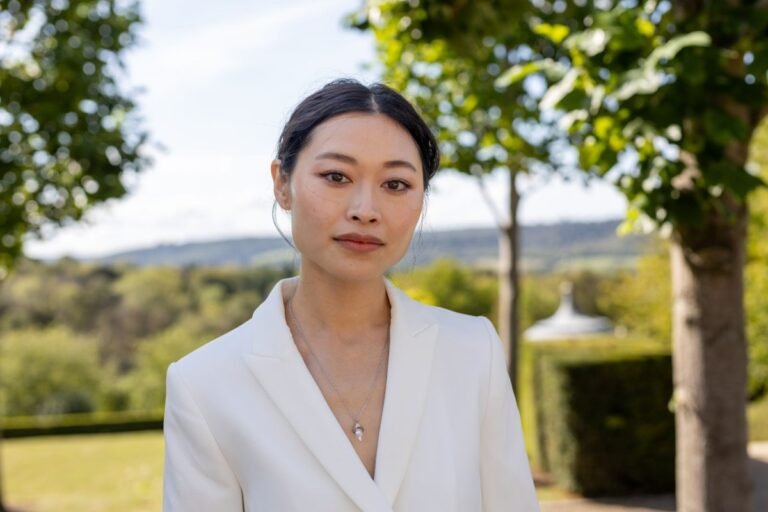

Lily Vittayaruksku was studying aerospace engineering when her aunt was diagnosed with colon terminal cancer. Her aunt had lived under the same roof as Vittayaruksku while she grew up and helped increase her. “We all went to care,” she recalled.

Post-Memotherapy, Vittayaruksku’s aunt “became very weak”, so her family-in-law from Cambodia-was about two and a half years of her daily long-term needs. “It has been financially off,” he told TechCrunch.

The emotional and economic impact was so traumatic that it prompted Vittayaruksku to rotate her studies in genetics and data science.

Finally, he founded Water lillerA four -year -old San Francisco start with the aim of helping individuals and consultants navigating long -term care choices by modeling costs and funding strategies. His goal, according to Vittayaruksku, is to facilitate financial advisers and insurance agents “to recommend the right financial products based on the predicted needs of a family.”

Vittayaruksku explained, “Usually people start to think about long -term care when they are between 65 and 70 years of age, or just when they need it.” But in many cases, this can be too late.

Waterlily uses artificial intelligence to predict future needs and costs of a family’s family and then guide them “to build a care plan and calculate the right way to pay for it,” Vittayaruksku told Techcrunch. “This may mean the purchase of life insurance with a long -term rider, buying a special LTC policy, use of revenue or simply self -financing.”

Waterlily’s predictor AI can be used for any person over 40 years.

The company pulls out of over 500 million data points and mechanical learning algorithms using AI modeling software in an attempt to “make very personalized care and cost predictions” and to predict “when”, “how” and “how” one’s potential Long -term care needs.

“We have official data exchange agreements with long-term care providers, government databases, academic research studies and individual users”-these include Medicare & Medicaid Services Centers and the Federal Long-Term Insurance Program-and completing similar contracts with Safety their anonymous data, “Vittayaruksku said.

Vittayaruksku initially began to be inflated as a solo founder until Evan Ehrenberg, a small angel investor, came. Ehrenberg – who had founded in the past and sell Clara Health – helped with early research and was hit by industry response. Curious, he examined himself the platform and was overwhelmed by his long-term care predictions-so much to change his diet, hire a personal trainer and informed his financial plans.

This experience pulled him deeper. He saw parallels between long -term care and issues he faced in clinical trials. Clara Health had helped tens of thousands of patients find tests, but also saw how many turned to them not for cutting -edge treatments, but for general copies of existing drugs, because insurance would not cover the drugs needed to need the name they needed. Long-term care has brought similar awareness-health insurance does not cover it and many are unprepared for financial burden, Vittayaruksku noted.

“After six months of cooperation, we knew it was a great application and made it a co -founder,” he said.

Ehrenberg’s backstory is interesting: After graduating from UC Berkeley at 16, he became MIT Ph.D.’s newest neuroscience. Today, it also serves as a header of Waterlily.

Stands in a complex space

There are other tools that help in long -term design, but Vittayaruksku believes they are different from Waterlily’s most personalized offer. The Genworth Care Cost Computer, for example, shows the average code terms. Naviplan, Emoney, MoneyGuidePro and RightCapital are wider platforms of economic designs that include basic long -term care units or cost computers as one of their multiple functions.

According to her, “while these tools help consultants who contribute to retirement and insurance scenarios, their LTC assumptions are usually guided by national average or monte carlo simulations in order to define financial planning by introducing noise into a basic default simulation ”. Waterlily, on the other hand, “combines deep predictor modeling with an easy -to -use platform.”

Waterlily only started its platform publicly in March 2024, so it still has no measurements on an annual basis, but Vittayaruksku told TechCrunch that the monthly repetitive start -up revenue (MRR) is greater than 22 times what was after the first month in the first month market. And, he said, the average increase in MRR of the month since the month from its release was 58%.

The company currently has eight “big” business customers, including prudential and “many other Fortune 100 insurance bodies”. There are also hundreds of independent financial advisers and insurance agents using water, according to Vittayaruksku. Its revenue model is based on SAAS, with the company charging $ 250 per consultant or seat agent per month.

And now the start has raised $ 7 million in seed funding. John Kim, a founding associate of Brewer Lane Ventures, with strategic investments by Genworth, Nationwide and Edward Jones. The launch has previously set a $ 2.2 million pre-service round of investors, such as Scott Barclay, Healthcare’s chief executive at Insight Partners.

Waterlily plans to use its new chapter, which has increased through safe, to create data and business science groups, as well as to continue to strengthen AI models and corporate data. It also plans to increase sales and marketing efforts.

Currently, the start has 9 full -time employees except the contractors.

Looking forward, disability, critical illness, hospital compensation and Medicare design or “really any area where advanced predictive modeling would help families make better decisions about life and health.” .

The company says it also receives interest from insurance carriers who want to use its data on the underwriting. It may also be expanded internationally to Canada, the United Kingdom and to parts of Asia.

Investor Kim, who is also a former New York Life president, told TechCrunch that he has put money on waterlily because he believes he is “the first AI guidance tool to help the only greater need as Americans”.

He added: “LTC Insurance is a great and increasing need and to a large extent inadequate by reliable advisers today. Waterlily’s guidance tool has no comparable offer. It provides a customized and personalized recommendation for one’s LTC needs. I believe it will be a player Change of Games for Ltc Insurance Market.