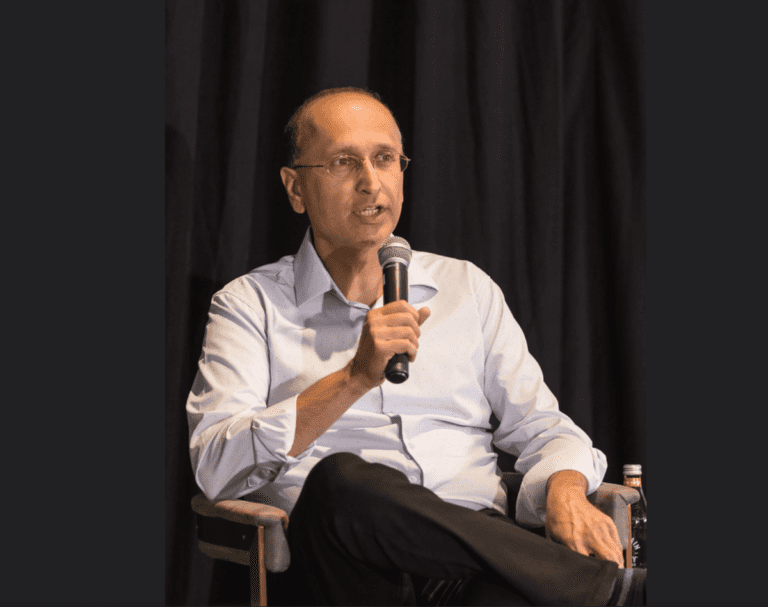

Navin Chaddha, Managing Director of Silicon Valley’s 55 -year -old business company MayfieldIt bets great for AI’s ability to turn heavy people industries such as consultation, law and accounting. Veteran investor, whose wins include Lyft, Poshmark and Hashicorp, were recently discussed at TechCrunch’s Strictlyvc evening at Menlo Park Why does he believe that “AI teammates” can create scope that looks like software in traditional labor tension areas and why newly established businesses should now target neglected markets instead of competing with the heads with giants such as Accenture-and acknowledged that the disturbance is where the disorder is where the disorder is and the disturbances are On the contrary. This conversation has been slightly elaborated for length and clarity.

You believe that law firms, counseling companies and accounting services-a collectively a $ 5 trillion market-will be completely redefined by the AI-FIRST companies that operate with software-like margins. Prove it. What have you seen beyond PowerPoint presentations?

I think one advantage of a business that has been active for over 50 years is that it has seen all the trends, from mainframe to minicomputers on computers, internet, mobile, cloud, social and now AI. The example I would give in the late 1990s, this concept of e -business came, which was: If I am a natural business, I cannot survive if I am just brick and mortar. I have to be click and mortar. The external assignment then became a trend and offshoring became a great trend. You could not create a software services company without presence in India or one of the emerging markets. The same thing happened with supply chains and construction – China and Taiwan Rose. So what is this new era with AI? Clearly, AI is a 100x force, and AI works with people, we hope they will improve them. And I think it is, and is going to help review businesses.

Many of the repetitive tasks are to be done by AI … and there will be two models. One is that you grow organically. The second is that you grow up inorganic …

Can you give a specific example of how will this work?

What are the kinds of things a llm or ai can do? Well, let’s say I have to apply salesforce. Who wants to go to do this project? The man will come and say, “I am your customer manager. You must apply salesforce.” They are the same set of things. Use AI as the horse to do it and whatever AI cannot do, have the man in the loop.

Now, suddenly, if you start doing these things, you can have less work than man and more work than AI, and [customers] Pay only for AI when [they] Use it.

And the market [entry] should not be to follow [big consulting and IT companies] Such as Accenture, Infosys or TCS. Go after the neglected masses. There are 30 million small companies in the US and 100 million worldwide that cannot be provided with knowledge workers. Provide services as software. They say, “I need a receptionist. I need a developer. I need someone to build my site …” AI has to get used to [create] Start -funding forms, with some people [involvement] for negotiation. You are not competing with the pronunciation of the world. Go after fragmented purchases, where instead of charging per hour, instead of charging per month for a contractor, you charge per incident.

Thus, the results based on the results and not the time -based charge.

This is based on the results, yes … the cloud charge is like that. Electricity is like that … If 80% of the work will be done by AI, it may have a gross margin of 80% to 90%. People can still have a 30% to 40% margin. You could combine margins of 60% to 70% and produce net income of 20% to 30%. And believe me, most service companies make money. Technology companies do not. They live with business moves and then public market money.

You have just driven the order A for a company called Gruve a few weeks ago. It’s a start of AI Tech Consulting. What did you see in the customer’s first pilots?

I think this is where the combination of inorganic and organic happens. [Gruve was founded by] very successful founders who had made two service companies before [and] Bootstrapped, and got them in $ 500 million in revenue each, and $ 50 to $ 100 million in profits. They started this time and said, “What do we know? We know security.” So they acquired a $ 5 million security consulting firm [that offers managed security services]. And they said, “Let’s look at people. All growth from this point will happen through AI.” And they grew up from that [$5 million in revenue] in $ 15 [million in revenue] in six months. They literally have a mixed margin of 80%. It is based on results. Customers adore it. Cisco loves it. They say, “Hi, I don’t get hacker. Why do I pay for all these security people?” If you assign, [a vendor has traditionally charged] $ 10,000 per month. [Gruve] says, “[You pay us] zero. If you get hacked, if there is an event, if I look at it, then you pay me. ”

Can’t companies like McKinsey buy these AI capabilities? They have big businesses that do not want to lose.

Yes, I think what is going to happen is what comes the dilemma of the innovative. [the model] because [SaaS companies] Billing companies monthly instead of five years in advance. Business companies also gathered a 20%maintenance fee. It was hard [for them] To get off this medicine and say, “Oh, I’ll charge you every month.” The innovation of the business model was the main thing. They didn’t. So McKinsey and Accenture, with so much dislocation, will be busy with their customer service [which is why I advise founders to] Go after the neglected masses. Understand a unique strategy for buying and serving someone [an Accenture] I can’t get off the market to serve.

But they are going to be redefined as well. Thus, these small companies, who do not compete with them today, mark my words: in 10 years, they will compete with them. And these big companies – McKinsey, BCG, Accenture, TCS, Infosys – all have the dilemma of innovative [and are asking themselves]: When do I do it? [When do I switch to an outcome-based AI model?] Because as a public company, my revenue is to be reduced by predictable revenue in utility revenue.

You have characterized $ 100 million Recently raised funds to devote last autumn to “AI teammates”. What makes a true AI teammate against an AI tool?

There are many keywords in the industry. First they were copilots, then ai tools, ai agents, AI teammates. Thus, the Mayfield thesis is that an AI teammate is a digital companion who works with a human being on common goals and gets better results. The technology that can be based could be technologies or copilots. His event is: “I am a HR teammate. I am a sales teammate.” The goal is not to be replaced. The goal is to cooperate and work together.

When people started talking about teammates and assistants, it was a novel, but I wonder if it looks tough as more people lose their job. Silicon Valley has a marketing problem?

Absolutely right and I think we should not cover it. We have to deal with it … Yes, there will be job shifts, but people are smart. It’s the rider. The horse here is AI. We will repeat ourselves. We will discover ourselves. Today, we are focusing on cutting the cost, but we will understand how to expand our markets, how to increase revenue. This is the case with any technological wave that comes. When Microsoft Word came to computer surface computers, people thought [executive assistants] was out of service. Then came the Excel and the accountants who made calculations – everyone thought it was out of order. We saw the same as Uber and Lyft. People believed that taxi drivers would go away. But what happened? Markets were expanded.

My dissertation is the way emerging markets such as India, China and Africa have never been constant – you could not dig copper, so they went wirelessly, cellular – this will happen with many markets. AI will do the project where people are not even available to serve this customer. So, in the long run, I’m very, very inflated. In the short term, there will be pain, but there is no pain, no profit.

Speaking of coding, recently announced “The deal codified by Vibe focused on an Israeli company 6 months old that just reached 250,000 users a month and $ 200,000 in monthly revenue.

In fact, these days, no mathematician makes sense. We are in the AI era. You don’t know what will happen. I’m surprised that with $ 2.4 million [annual recurring] Revenue that only sold for $ 80 million. I thought it would be $ 800 million, right? [Laughs.] In today’s world, you don’t know. It’s a market.

How do you invest in this market?

There the secret recipe comes from people who are proven investors. Have broken the code. It’s not a science. It’s art. It’s like the 10,000 hours [rule]: The more you exercise this, the better you get. And businesses that have passed for 50 or 60 years – we have seen all kinds of bubbles.

The number one rule is, you have your own North Star. You have discipline and you have no fomo because fomo is for the sheep. And if you have these two or three things, your own strategy and without fear, [you’ll do well]. Just remember one thing: For people [in this audience] Who are VCS, we are in the money management business. We are not for collecting logo. We are to get small sums of money and make them bigger.

During this part [of the cycle]a lot of money will be made. But I think 80% of people will lose money. They don’t know what they are doing.