Rapido, a popular ride platform in India, started quietly Beta to test the Bangalore Food Delivery Service, signaling its first serious move to challenge the leaders of the Swiggy and Zomato market in one of the fastest growing markets.

The 10 -year -old start has begun to test the Food Delivery Service in three basic locations in the southern city of Bangalore, and the arrangement of Byrasandra, Tavarekekere and Madiwala (BTM)

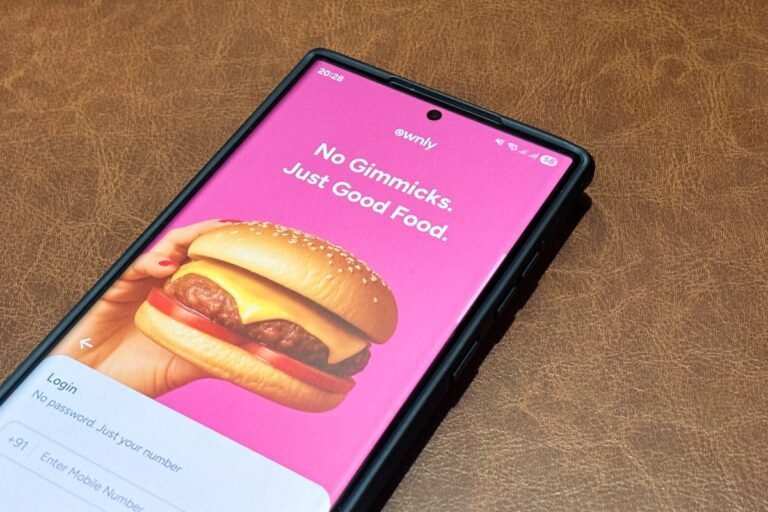

Rapido created a CTRLX subsidiary CTRLX technologies to start the food delivery service, called by itself. Sanka’s subsidiary and Vice President of Fuso Finance Vivek Krishna as managers, according to regulatory deposits examined by TechCrunch.

Sanka said there was no specific reason for the creation of the subsidiary. However, it may be a strategic move to avoid possible conflicts of interest with Swiggy, which today holds a minority minority of a 12% startup.

Swiggy recently confirmed In a letter to the shareholders that she will reassess her investment in Rapido, citing a possible conflict of interests “that may arise in the future”.

In the meantime, rapido also has liberated The Android app on Google Play that offers food from nearby restaurants at about 15% lower than those of Swiggy and Zomato.

The lower pricing is the result of the Rapido model that it does not receive restaurant supplies, which amount to 30% in the case of other food delivery applications, including Swiggy and Zomato, and instead charge a fixed fee per order. The start reported the approach of the fixed end On a June restaurant proposal.

TechCrunch event

Francisco

|

27-29 October 2025

Rapido has a fleet of about 10 million vehicles, including 5 to 6 million two vehicles, across India, in a business that is familiar with the start -up at TechCrunch recently. The company uses its fleet with two wheels to deliver food-in front of its taxi and courier services.

Rapido will avoid the appearance of restaurants far from customers to reduce fuel costs and delivery times and clean the menu details in its application to maximize margins while offering enough detection, a Rapido investor told Techcrunch.

While handling Swiggy, Rapido has acquired peak hours and high demand restaurants-the data they would now use for his own food delivery service, the investor said.

The agreement with Swiggy does not prevent Rapido from using this data, although it forbids starting contracts with Zomato or other competitors, the investor added.

Founded in 2015, Rapido started as a bicycle taxi battery before expanding to automatic rickshaws, parcel delivery and third part logistics. In 2023 he entered the cabin operation to take over Uber and local opponent Ola. The start has attracted this section with the subscription -based model, placing it as an alternative to the approach based on the committee used by its competitors.

Rapido also worked with the Taiwanese Battery-Swapping Electric Two-wheeler Gogoro to develop his vehicles as a bicycle taxi. In addition, recent moves have helped the start to boost his valuation and become unicorn last year.

India’s online food market is projected to exceed 2 trillion (about $ 23 billion) by 2030, per Bain & Company and Swiggy report released last year. Zomato today drives the market with a share of 58%According to Motilal Oswal brokerage company, while Swiggy Holds the remaining 42%per Bernstein. Uber was also among the early players with Uber Eats, which she sold to Zomato in early 2020.

So far Rapido has raised $ 574 million in 13 rounds, per Tracxn. It operates in more than 250 cities and handles over 3.5 million walks daily. The start counts Prosus, Westbridge Capital, Nexus Venture Partners and believes that investments among its basic investors.