In the startup world, it’s not uncommon to see talent from successful companies go on to found their own ventures. This is particularly evident in fintech in Europe, where unicorn graduates such as Monzo, N26, Revolut and others have launched a storm of new companies.

Andrena Ventures, a UK-based solo GP fund, wants to support this snowball effect in the startup factory by investing in such second-generation startups at the pre-seed and seed stages. To do this, it has raised $12 million from backers, including several VCs and entrepreneurs.

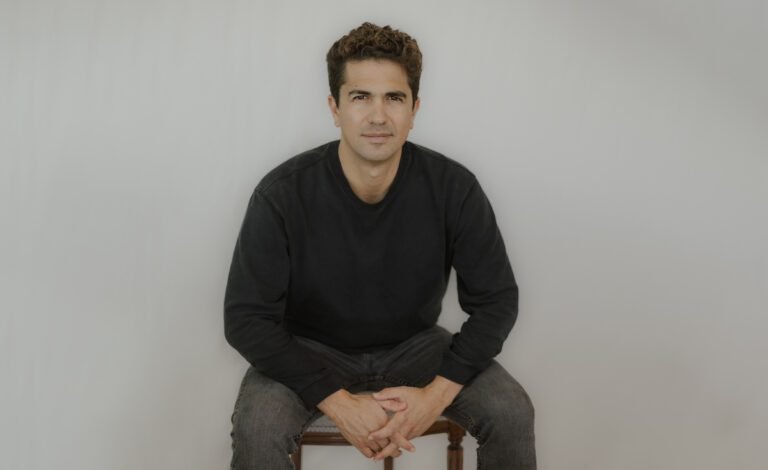

The firm’s general partner, Gideon Valkin, told TechCrunch that while it will fund talent with roots in European and UK fintech, Andrena itself is industry agnostic. He expects most of his portfolio companies to focus on other categories such as artificial intelligence, climate technology and B2B business solutions.

Andrena has already made her first investment: Nustom, an artificial intelligence startup founded by Monzo co-founder Jonas Templestein, who Valkin referred to when he was working at Monzo. Nustom has yet to go public (which explains its brief website), but it already has a long list of investors, including OpenAI, Balaji Srinivasan, Garry Tan, Naval Ravikant and others.

Andrena’s participation in Nustom’s party round reflects the company’s position and strategy: Most often, she will contribute between $100,000 and $400,000 in rounds led by others. But Valkin hopes his network will make it easier for founders to raise Series A rounds, possibly from his limited partners or other investors he’s connected to.

The solo GP approach

By leveraging his network and writing relatively small checks, Valkin hopes to gain access to hot deals that larger funds may be unable or unwilling to participate in.

Having a small capital means that small investments have the potential to return all the invested capital. For a larger company, such investments would not move the needle or be worth the risk. Valkin knows that side of the equation: After leaving Monzo, he became an angel investor himself and began working as an early stage investor at VC firm Entrée Capital, which is now one of Andrena’s limited partners.

But managing an individual fund is not without its challenges, and not just because the management fees are proportionately lower. As my colleague Rebecca Szkutak noted last year, “emerging managers have been on the same roller coaster ride as startups in recent years.”

Valkin says he’s taken a significant pay cut, but he sees that as an advantage: Founders can see him as a trusted partner who’s equally at stake. “I think that aligns us very well,” he said. His value proposition is to open up his network to founders and help them raise their Series A round, while also relying on his operational expertise.

This mix is more common in the US than in Europe, where many local VCs have never started a company. But things are changing and angel investments are increasingly common among European entrepreneurs, especially in fintech.

One of Andrena’s LPs, Taavet+Sten, is an investment vehicle run by Wise co-founder Taavet Hinrikus and Teleport co-founder Sten Tamkivi. Both are ex-Skype employees and have now officially launched an early-stage venture fund, Pluralwith two other partners.

The fact that the couple chose to support Valkin can be seen as a sign of validation for his thesis. With swarms of fintech early adopters looking for the next challenge, the name Valkin chose for his venture is fitting: Andrena is a type of bee, and “pollination, in my mind, is probably the best analogy for what I do,” he said. .