The United States Commerce Department on Monday proposed investing up to $6.6 billion to finance a third Taiwan Semiconductor Manufacturing Company Limited (TSMC) plant in Arizona. The funding will come through the CHIPS and Science Act, in an effort to promote more domestic semiconductor production.

The move represents a broader push to bring more manufacturing to the US, but unspoken in the fanfare surrounding today’s announcement is the potential escalation of tensions with China.

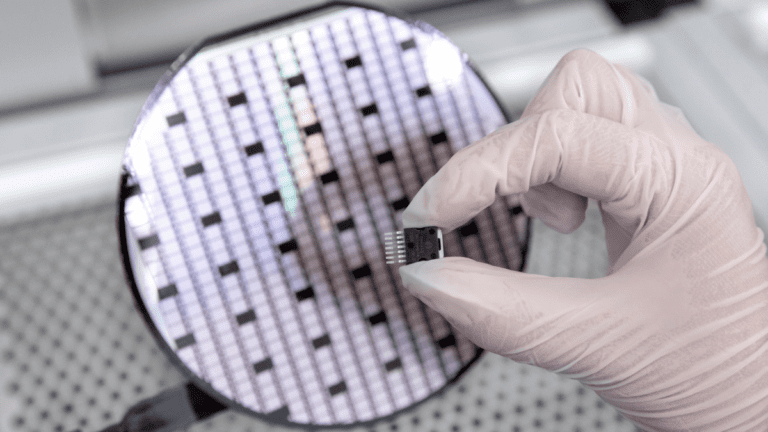

The proposed plant is a greenfield facility — meaning it is custom built from the ground up. It would focus on 2nm (“or later”) architectures, designed for a range of different applications, including computing, 5G/6G wireless communications and, of course, artificial intelligence. TSMC Arizona — the subsidiary behind the proposed facility — has said it will build the facility before the end of the decade.

The chipmaker says the construction will bring more than 20,000 jobs to the region, while it anticipates around 6,000 manufacturing roles once the facility is up and running.

Local manufacturing has been a key focus for the Biden administration as the COVID-19 pandemic has highlighted vulnerabilities in the global supply chain. These issues have been exacerbated by the ubiquity of silicon in our daily lives. These numbers are only increasing. According a semiconductor trade associationglobal sales reached $47.6 billion in January 2024 — an increase of more than 15% over the previous year.

“TSMC’s renewed commitment to the United States and its investment in Arizona represent a broader story for semiconductor manufacturing that is made in America and with the strong support of America’s leading technology companies to build the products we rely on every day,” said President Biden. an announcement linked to the news.

Much of the administration’s funding has focused on U.S. companies such as Intel, which had its own $8.5 billion offering in late March. TSMC, however, is an 800-pound gorilla, both in market share and technological advancements. The company, however, found itself in the middle of looming geopolitical concerns. The United States and allies will be at a huge disadvantage if China seizes control of Taiwan and its manufacturing capabilities.

TSMC has its own concerns about such a scenario. First, the company’s two biggest customers – Apple and Nvidia – are American. For another, some in the US have gone so far as to suggest the country’s chipmakers bomb if such things happen.

“We should make it very clear to the Chinese, if you invade Taiwan, we will blow up TSMC,” Massachusetts Rep. Seth Moulton said at an event in May.

The Democratic representative has since distanced himself from the clip, stating that it was selective processing by the Chinese Communist Party. However, he is hardly alone in making such suggestions. Earlier that year, Trump’s former national security adviser, Robert O’Brien, said: “The United States and its allies are never going to let these factories fall into the hands of China.” suggesting the destruction of the country the factories. O’Brien went so far as to compare such hypothetical actions to Britain’s actions during the Second World War.

Such sabre-rattling has drawn international criticism. Beyond the obvious moral questions, such an evasive action would have a huge impact on the global economy. In addition to Apple and Nvidia, TSMC also serves Sony, MediaTek, AMD, Qualcomm and Broadcom, among others.

For all the money the United States government continues to invest, Intel is simply matching TSMC’s years of technological leadership. TSMC produces about 90% of the world’s most advanced chips. For now, the best defense the U.S. has against future disruptions — be they pandemics or geopolitical conflicts — is supply diversification. This applies to where and by whom the components are manufactured.

While the architects of the CHIPS and SCIENCE Act would no doubt like to elevate American companies that manufacture domestically, ours is a global economy. TSMC certainly knows the value of supply chain distribution.

“The proposed funding from the CHIPS and Science Act will give TSMC the opportunity to make this unprecedented investment and offer our foundry service with the most advanced manufacturing technologies in the United States,” said the chip giant’s president, Mark Liu , in an announcement related to the news. “Our US operations allow us to better support our US customers, which include several of the world’s leading technology companies. Our US operations will also expand our ability to monitor future developments in semiconductor technology.”

Among those watching US-China relations, the upcoming presidential election could be a key turning point. Former President Trump dramatically escalated trade tensions, for one. The addition of Huawei to the entity list marked a huge setback for the carrier, as it lost access to key assets from US companies such as Google and Qualcomm.

Speaking last yearBiden’s former US Director of National Intelligence, Avril Haines, noted that if a US invasion stopped Taiwan-based TSMC’s product, “it would have a huge global economic impact that I think is somewhere between $600 billion to $1 trillion annually base. the early years”.