Superlogic, a start that helps consumers a way to implement reward points to experiences, has raised $ 13.7 million in a $ 200 million valuation, the company tells TechCrunch exclusively.

Lin Dai, CEO and co -founder of Miami Based OverseeHe said his company technology is designed to “enhance the value of reward points” giving consumers a wider range of options for how to use them. Its platform is directly linked to existing loyalty programs for credit card companies, airlines and retailers.

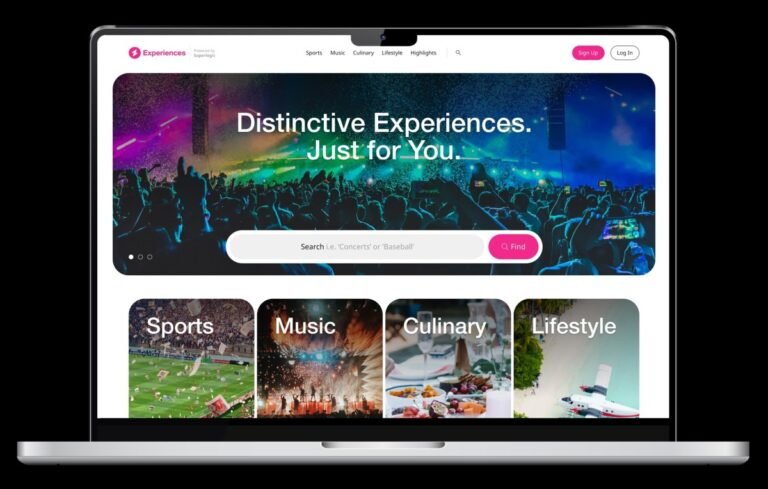

Superlogic brands with chips to help consumers what Dai described as “a list of experiences” that consumers can choose from instead of traditional rewards based on points such as staying in the hotel or commercial flight. Examples include NBA Finals tickets, “exclusively” tickets to music festivals, a backstage examining a broadway or private food with top chefs

Because its offer is a white label, you will not necessarily know that you are using Superlogic technology when redeeming rewards through companies such as American Express, Mastercard, Visa and Warner Music. The platform also manages the experience of experience, negotiate with providers and handles payments on behalf of the trademarks with which it works.

While Dai refused to reveal the harsh revenue, he said the company had revenue “eight-plus” revenue in 2024 and saw “significant growth on a yearly basis”.

Many people do not realize that unused rewards/points can be considered responsibility for a credit card company.

When a consumer earns points back in a market, this money is technically owned by the consumer, Dai explains.

“So it’s money that the credit card company, for example, owes the consumer,” he said. “For every 100 points, there are about $ 1 that the reward company had to put aside to support this debt to its own customers … and say if a brand Fortune 500 is bankrupt. These points must really be paid to consumer ”.

In other words, it is in the interest of a company to have consumers to count in these points.

Superlogic earns money by taking what Dai described as a “small margin percentage” in his transactions when a consumer was forced to have an experience that has helped to facilitate.

“There are unknown points worth 25 billion dollars sitting in user accounts and balance sheets of credit card programs,” he told TechCrunch. “Our tam is very high.”

Powerledger drove the round, which was structured as safe. Sangha Capital, 10 -year -old, Nima Capital, Actai Unicorn Fund, Hyla Liquid Venture Fund and Liquid 2 Ventures also participated. Previous investors include Amex Ventures, Warner Music, Galaxy Interactive, Mirabaud Lifestyle Impact and innovation, capital recharge, capital dispersion and Sanctor Capital, among others. The capital infusion brings Superlogic’s total funding of more than $ 21 million since its start in 2017.

Jemma Green, Powerledger’s executive president, told TechCrunch that her business invested in Superlogic because she helps brands to avoid “excessively” sponsorship fees and “sign thousands their”.

He added: “This ability to get strongly involved consumers at minimal cost and complexity is really a game change player.”

Currently, Superlogic has only 40 employees.

The company plans to use the new capital to launch with about half a dozen programs this year – increasing staff, businesses and product capabilities, Dai said, “to support the expected new volume”.

Do you want more new Fintech in your inbox? Sign up to TechCrunch FinTech here.

Do you want to reach a tip? Email me to maryann@techcrunch.com or send me a message on the signal at 408.204.3036. You can also send a note to the entire TechCrunch crew to tips@techcrunch.com. For safer communications, Click here to contact uswhich includes securedrop and links to encrypted messages.