Welcome back to TechCrunch Mobility – your central hub for news and information about the future of transportation. To get it in your inbox, sign up here for free — just click TechCrunch Mobility!

Senior Journalist Sean O’Kane went to palo alto to check out Rivian’s Autonomy & AI Daywhich some insiders told us would be the company’s most important event. I’m not sure I’d categorize it as such, but how about I let the reporter on the ground give his assessment?

Via Sean (and some of my thoughts sprinkled in) after the event…

It was easy to get lost for words at times during Rivian’s ‘Autonomy & AI Day’ this week. But there was a clear underlying message he shared: Rivian is trying to build a company that is about more than just selling cars.

Not up to Tesla. For example, there were no humanoid robots roaming the company’s Palo Alto campus.

But it’s clearly creating other revenue-generating products — and advanced driver assistance is in the starting gates.

The hands-free version of Rivian’s driver-assistance software – currently usable on about 135,000 road miles – will be extended to 3.5 million miles and include surface roads. This expanded feature, which will roll out in early 2026 and eventually include hands-free (but careful) point-to-point automated driving, costs $2,500, or $49.99 per month.

Techcrunch event

San Francisco

|

13-15 October 2026

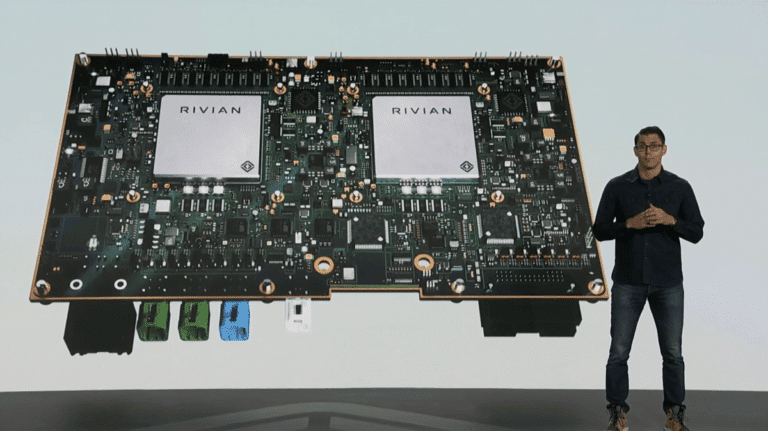

Then there’s his futuristic eye-disabling system. Rivian has revealed that it has developed its own custom 5nm processor, which it says will be built in collaboration with both Arm and TSMC. That chip will power Rivian’s “range computer” — the backbone of an upgraded automated driving system — that will debut in the R2 SUV in late 2026.

That will likely be an additional charge, though Rivian didn’t say if it would be more than the $2,500 fee.

But there’s another scenario we should also consider: licensing its technology to others.

Besides, Rivian already has a joint venture with the Volkswagen Group to share its electrical architecture and core software. And Rivian created two startups this year with Also (mobility) and Mind Robotics (industrial artificial intelligence and robotics).

Barclays’ Dan Levy wrote on Friday that “subsequent discussions reiterated hopes/possibilities” for Rivian to license its entire AV platform or just components like the customs processor. And when I asked CEO RJ Scaringe if Rivian will sell the processor to Mind Robotics, he quipped, “It doesn’t take much imagination.”

At the most abstract level, it makes sense to put new revenue streams into the existing auto industry (especially if those new projects play nice with cars). Who doesn’t love more money?

Here is the coverage of the event:

Rivian builds its own AI assistant (deep dive into technology). And it comes to its electrics at the beginning of 2026.

Rivian moves to long range with custom silicon, lidar and a hint of robotics

A little bird

Nothing this week — or should I say, thanks for the tips, everyone, but I can’t share anything yet.

In the meantime, here’s a tidbit to keep you going. As you read above, senior reporter Sean O’Kane was on Rivian‘small AI & Autonomy Day and one of the whispers he heard was about the company’s public demonstration of its AI assistant and concerns that it might not work. Apparently, the tests on the morning of the event were a bit touchy.

Unfortunately, the public demo went fine after a tense moment at the beginning. The risks are high for public demonstrations, which is why many companies avoid them. Kudos to Rivian for doing it.

Do you have a tip for us? Email Kirsten Korosec at kirsten.korosec@techcrunch.com or my Signal at kkorosec.07 or email Sean O’Kane at sean.okane@techcrunch.com.

Offers!

In early 2025, I didn’t think TechCrunch would be publishing an airline-startup-meets-datacenter story. But here we are.

Aircraft launch Boom Supersonic began in 2025 by breaking the sound barrier with the XB-1 civilian demonstrator aircraft. And it ends the year with a plan to sell a version of its turbo engine as a static power plant. Its first customer will be the data center startup Crusos.

Under the deal, Crusoe will buy 29 of Boom’s 42 megawatt turbines for $1.25 billion to generate 1.21 gigawatts for its data centers.

Boom raised $300 million to help commercialize this new business. The round was led by Darsana Capital Partners with participation from Altimeter Capital, Ark Invest, Bessemer Venture Partners, Robinhood Ventures and Y Combinator.

The plan is to use money from the Superpower fixed turbine business to fund the development of its supersonic aircraft.

Other offers that caught my eye…

Self-driving truck company Aurora Innovation did a commercial agreement with Detmar Logistics transporting autonomous sand dam in the Permian Basin.

Some deals don’t always work or change. Take SK On and Passagefor example.

four years ago, Ford and South Korean battery maker SK On have entered into a joint venture agreement and are spending $11.4 billion to build plants in Tennessee and Kentucky that will produce batteries for the next generation of F-Series electric trucks. Now the joint venture is ending and the two companies will split assets: Ford will own and operate the twin plants batteries in Kentucky, while SK On will operate the plant at SK’s massive BlueOval campus in Tennessee.

Vatn systemsa Rhode Island-based startup developing autonomous underwater vehicles, raised $60 million in a Series A funding round led by BVVC.

Notable reads and other items

700 Credita company that performs credit checks and identity verification services for auto dealerships across the United States, said a data breach affected at least 5.6 million people whose names, addresses, dates of birth and Social Security numbers were stolen.

The former CEO of the bankrupt EV startup Canoo had pledged to provide support to NASA and the United States Postal Service so he could continue to use the trucks. Obviously, this was not a convincing argument. NASA and the USPS have stopped using them.

Passage and Renault have agreed to work together to bring two affordable Ford-branded vehicles to the European market in 2028. Ford will lead the design and Renault will assemble the vehicles at its plant in northern France.

Clear is being sued by its former chief engineer Eric Bach, who alleges wrongful termination, discrimination and retaliation. Bach, who is of German heritage, also claims that one of the car industry’s top HR executives referred to him as a “German Nazi”.

Subaru revealed Uncharted EV and specifications may attract buyers. The Uncharted Premium trim EV will have a range of 300 miles and a skosh price of over $36,000. Potential deal killer among Subie die-hards? The Premium version is front-wheel drive only.

A pregnant woman in San Francisco gave birth within a Waymo robotaxi en route to UCSF Medical Center. And no, this isn’t the first baby to be born at Waymo. Read on to learn more.

Meanwhile, on the Waymo news front, a leaked letter from Tiger Global Management disclosed to investors that Waymo now provides 450,000 ride-hailing robots per week — nearly double the amount it disclosed this spring. Waymo declined to comment.

Zevo is looking to add robotaxis to its fleet of shared cars, starting with newcomer Tensor. Senior reporter Sean O’Kane digs inside.

One more thing…

I asked and you answered. Thanks to all the readers who participated in the last poll. As a reminder, I asked: The pace of autonomous vehicle development has accelerated, prompting more scrutiny and questions about safety and liability. Should companies stay the course, scale faster, or hit the brakes?

About 48% of you chose “stay the course.” Almost 23% chose the scales faster, while 29.4% of readers want companies to hit the brakes.