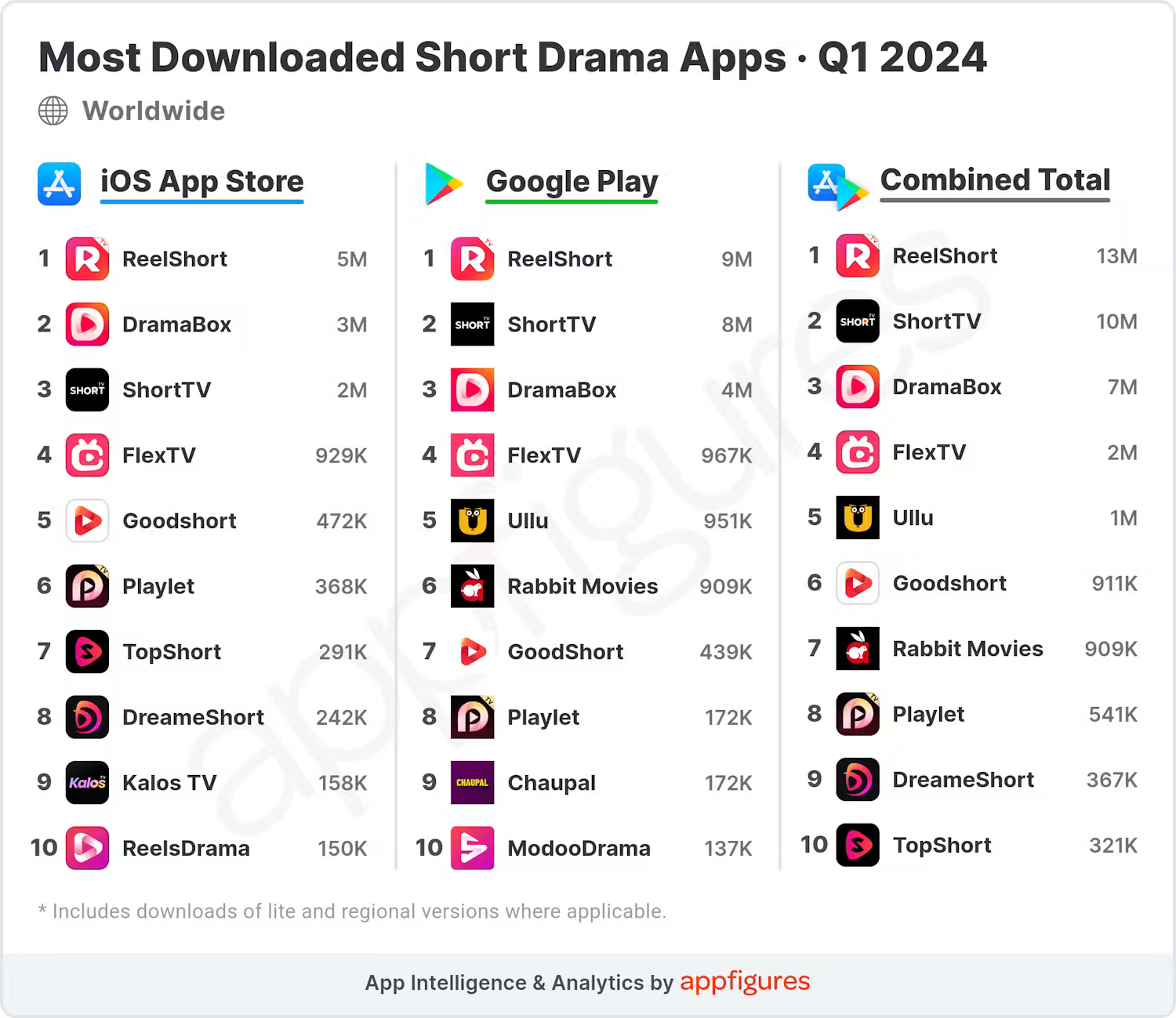

In Q1 2024, short drama apps were installed nearly 37 million times, up 992% from 3.4 million in Q1 2023. By downloads, ReelShort and ShortTV are the top two apps, with the former accounting for 37 % of installations, or 13.3 million. and the latter with 10 million installations, or 27%. DramaBox, No. 2 in consumer spending, was No. 3 in installs with 7 million (19%) downloads.

Image Credits: Appfigures

Reflecting broader app store trends, the majority of revenue (63%) is generated on iOS, while Android accounts for the majority (67%) of downloads.

While there is growth in this market, these apps are seeing nowhere near the traction that their closest competitors — short-form video and streaming video — are doing. Short drama apps claimed a 6.7% share of the total in all three categories combined, up from 0.15% a year ago. But the wider video app market makes a lot more money.

For example, the top 10 apps in the three categories combined, which includes apps like TikTok and Disney+, earned $1.8 billion in the first quarter.

Image Credits: Appfigures

Image Credits: Appfigures