Mixing finances can be a daunting endeavor for people who have decided to share their lives with each other. With people getting married later in life, that often means moving in with someone before any marriage — if ever.

That was the dilemma Michelle Winterfield faced when she moved in with her partner a few years before getting married. They had all the usual conversations: opening a joint account and having joint credit cards.

“It’s hard to build a life as a single couple,” Winterfield told TechCrunch. “And with couples getting married later in life, there’s a reluctance to combine finances, but they still want to have the benefits of it.”

When Winterfield, who was a private equity investor on Wall Street, couldn’t find an app that focused on what she called “the modern couple,” she and co-founder Daniel Couvreur, a former investment banker, set out to build one. years ago.

Their result is Tandem, a fintech app that addresses early financial milestones for couples and grows with the relationship through planning, saving and spending features. The subscription-based app launched in August 2023.

“We’re both tired of using Venmo to split rent, groceries, and many other expenses with our significant others, and didn’t see an objection to a joint debit card/account — who wants to give up credit card points/cash back and with the pain of opening a joint account + combining finances?’ Couvreur wrote in a LinkedIn post two years ago.

Row group, from left, Michelle Winterfield, Matthew Dennis, Daniel Couvreur and Emily Brent. Image Credits: Tandem

How does it work

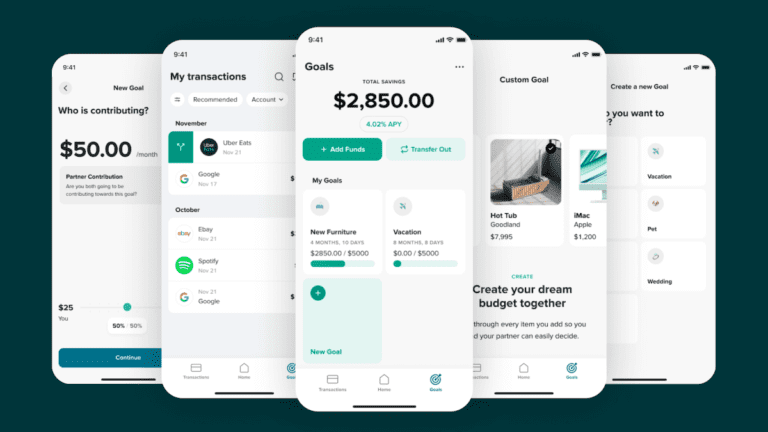

Users are set up on Tandem in minutes. One person joins and invites their partner. Both link their credit and/or debit card. Tandem pulls the trades, however, so each partner only sees what the other wants to see, Winterfield said.

Couples can set up automatic money transfers into a shared pot and set it towards certain expenses, for example, rent or Netflix. More than 25,000 couples currently use Tandem, which has managed $60 million in expenses so far.

“It gives you the experience of a joint account without actually having to have one,” Winterfield said. “Everything you want to share is in one space, so it eliminates the back and forth. You can also settle any balances whenever you’re ready.”

Investors are also interested in the idea, recently pumping $3.7 million into Tandem. Corazon Capital led the round and was joined by a group of individual investors and executives from companies including OkCupid, Match Group and Tinder.

“Rarely have I seen consumers love a product so much, highlighting the need for innovative solutions for the modern couple,” said Sam Yagan, co-founder and CEO of Corazon Capital, via email. “As a relationship expert, I’ve long believed in the need for a product to help couples meet the unique challenges of managing their finances. Tandem stands out as a platform of reliability, trust and modernity and helps new and existing relationships thrive financially and emotionally.”

Relationship Goals

Tandem is not alone in facing this problem. We’ve previously reported on companies that tailor financial services to couples, including Plenty, Honeydue, Zeta, Ivella, and Ensemble, which targets co-parenting divorcees.

Many of Tandem’s competitors focus on providing a debit card to share expenses, which Winterfield said can be a big step for people just starting out in their financial lives.

“We really wanted to build it with the consumer in mind as opposed to just offering banking products,” he said. “We also wanted to create a much more automated experience that really solves that pain point first for our core demographic.”

Tandem Crowdsources its potential from its user base, and the majority of users have inspired the next set of features called “Goals,” which will be released this week. The Goals feature is based on starting a plan for shared purchases that both members of the couple will work on.

For example, you set a goal together — buying new furniture — and choose how much each will contribute to that goal each month. Each person can then pull up websites or apps to get various products to add to your goals so everyone is on the same page and no one feels like they’re doing it alone.

The new capital will go towards the launch of this new feature, marketing and team development. Additionally, an Android app is coming soon.

Initially, Tandem launched with a choose-your-own-price model. With the new feature now here, the platform will launch with $10 per pair, per month annual pricing or $12 per pair, monthly payment per month.

“We want to create something that integrates very seamlessly, allows you to share everything in a very automated way without having to take that next step and sign up for a joint card together,” Winterfield said. “Tandem allows you to maintain that independence while building a life together.”